Euro-Dollar Still Forecast Below Parity at Lloyds

- Written by: Gary Howes

Image © Adobe Images

The euro is expected to weaken further against the U.S. dollar.

EUR/USD is forecast to drop below parity this year as diverging monetary policies and economic fundamentals favour the greenback, according to Lloyds Bank FX strategist Nick Kennedy.

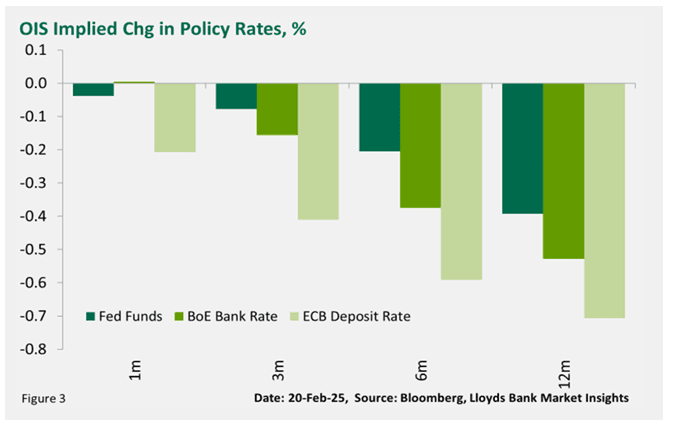

The U.S. dollar remains supported by strong growth and interest rate differentials, even after a recent pullback. While markets anticipate some rate cuts from the Federal Reserve later in the year, the European Central Bank (ECB) is on track to ease policy more aggressively, with at least three rate cuts expected by mid-year.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

“We remain positive on the U.S. dollar’s near-term potential,” said Kennedy. “The ECB’s easing bias, coupled with Europe’s economic and geopolitical headwinds, makes the euro particularly vulnerable.”

The euro’s decline is further driven by weaker economic momentum in the eurozone, where growth remains stagnant and inflation risks persist. Additionally, uncertainty over U.S. trade policy under President Donald Trump has cast a shadow over European exports, adding further pressure on the single currency.

The FX strategist also highlighted that while the Federal Reserve remains cautious about easing policy too aggressively, strong U.S. labour market data and consumer spending continue to provide fundamental support for the dollar.

“The market remains underpriced on ECB cuts, and as this expectation adjusts, EUR/USD could see further downside,” Kennedy added.

Image courtesy of Lloyds Bank.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Lloyds Bank maintains a bearish outlook on the euro, expecting capital flows to continue favouring U.S. assets over European investments, reinforcing the dollar’s dominance in global markets.

Weighing on EUR sentiment ahead of the weekend was the release of France’s latest Purchasing Managers’ Index (PMI), further underscoring the region’s economic slowdown.

The HCOB Flash France Composite PMI, compiled by S&P Global, fell to 44.5 from 47.6 in January, marking a 17-month low and extending the downturn to six consecutive months.

A reading below 50 indicates contraction. Data showed a deeper-than-expected contraction in the country’s manufacturing and services sectors, raising fresh concerns about sluggish demand and corporate investment.

The weaker PMI figures suggest that growth prospects in the eurozone’s second-largest economy remain under pressure, reinforcing expectations of further ECB intervention.

“The French economy is in recession with no end in sight,” said Tariq Kamal Chaudhry, economist at Hamburg Commercial Bank. “The latest decline is particularly concerning as it stems from the services sector, which had previously shown more resilience.”