EUR/USD Forecast: Declines Ahead, But No Fireworks

- Written by: Gary Howes

The euro will fall against the dollar through the remainder of 2016, but those looking for fireworks would best be served looking elsewhere it is argued by a number of analysts.

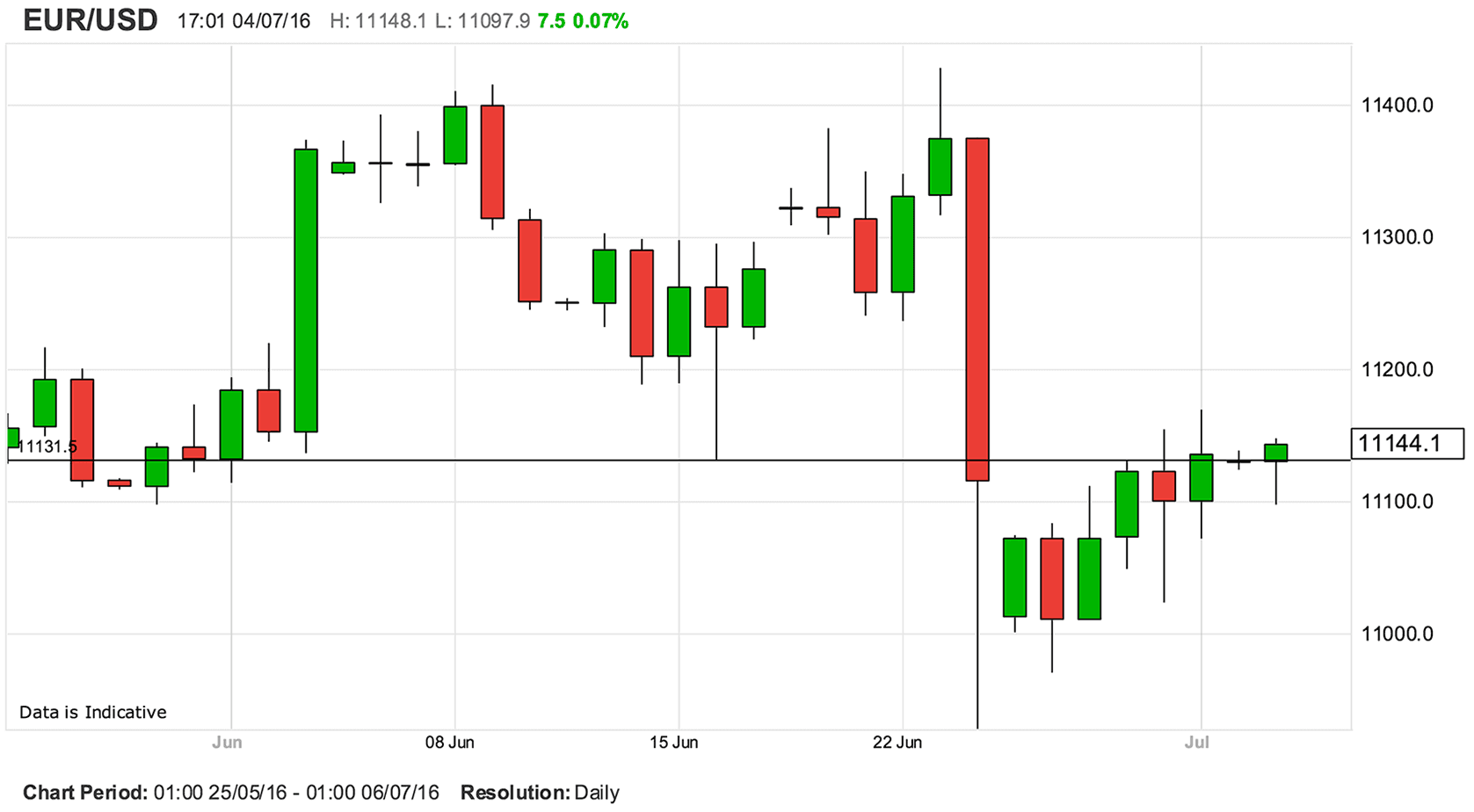

If we look at the charts we realise the impact on EUR/USD from Brexit is arguably negligible, with only a slight drop recorded over the month of June as a whole.

Warnings of the Eurozone's doom following Brexit remain firmly in the realm of speculation at this stage and we are yet to see any major downside impact on EUR/USD.

The euro to dollar exchange rate opened June at 1.1131 and closed at 1.1105:

We are hardly off this level today, betraying what a quagmire this market represents the directional trader.

