EUR/USD Exchange Rate Forecast to Remain Capped at 1.12

The EUR to USD pair is still technically trapped within a range, whilst fundamentals showing upside potential for both pairs forecast even more sideways action.

The EUR/USD exchange rate continues to be caught with a long-term sideways trend with neither side of the equation able to gain any long-term advantage.

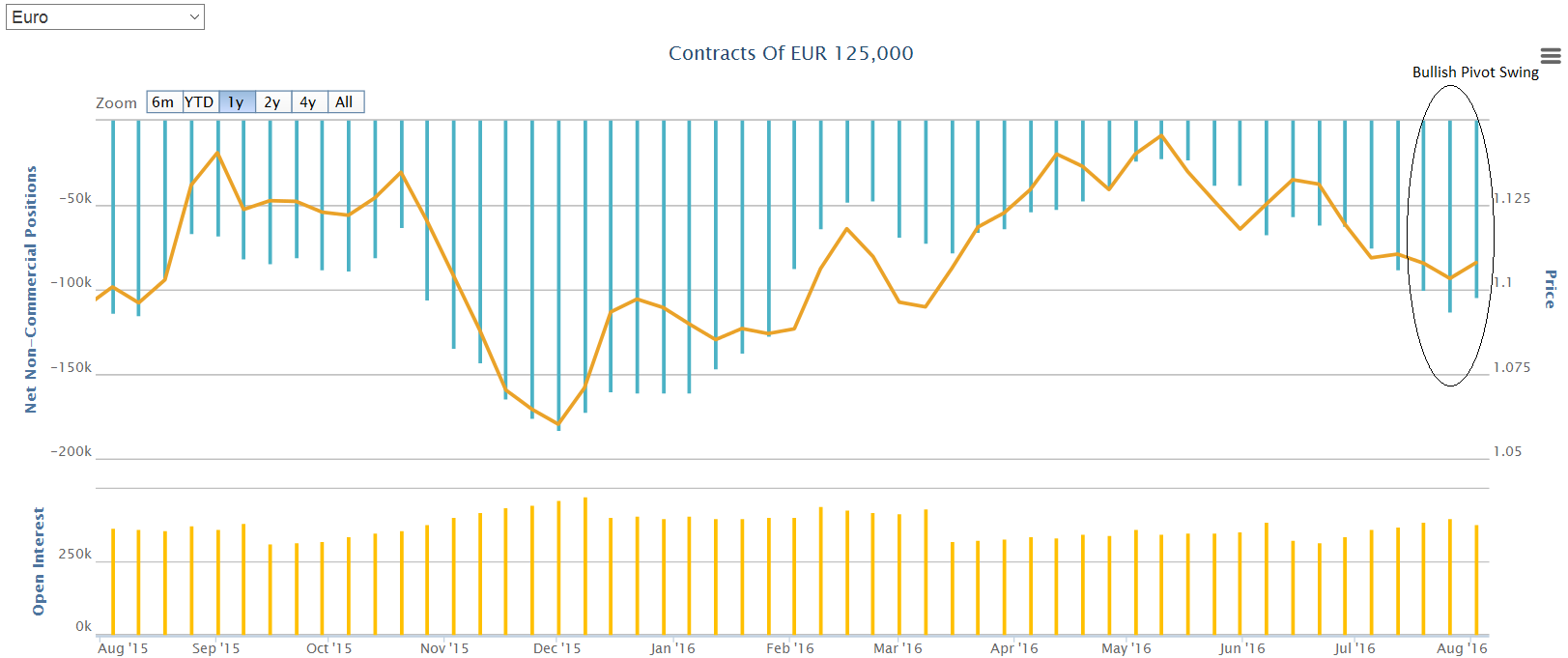

Positioning data from big fund managers, or the ‘smart money’ as they are known, seems to indicate a preference for more Euro strength on the horizon, but there are limits.

Germany reported stronger than expected industrial production for June (+0.8%) but the rebound in output simply reversed the weakness seen in May (-0.9%) and broader trends remain quite soft.

The Banque de France reported a small increase in business sentiment for July (98, from 97), suggesting sentiment was unaffected by the shocking domestic events of last month.

"Data do little to change the outlook for sluggish growth (Q2 data due at the end of the week) in the Eurozone overall, however. We continue to feel that ECB policy makers will ease again in September," says Shaun Osborne at Scotiabank.

Easing at the ECB may no longer have the ability to propogate notable Euro weakness, but it will certainly keep a lid on any strength.

We would expect the markets to continue selling any spikes in the exchange rate.

"I expect the EUR/USD to remain inside the current range and below 1,12," says Sean Lee, a professional trader who heads up the ForexTell community.

