Euro to US Dollar Bounces Today, But Forecasts Point to Rally's Limits

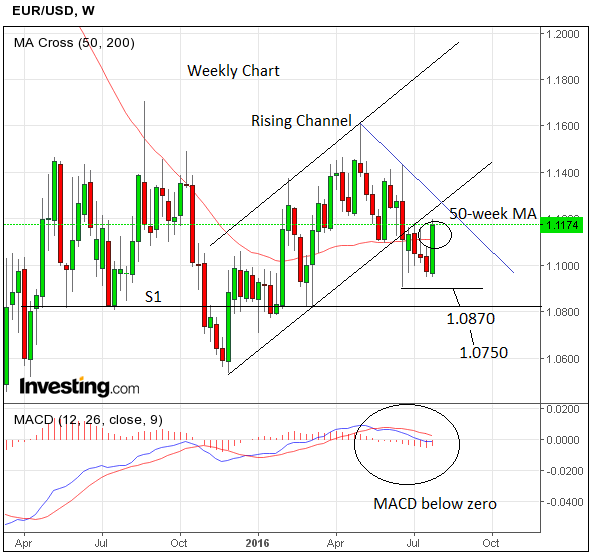

Despite the EUR to USD conversion's strong rebound in late July, the pair remains in a short-term down-trend from a technical point of view.

The EUR/USD exchange rate is seen charging higher on Tuesday the 2nd of August with the spot market rate quoted at 1.1198.

Studies show that the pair has been trending higher since the 24th of July with those looking to make Dollar payments doing so off the best exchange rates since June.

Concerning the outlook, we would expect analysts to maintain a constructive tone going forward.

The EUR/USD failed to decisively break below support at 1.095 and followed-through with a bullish reversal pattern.

"This recent price action has caused us to revisit our bearish bias on the pair, though we do not believe a rally from here is imminent as long as the pair remains below 1.118," say Standard Chartered in a briefing to clients.

Therefore, we note the exchange rate to be trading at an important technical level.

Looking ahead, charts confirm EUR/USD to be in a long-term sideways trend, which has its base at the 1.04 lows and it ceiling at around 1.17.

Within that broad sideways range the pair recently broke out a rising channel and fell to lows at 1.0941 before recovering.

The eventual downside target from the channel break is calculated to be at about 1.0750ish based on an extrapolation of the height of the channel down from the point of the break, and the pair is expected to eventually reach there:

However, on Friday it made a strong recovery as a result of the dollar weakening due to a lower-than-expected second quarter GDP result.

According to Commerzbank’s Karen Jones the resulting day was of the ‘key reversal’ variety, which is indicative of a change in trend:

“The price action on Wednesday was a key day reversal and there is scope for a retest of the recent highs at 1.1165/87.”

For Jones only a break below 1.0941 lows would reassert the down-trend and target 1.0821 (the March low).

For us we stick with our downside forecast based on the breakout from the rising channel, with an initial target at 1.0870 from the S1 monthly pivot, followed by an eventual move down to 1.0750.

Our view is informed the fact that Friday’s rise encountered both the 50-week moving average and the 50-day moving averages in the 1.11s and these are likely to severely limit further gains for the pair, which will probably fall back down in the week ahead.

The MACD indicator is below zero on the weekly chart which is a signal the overall trend is bearish.

The main event for the dollar in the week ahead is the release of Non-Farm Payrolls on Friday August 5.

Another strong payrolls result will increase expectations that the Federal Reserve will go ahead and increase interest rates in 2016.

The probability of the Fed raising rates this year currently stands at about 50%.

A rates rise or expectation of one will strengthen the dollar as higher interest rates tend to attract more flows of international capital.

Alternatively, if payrolls data comes out below-expectations it could weigh heavily on the dollar as it would reduce expectations of a rate hike.

Q2 GDP on Friday was a disappointment as it came out below expected and below the average, and this means growth forecasts for the year will almost certainly be downwardly revised, further reducing Fed rate hike expectations.

Christopher Vecchio, Currency Analyst at DailyFX, notes how the GDP report further lowered Fed Rate Expectations.

"In the days ahead of Friday's Q2'16 US GDP report, there was as high as a 65% chance of a rate hike by June 2017, according to the Fed funds futures contract, rising from an implied first-month hike in January 2018 at the start of July. The collapse in rate expectations post-GDP has proven to be a major burden for the US Dollar.

“The dissonance between what the Fed said it might do - raise rates one to two times this year if US data continues to improve - and what markets are expecting - now, no confidence in a hike until at least January 2018 - is the greenback's albatross. The stark reality for Fed policymakers is that the US economy (+1.2% annualized) is growing slower than the Euro-Zone economy (+1.6% annualized). Against this backdrop, it seems highly unlikely the Fed would be in a hurry to raise rates.

“Markets don't see any period before the end of 2017 as eclipsing the 60% threshold. The GDP report knocked at least six months off hiking expectations. Correlation is not causation, but the Fed has not raised rates unless market participants have priced in at least a 60% chance in the front month of them doing so. Accordingly, if US economic data remains surprisingly weak, then Fed officials will have no choice but to backtrack on their recent optimistic tone - something that could only hurt the US Dollar further."

US Manufacturing Gives Dollar Bulls Optimism

The US manufacturing ISM index fell to a still healthy 52.6 in July, the fifth straight reading above the 50 break-even level consistent with expanding factory output, from 53.2 in June, which was a 16-month high.

"Although manufacturing growth cooled slightly in July, the ISM manufacturing survey was still another encouraging sign that US manufacturers are pulling out of a prolonged slump. Improving survey evidence gives reason for some optimism regarding GDP growth in H2 2016 after the surprisingly weak performance in H1," says Johnny Bo Jakobsen at Nordea Markets.

The recent low was December’s 48.0.

The data will be welcomed by USD bulls who had to endure a beating at the close of July following an underwhelming set of economic growth data which showed the US economy did not grow as fast as markets were anticipating in the second quarter of 2016.

The economy grew 1.2%, analysts had forecast a figure of 2.6%.

The result was the Euro to Dollar exchange rate rising to above 1.1150, where we find it today.