US Dollar Forecast Higher

The Dollar recently reached a 13-year high versus a host of major currencies and studies suggest more upside could be on the horizon.

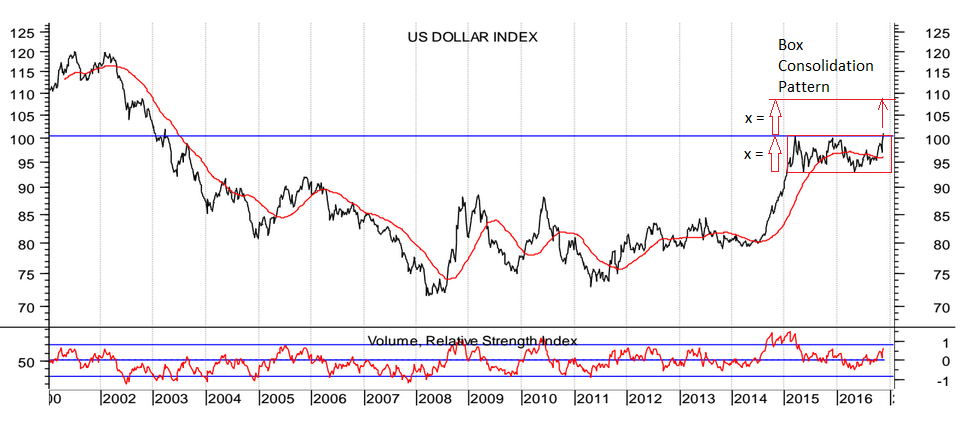

The Dollar Index (DXY) - a measure of overall Dollar performance against a basket of currencies - has broken out of a significant consolidation range which has been developing since spring 2015.

The Index has just nudged above the range highs, reaching a new 13-year high at 100.33.

“Dollar bulls remain in control,” says Kathy Lien, Director at BK Asset Management in New York, dips in the greenback have been shallow.”

Lien notes that U.S. Treasury yields have pulled back but not by much and more importantly, yield spreads continue to favour the dollar.

“For example while 10 year Treasuries dropped 1bp on Tuesday November, 22, German bund rates fell 5bp pushing the German - US Treasury yield spread to a fresh 16 year low. U.K. gilt yields also tumbled, dragging GBP/USD lower,” says Lien.

How high can the Dollar go then?

There is now a strong case for seeing a move higher equal to the height of the range (see ‘x’ on the chart below).

This would take the pair to roughly 108.50.

A more conservative estimate at 105.00 is supplied by analyst Bill McNamara of broker Charles Stanley.

“The result is that the trade-weighted dollar has pushed through the upper end of a range that has been in place since March 2015, when it peaked at 100.33, and the chart is now implying that there is scope for further upside in the short-to-medium term, with 105 or so as the next target,” says analyst Bill McNamara of broker Charles Stanley.

The largest constituent part of the Dollar index is the EUR/USD, therefore for the DXY to extend higher there would presumably need to be further losses on EUR/USD.

However, the pair is looking heavily oversold on the daily charts and we anticipate some near-term consolidation which suggests Dollar bulls may have to wait before the Greenback extends notably higher.

US Yields: Debate on Whether they can Drag the Dollar Higher

The main driver of the recent rally has been the rise in US Treasury yields.

Yields have surged since Donald Trump won the US presidential election as markets price in higher inflation.

Yields are however starting to look over-cooked and will likely need to fade.

Strategists at Deutsche Bank believe there are some factors that should at least contain the rise in Treasury yields, including: i) limits to how steep the US yield curve will get before carry constrains the long-end backup in yields.

Deutsche cite the observation that US Treasury Note 10s minus 2s as having rarely traded above 250bps for any length of time.

Another constraint on US bond yields is the, “global negative output gap, the world likely still has a disinflationary bias, although protectionism is bound to challenge this,” say Deutsche.

If correct Treasuries should find some buying interest which will bring yields down and dampen the Dollar accordingly.

However analyst Kit Juckes at Societe Generale says he believes the Dollar can extend higher alongside yields.

"Our US economics team have raised their real GDP forecasts by 1.1% in 2018 and 1.2% in 2019. The Fed Funds forecast has risen proportionately but while the CPI forecast is higher, the move is relatively modest, making for a dollar-friendly balance between growth and inflation revisions.

"With real rates and yields set to rise, the dollar will benefit."

The Dollar followed inflation-adjusted Treasury yields down between mid-January and the summer, before bouncing back sharply.

Nominal 10 year yields have risen by a little under 50bp from their lows, and over that time the dollar has bounced by about 6% in trade weighted terms.

Societe Generale forecast of a further 60bp rise in nominal yields over the next year.

'Thanksgiving Effect' Forecasts Volatility on Friday

Although the Index may tread water during the days up to and during Thanksgiving on Thursday, November 24, there is a strong possibility that a further strong move higher might come about on the Friday after Thanksgiving (Nov 25).

There is an observable effect which results in low volatility in the days up to and during Thanksgiving which is followed by a sudden volatile breakout on the Friday after, called the ‘Thanksgiving Effect’.

The effect was first noted by Kathy Lien of BK Asset Management.

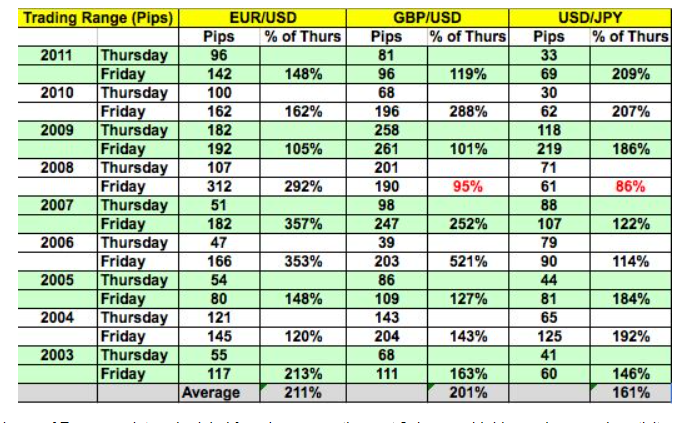

“While many U.S. traders also take Friday off, the intraday range of the EUR/USD, GBP/USD and USD/JPY tends to expand significantly on the day after Thanksgiving.

“Some traders are back and the low liquidity exacerbates the volatility in the FX market,” says Kathy Lien.

She goes on to provide empirical evidence that the increase in volatility is quite marked:

“The following table shows that on average since 2003, the trading ranges for the EUR/USD and GBP/USD increases 200% the day after Thanksgiving.

The impact on USD/JPY is less significant but we still see similar trading activity.”