EUR/USD Rate Struggles to Break Key Resistance Point

The Euro rebounded against the US Dollar after reaching new lows at 1.0567 but we remain unconvinced that any major strength is likely.

The EUR/USD pair moved up from the week's open at 1.0599 to hit a high at 1.0649 on Monday November 21 as the Dollar’s relentless rally finally stalled.

The pair has since retraced to 1.0638 at the time of writing.

The retracement fulfils the expectations laid out in our forecasts written at the time of the bounce.

We warned the recovery was likely to be capped after hitting a double layer of tough resistance in the form of a long-term trendline (drawn from the March 2015 lows) and the S2 monthly pivot at almost the exact same level.

Monthly pivots are levels where the exchange rate often runs into a barrier of counter-trend buying or selling and usually result in a pullback.

Given these tough resistance levels acting as a cap on the exchange rate, we viewed this rebound – and indeed any subsequent rebounds - as a temporary relief rallies at this point.

The bounce is likely to afford bears an opportunity to sell the Euro from preferable levels.

More downside is therefore still expected in line with the dominant trend, and a move down to the 1.0567 lows is likely from here whilst a break below those lows would confirm a continuation down to 1.0537 and the level of the December 2015 lows.

A move below December’s lows would probably lead to a further sell-off down to the March 2015 lows at 1.0460.

The moves in EUR/USD are more a function of the Dollar at present as Monday's bounce was not reflected in non-Dollar Euro pairs such as EUR/GBP which continues selling off.

“Dollar bulls remain in control,” says Kathy Lien, Director at BK Asset Management in New York, dips in the greenback have been shallow.”

Lien notes that U.S. Treasury yields have pulled back but not by much and more importantly, yield spreads continue to favour the dollar.

“For example while 10 year Treasuries dropped 1bp on Tuesday November, 22 while German bund rates fell 5bp pushing the German - US Treasury yield spread to a fresh 16 year low. U.K. gilt yields also tumbled, dragging GBP/USD lower,” says Lien.

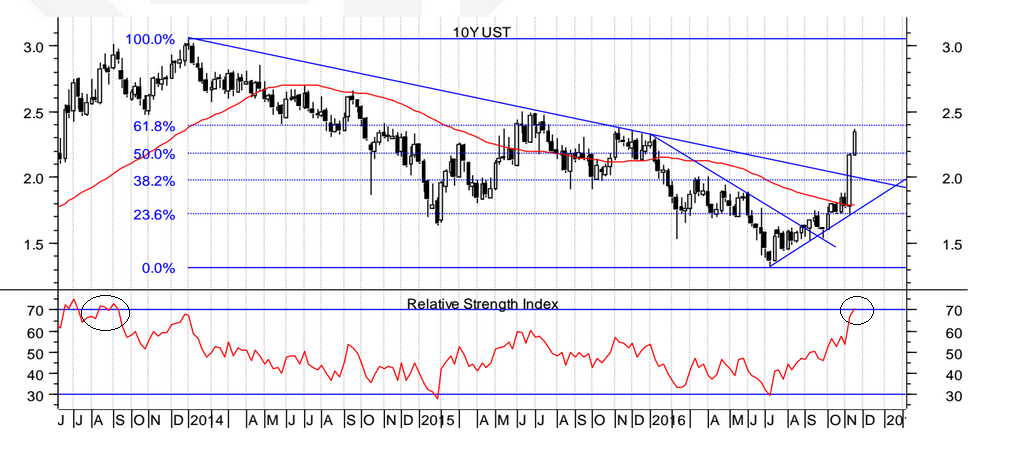

Treasury Yield Surge Slows

However, the US rally in US treasury yields does appear to be fading and this should halt the Dollar's advance.

The overstretched nature of US 10-year yields rally requires some consolidation.

The chart below shows how the RSI momentum indicator is flashing overbought by moving over 70 on the lower pane of the Treasury Bond yield chart.

This is a sign the rally in yields is becoming overstretched and likely to stall/consolidate or even start to fall.

Whilst it is unlikely the rally will end altogether it may take a breather now, before going higher again at a later date which should signal a resumption of the Dollar's rally.