EUR/USD Rate Forecast: Sharp Recovery Possible, Only Decline Through 1.10 Invites Further Weakness

After a month of declines the EUR/USD exchange rate is looking to stage a recovery - here are the compelling reasons why.

- "Unless an accelerated decline through the psychological 1.1000 level unfolds immediate downside risk looks increasingly limited." - Lucy Lillicrap @ AFEX.

- “Dollar risks are asymmetric in our view heading into this week’s non-farm payrolls report" - Ian Gordon @ Bank of America.

- "We are probably closer to staging a stronger corrective rebound back towards 1.1250-1.1300 before the next leg lower." - Robin Wilkin @ Lloyds Bank.

The euro has been in a downtrend against the dollar since early May and for now there is little reason to argue that further declines should occur based on observable momentum.

However, there remains compelling evidence on the technical and fundamental front to suggest that the pace of decline should subside in intensity.

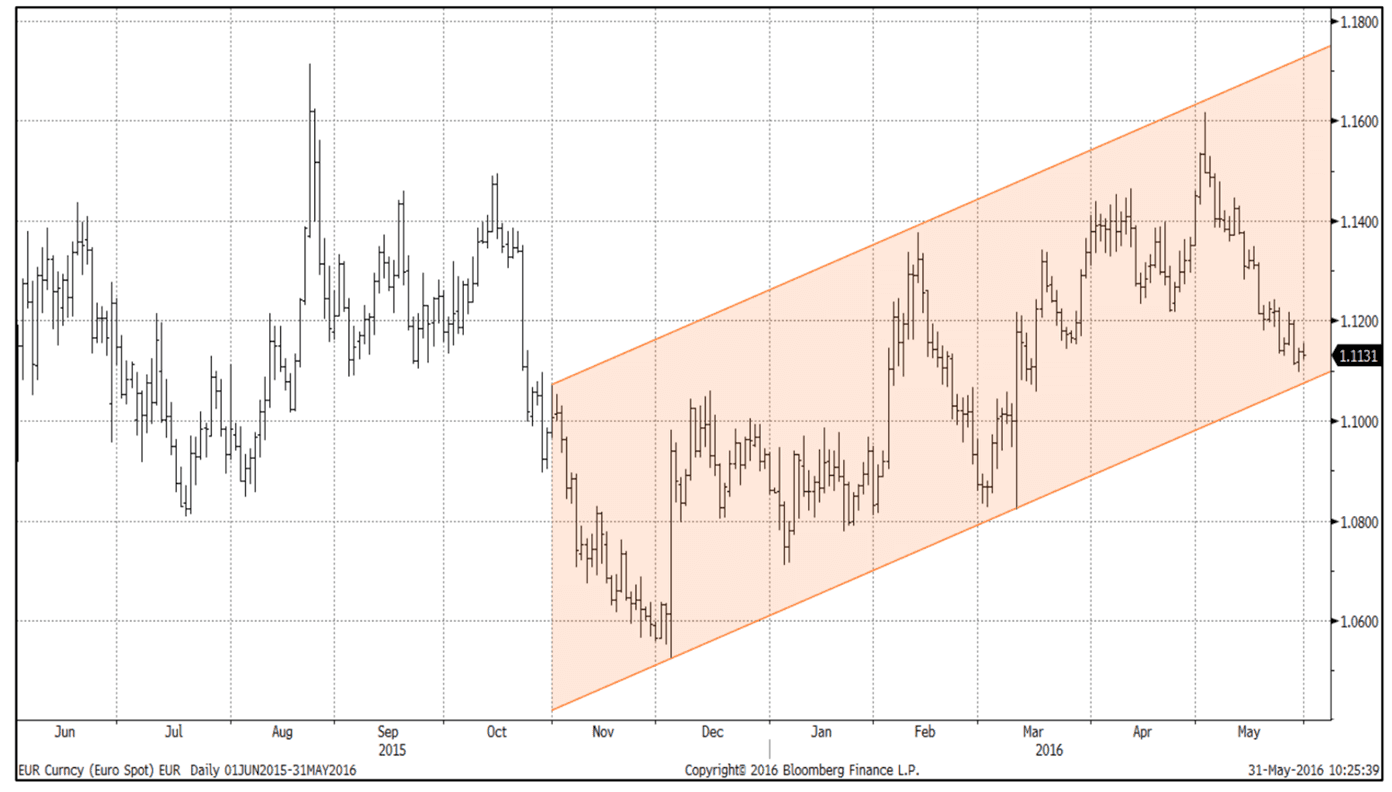

Firstly, we note the while the near-term downtrend remains in force, “the proximity of broader channel support may well at least slow further EUR erosion initially and given this pre-existing albeit shallow recovery formation enable further advances going forwards,” says Lucy Lillicrap at AFEX, a London-based foreign exchange broker.

On this, Lillicrap argues the nature of any rebound (corrective or otherwise) over coming days will be key in terms of shaping price action from a medium term standpoint but unless an accelerated decline through the psychological 1.1000 level unfolds immediate downside risk looks increasingly limited.

1.10 is widely forecast to be a level of support from where the market will be placing buy orders as corporates buy cheap euros and speculators take a punt on the idea a rebound will ultimately shape up at this round number.

