The Euro / Dollar Rate Could Hit 1.16

- Written by: Gary Howes

The shackles holding back the Euro might have just been broken and some of those watching the foreign exchange market place reckon the Euro to Dollar exchange rate (EUR/USD) could go notably higher.

The Euro pierced new one-year highs against a battered Dollar this week with data showing optimism across the Eurozone was at a ten-year high; enough to keep the Euro-bulls in control.

However, it was the European Central Bank (ECB) who sparked a tear higher in the Euro after its President Mario Draghi delivered an upbeat message that suggested it could soon upgrade its policy bias to neutral.

ECB President Mario Draghi’s speech on Wednesday was digested by markets as a signpost to a future of higher interest rates and the end of quantitative easing; a message that is likely to have a lasting impact on foreign exchange markets we are told.

Draghi's speech “was important not because he marked a hawkish shift to policy but because he implicitly signalled that the ECB is not as concerned about low inflation any more: it is now considered temporary,” says foreign exchange strategist George Saravelos at Deutsche Bank.

Euro Liberation

According to Saravelos, “the language shift is critical because it 'liberates' the Euro, disinflationary strength in the currency may now matter less for the ECB.”

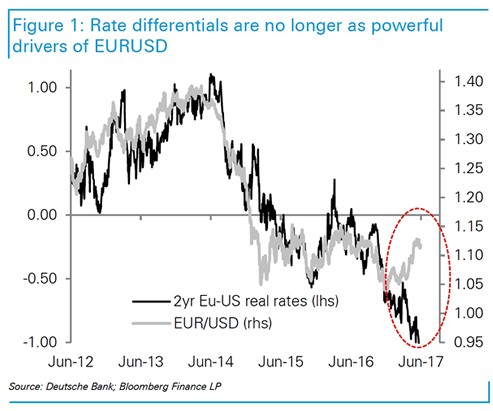

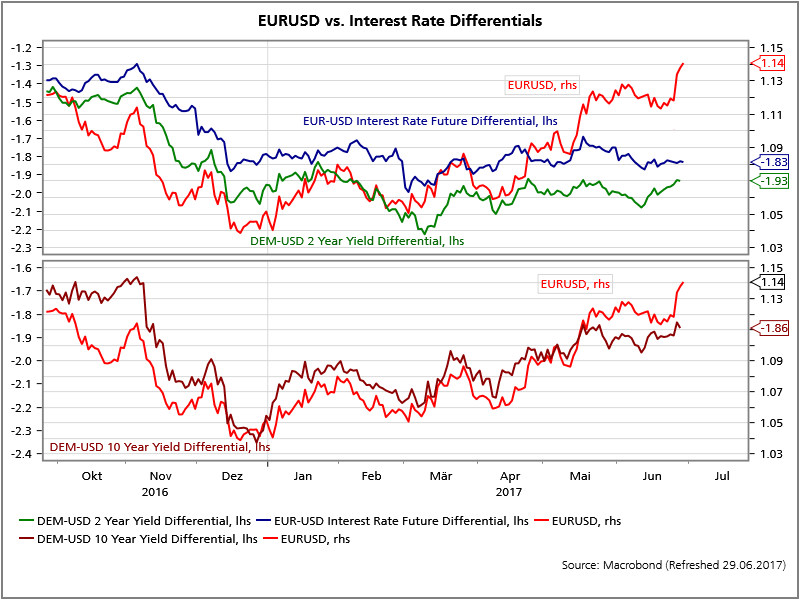

The analyst notes the shift in language actually coincides with another regime change that has been evolving in recent months and is even more important: “the complete breakdown of EUR/USD with rate differentials suggesting the ECB was losing control of FX anyway.”

For Saravelos, both these observations are critical “because they suggest that the Euro can strengthen despite, not because of higher bund yields”.

The more the Euro appreciates the more ECB tightening will be slowed.

“The key driver of Euro strength is not ECB hawkishness but medium-term rebalancing of structural post-crisis underweights in European assets,” says Sarvelos. “The ECB may not able to do much about it.”

In short, Eurozone economic growth is attracting large investor flows that will drive up the value of the Euro, regardless of whether the ECB dislikes a stronger Euro.

The ECB has often fought back against periods of Euro strength as such appreciation threatens to choke the Eurozone economic recovery which is so heavily reliant on exports. A stronger Euro makes for more expensive exports.

However, this view is controversial and not all agrees that the Euro-Dollar rate has in fact been liberated.

Analysts at UBS suggest that the relationship between interest rate differentials and the EUR/USD is not dead and ultimately and the recent move higher in EUR/USD is looking overdone.

How High can the Euro go Against the Dollar?

The Euro is now forecast to move higher, but just how high should reasonable expectations be set?

“EUR now seem likely to push positioning concerns aside and threaten extremes of the past two years’ range,” says Tim Riddell, an analyst with Westpac Bank in London. “The push above 1.13 now suggests a higher range for EUR/USD.”

Westpac view the range as existing between 1.10 and 1.16 and say they have a bias to test range resistance near-term.

However, a break higher in yields spreads would be needed to lift EUR any further.