EUR/USD "Not Yet Decisively Bullish" says City Index

- Written by: Gary Howes

Image © Adobe Images

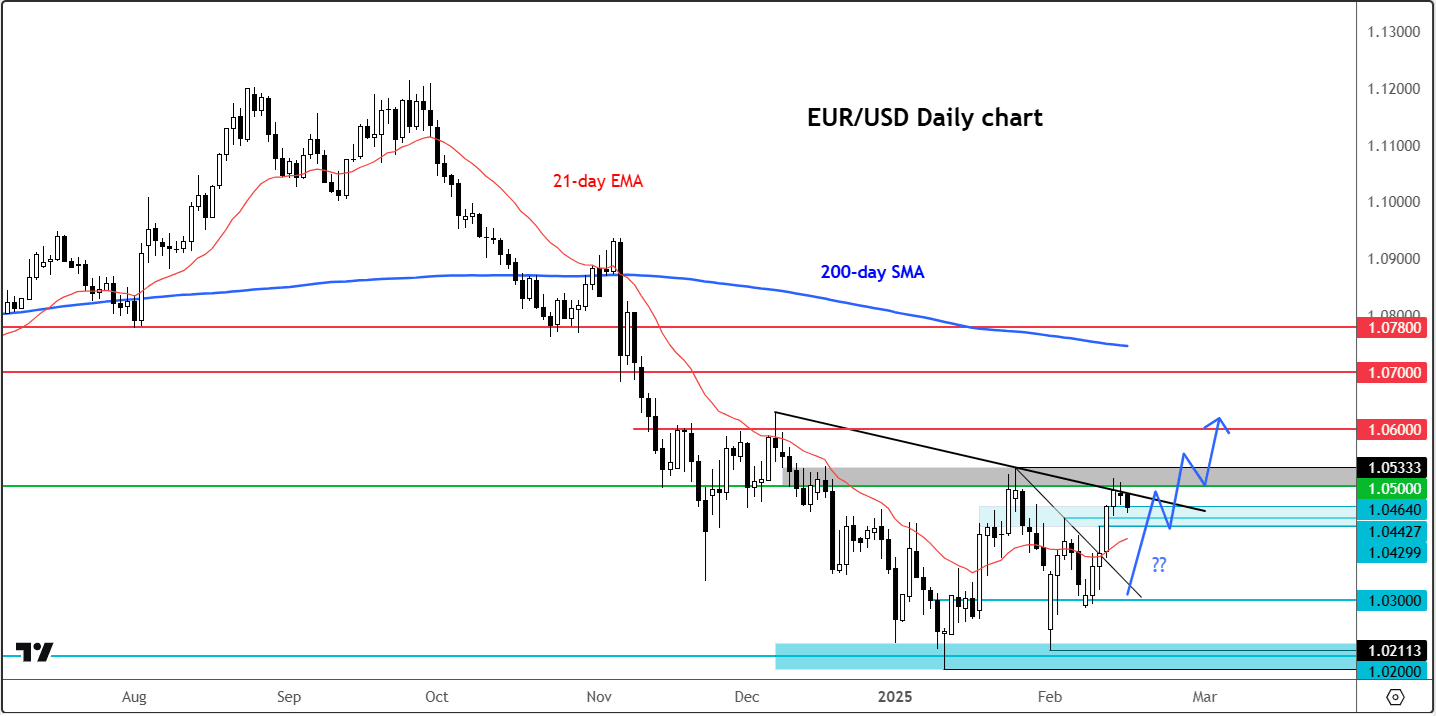

The technical EUR/USD outlook improved last week with the pair printing a large bullish candle after establishing support around the 1.0300 level earlier in the week.

The pair has since been trying to break key resistance in the 1.0480–1.0500 zone, where it has encountered some pushback.

Still, the recent higher lows indicate some buying interest, even if the broader technical outlook has not yet turned decisively bullish.

Image courtesy of City Index.

We would be more confident in expecting higher levels on the back of some further bullish price action. For me, a decisive break above the 1.0480–1.0500 range could suggest a shift in sentiment.

If that happens, we could see follow-up technical buying towards the next potential resistance levels of 1.0600 and possibly even 1.0700 thereafter.

The US dollar index is bouncing back slightly after a two-week drop and a flat performance in January, which ended a three-month winning run.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

It remains to be seen whether the recent retreat was just a correction for the dollar and whether that has now largely played out. But there’s still some scope for a risk-on, dollar-off, move should a Russia-Ukraine peace agreement materialise.

In any case, the downside should be limited in the short-term outlook as negotiations continue over Ukraine. Should Russia and Ukraine eventually strike a peace deal, the dollar may well face another correction.

However, for now, markets are lacking any concrete bearish drivers for the greenback, which has allowed it to stage a bit of recovery along with bond yields.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Still, the near-term EUR/USD outlook has improved, and I think the risks are now skewed to the upside for the pair, which I think is still heading north of the 1.05 handle in the coming days.

Last week’s hotter inflation data failed to lift the U.S. dollar, which suggests the dollar may have already priced in upside risks to inflation owing to Trump’s protectionist policies.

The impact of tariffs could come back to bite the EUR/USD once the focus shifts away from the Ukraine peace negotiations in the coming weeks.

Tariffs are likely to have more tangible implications for the ECB, the economy, and, by extension, the euro in the coming months. For now, though, markets are not focusing much on this, and the ongoing risk rally is helping to keep the euro’s downside limited.