Nevertheless, the slow pace of change in EUR/USD risks betraying a market that is turning lower, and based on the evidence, should continue lower.

"While the key 1.1210 resistance continues to cap, the pull-back from the overnight high of 1.1164 is lacking in momentum and a sustained down-move appears unlikely for now," says Quek Ser Leang at UOB in Singapore.

"Overall, EUR is expected to continue to trade sideways albeit with a bias for a probe lower to 1.1095. Resistance is at 1.1165 followed by the still very strong level of 1.1210," says Ser Leang.

While the Eurozone has not collapsed, it certainly is not a winner of Brexit.

As such, the euro will remain exposed to downside pressures over coming weeks and months argue a number of analysts who believe the economic hit of the referendum result in the UK will ultimately be felt across the channel.

The European Central Bank (ECB) believe there is a possible 0.3-0.5% downside impact in store for Eurozone GDP as a consequence of Brexit.

Ahead of the June 23rd referendum ECB forecasts estimated Eurozone economic growth would proceed by 1.6% in 2016 and by 1.7% in 2017 and 2018.

Rest assured, expectations such as these will ensure the ECB maintain their EUR-negative policy of low interest rates and asset purchases in action for the foreseeable future.

“After the Brexit shock, Europe is one step closer to a persistent 1% growth, 1% core inflation economy. This is neither politically nor socially sustainable in the long run given the high levels of unemployment and poor productivity developments,” says Ruben Segura-Cayuela at Bank of America Merrill Lynch Global Research in London.

Segura-Cayuela believes Brexit poses obvious existential threats to the Eurozone, not only politically, but via an inability to deliver growth.

“This is a very unstable equilibrium, only sustainable because of the ECB backing, but we expect it to destabilise once QE is gone, absent any further policy innovations,” says Segura-Cayuela.

Mood Music for a Lower Euro

There is simply nothing written into the fundamental backdrop that advocates for a persistently higher euro.

At best it stays in its current ranges, at worst it makes a bid for parity once more.

Technical analysts at Barclays read from the charts that the EUR/USD exchange rate is biased lower saying Monday’s small topping candle encourages their bearish view:

"A low close today would point lower in range towards initial targets near 1.0970 and 1.1025 ahead of the 1.0910 lows. Further out, we see room towards 1.0840 and then the 1.0710 area."

Expect the move lower to be gradual though as any further recovery in bank equity prices would help alleviate concerns and help support the euro.

“The combination of a record current account surplus and the ECB QE policy that helped keep debt market stable was a key factor in EUR stability,” says Lee Hardman, Currency Analyst Bank of Tokyo Mitsubishi UFJ.

Over coming days there is a good chance that EUR/USD is increasingly influenced by developments in the US with some key data like the ADP and NFP employment report being released.

“Still, we can’t see any big moves at this stage with the markets likely to remain convinced that the Fed can remain patient for some time given the shock to the markets from the Brexit vote,” says Hardman.

Sam Lynton-Brown, FX Strategist at BNP Paribas has told clients he is targeting a weaker Euro over coming weeks saying uncertainty and financial market stress are likely to remain high.

“In this environment, the EUR short exposure may catch up with the GBP’s short exposure,” says Lynton-Brown.

Like Hardman at Bank of Tokyo Mitsubishi UFJ, Lynton-Brown also believes the move will be a slow one that requires patience:

“We favour positioning for a grind downwards in EURUSD, rather than a sharp move, as we see two key factors preventing a sharp decline in the EUR.”

BNP Paribas believe ECB policy (the asset purchase programme in particular) will limit the widening of peripheral spreads through its purchases.

As opposed to the last financial crisis, the ECB is now actively involved in sovereign debt markets, providing the demand required to ensure stable sentiment when shocks such as Brexit come along.

Hence borrowing costs should not return to levels which would compromise fiscal sustainability.

Peripheral spreads (Spain and Italy) versus Germany did initially widen by around 30bp but have since narrowed back.

Unlike the British pound, the EUR should draw support from its circa 3% of GDP current account surplus, which has expanded considerably since 2012.

The UK’s current account deficit stands at about 7% of GDP, leaving the currency extremely vulnerable to shocks should investor inflows cease to provide the necessary funding.

Furthermore, to the extent that global investor confidence is currently at a low level, eurozone investor outflows may slow.

BNP Paribas' FX positioning analysis signals that short EUR exposure is much lighter than short GBP positioning.

Short EUR positioning stands at -16 (on a scale of +/- 50), while short GBP positioning has reached -45.

“Therefore, there is considerable scope for investors to add to short EUR positions to position for further European stress,” says Lynton-Brown.