"The attempt to break higher from the emas failed and it closed the week just below 1,11. I expect it to continue moving lower and test the ascending DeMark trendlines (daily and weekly) between 1,09 and 1,10. I only want to short the pair from bounces from higher levels," says Lee.

The daily chart view of EUR/USD shows the last three days have been down-days, which - preceded as it was by a rough A-B-C pattern- suggests, according to research, that the pair will probably break below Friday’s lows.

Downside, however, is likely to be capped by the S1 monthly pivot at 1.1015, leaving little scope for gain given Friday’s lows are 1.1043.

There is also the troubling bullish signal from MACD in the lower pane, which has nudged above its zero-line, indicating that the trend is ‘bullish’.

According to Richard Perry at Hantec Markets, the daily chart continues to show the long term pivot bands doing a job between $1.1050 and $1.1100 with the low of the bearish candle on Friday all but at the lower band (at $1.1043).

"The momentum indicators reflect the uncertain medium term outlook as although the latest three candles have been negative, they are still retracing the previous run higher," says Perry.

here is minor resistance around $1.1110/$1.1120 and if another lower high comes below $1.1162 then the near term corrective move will continue.

"A close below $1.1050 would see the bears gather momentum but for now the outlook remains uncertain," warns Perry.

Market Positioning Favours the Euro

The most recent Commitment of Trader (COT) data from US futures exchanges which shows how hedge funds and professional fund managers are positioned, is also showing that there is a roughly 60% probability (according to research) that the Euro will rise versus the Dollar at the start of next week.

The COT data is also showing Gold and Yen likely to rise - both of which are safe-havens - as a sign of heighted risk aversion at the start of next week.

Normally increases in risk aversion are positive for the euro as they lead to the repatriation of funds used in the carry trade, or invested in risky emerging market assets.

These signals from COT are signs the EUR/USD could rise on Monday.

The US Dollar and the Fed - Will They, Won’t They?

After the impressive come-back in Non-Farm Payrolls in June many investors are arguing that the Federal Reserve may see fit to increase interest rates in September - a move which would be positive for the dollar as it would attract more capital from yield-seeking international money-men.

Analysts’ views are mixed about the strong jobs report is likely to lead the Fed to raising rates in 2016.

Those critical of the likelihood of the Fed raising rates point to sluggish growth, the timing of the presidential election and the persistence of opaque international risk premia, as the main reasons for deferring.

Swissquote’s FX analyst Yann Quelenn, for example states that: “The collapse of oil prices, the Brexit and then the US elections are or will be the Fed excuses for holding rates in 2016.”

Whilst Kathy Lien of BK Asset Management said that whilst the data would increase calls from hawks to raise interest rates, “We are still skeptical of the Fed’s commitment to raising interest rates this year.”

Capital Economics’ David Rees was more optimistic about the chances of a hike, despite the likelihood of poor growth in Q2:

“Looking ahead, while the payrolls figures are probably not enough to trump weak Q2 US GDP data and trigger a rate hike at next month’s FOMC meeting, we still think that there is a good chance that one will be delivered before year-end. Moreover, we continue to believe that the Fed funds rate will reach 1.50% next year, which is much more than is discounted in the market.”

Rees also outlines the implications of such a move by the Fed:

“The implications of this for the US are clear. Treasury yields would climb – we expect the 10-year yield to rise to 3% next year – while the dollar would strengthen even further and weigh on the stock market. This is one reason why we think the S&P 500 is unlikely to sustain its recent strong performance and that it will rise by only another 10% or so by the end of 2018.

"The flipside of this is that weaker currencies should support a better performance by equities in Japan, Europe and perhaps even the UK.”

The Euro - Events to Watch

August is a slow month for the Euro since most of the Eurozone is on holiday; the hallowed summer break not to be forsaken in the countries of the old world.

Record-low interest rates in the Eurozone have attracted many investors to borrow in euros in order to buy more risky higher returning assets in emerging markets or simply higher yielding commodity currency assets, however, when risk appetite falls the repatriation flows back to euro-land mean a net positive demand for the euro, raising its value.

The other issue for the Euro is politics but currently there does not yet seem to be a serious threat to the currency from the break up of the EU despite Brexit potentially providing other countries with a template for escape.

According to Deutsche Bank’s Fixed Income team the Spanish economy is weathering the extended delay in forming a coalition government quite well. They see a 60% probability of the outcome being a minority PP government.

Data is likely to be dominated by Q2 GDP and Industrial Production, which should show a moderate monthly rise in German industrial production (Monday).

Then the second estimate of euro-zone GDP (Friday) for Q2 should confirm that the economy expanded by 0.3%.

We also expect first estimates for Q2 GDP to show growth of 0.1% in Italy (Friday), 0.4% in the Netherlands (Friday) and 0.2% in Portugal (Friday), but a 0.2% contraction in Greece (Friday).”