On this basis, “we look for a solid USD performance and expect EUR/USD to break below the 200-day MA support level of 1.1095 and creep towards 1.1000,” says Petr Krpata at ING.

Keep in mind that the longer-term timeframe still favours the euro and the uptrend, in place since November, still appears valid.

But, as noted in the supplied graphic, a break below 1.10 would seriously call the move into question.

To ascertain whether the dollar can find the requisite buying interest to prompt such a substantial break, we need to consider what the potential trigger to the move below 1.10 in EUR/USD would be.

Robin Wilkin, an analyst with Lloyds Bank, is also wary of an impending recovery in the euro:

"Intra-day studies are showing mild bull divergence, suggesting the downside is becoming limited. While under 1.1175/85 resistance we couldn’t rule out a test of the 1.11-1.1070/60 key support, but we believe we should be limited to there.

"We are probably closer to staging a stronger corrective rebound back towards 1.1250-1.1300 before the next leg lower."

Dollar in Demand

The dollar has been in demand since the start of May as expectations for a June/July interest rate rise at the US Federal Reserve have continued to grow.

"May has been a great month for the U.S. dollar. The greenback traded higher against all of the major currencies with its gains ranging from 1% against sterling to nearly 5% against the Australian dollar. Thanks to these moves the broader Dollar Index is up over 3.25%, marking the 7th straight year of gains in the month of May," notes Kathy Lien, Director at BK Asset Management.

The promise of higher interest rates at the US Fed have been the life force behind the dollar rally seen over the past couple of years, and the reigniting of expectations for imminent moves at the Fed are once again stimulating dollar demand.

“The dollar’s recovery continues to suggest that the low printed on the 3rd May on the dollar index was a key reversal low, and that price will continue to grind higher. The dollar index is now holding above the 5-day moving averaged may test the 200-day, currently at 96.07 this week. The RSI is also testing the 60 level on the RSI. A decisive move through this level would also indicate further strength. For now, the long-term trend remains down for the dollar against all the majors,” says Phil Seaton at LS Trader.

The dollar moved yet higher towards the end of May following Federal Reserve Chair Yellen’s comments at Harvard University on May 27 in which she noted that a rate rise may be appropriate “in coming months.”

“It’s appropriate - and I’ve said this in the past - I think, for the Fed to gradually and cautiously increase our overnight interest rate over time. And probably in the coming months, such a move would be appropriate,” remarked Yellen.

Yellen, speaking at the Radcliffe Institute for Advanced Study’s annual post-Commencement gathering, did however add that the hike is dependent on whether the economy keeps improving.

As a result, June’s US labour market data, due on the third June, will be keenly anticipated by foreign exchange traders who will be looking for signs of the requisite economic improvement.

Risks Tilted to Dollar Weakness Heading into NFP Release

With the dollar in the driving seat for the EUR/USD exchange rate, anticipating the potential reactions by the Greenback to the Friday 3rd data release will be key to the pair’s outlook.

Interestingly, the outlook for the dollar heading into the data, we are told by analysts at Bank of America, is tilted to the downside.

“Dollar risks are asymmetric in our view heading into this week’s non-farm payrolls report as the Fed recently pulled up market expectations for a summer hike amidst modest data improvements,” says Ian Gordon at Bank of America.

Gordon’s thinking is based on the observation that the USD has responded positively to the Fed’s hawkish tone, but with the market pricing a 70% chance of a July hike already, a lot of good news appears to be priced already.

“Indeed, based on real yield differentials, the USD looks pretty fair here. This leaves the burden on the data to justify their more optimistic tone. A figure which leaves the 6m moving average above 200k (the Fed’s rough benchmark for labor market tightening), and strong wages should see the USD modestly supported,” says Gordon.

But, argues the analyst, a disappointment could have a more significant negative impact given market pricing, leaving the dollar under pressure.

“In our view, the next leg higher in the USD needs to come on the back of better US data that convinces the market spillover risks from Fed hikes will not stop it in its tracks. With short-term Fed expectations looking a bit stretched, we think the pace of hikes in 2016 & 2017 would need to rise for the USD to rally more significantly,” says Gordon.

No Fireworks from the ECB

From the Euro side of the EUR/USD equation, there is likely to be little fireworks sparked by the European Central Bank who hold their latest policy meeting on Thursday.

No change in policy is forecast to be announced, particularly ahead of the start of CSPP and another TLTRO.

These policies afford the ECB time to assess the impact on the real economy before deciding whether further measures are needed after the summer.

Expectations around this meeting are correspondingly low, with the rates market pricing virtually nothing in for the event.

The market seems to be reassured that the ECB can bide it’s time given the improvement in macro data and the weakness in the euro exchange rate complex.

The depreciation of the EUR TWI since the start of the month (-1.9%) will also alleviate concerns over broader financial conditions in the Eurozone

which have steadily improved through May.

The EUR has meanwhile found some support from the improvement in Eurozone macro data surprises which have recently moved back in positive territory.

“However, against this improving macro backdrop, and supportive of our view for a lower EUR by year-end, 5Y/5Y inflation break-even rates have not responded to the data improvement and have remained relatively stable since March. With the ECB in stasis for now, the burden of proof for further EUR/USD weakness likely will continue to fall on the Fed and we look for USD gains (albeit modest) through Q3 as the Fed tightens policy once more in September,” says Bank of America's Gordon.