Euro-to-Dollar Week Ahead Forecast: Looking for a Temporary Dip

- Written by: Gary Howes

Image © Adobe Images

The Euro is in a period of stabilisation following a multi-month selloff against the Dollar, but we look for a small setback to a recent recovery in the coming hours and days.

The Euro-to-Dollar exchange rate (EURUSD) advanced by a solid 1.57% last week, fueled by hopes that war in eastern Europe will soon give way to peace. The coming week will be dominated by a frantic geopolitical calendar that includes U.S.-Russia talks in Saudi Arabia and separate security talks among European leaders that have seemingly been unable to secure a spot at the negotiating table.

Progress will underpin the Euro's recovery, but there is reason for caution. That the U.S. is going alone without Europe or Ukraine suggests the road to peace could be fractious and littered with setbacks.

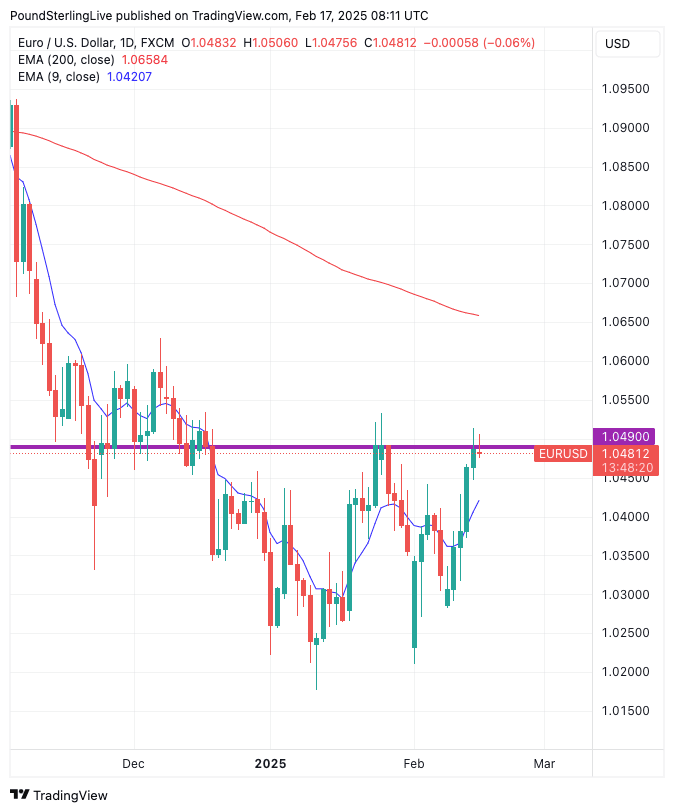

This uncertainty is reflected by a potential fading in momentum in the Euro-Dollar exchange rate at approximately 1.0490.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The daily chart shows that this level is where a long-running support/resistance zone lurks, which can tend to attract self-reinforcing market behaviour. In this instance, we would anticipate layers of market orders that will look to sell Euro-Dollar to profit on a trade or enter a pullback.

Rewind to November-December, and the same level offered support. So we are, in effect, looking at what is quite an important pivot.

A break above here opens the door to 1.06, but failure and a pullback to 1.03 is in scope.

Above: EURUSD at daily intervals.

EURUSD trades above the nine-day exponential moving average (EMA), which confirms near-term momentum is positive. But, potentially of more relevance, spot (1.0478) has diverged some way from the nine-day EMA (1.0419).

We like the 9-day EMA in our Week Ahead Forecast toolkit because spot tends to hug it, and wide divergences almost always result in a mean divergence.

We are seeing a decent divergence at present, which makes a retreat towards 1.0419 is a preferred possibility in the coming days.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Upcoming Eurozone Economic Events

Here’s a breakdown of key Eurozone economic events scheduled for next week, along with market expectations:

Tuesday, February 18

📌 Germany ZEW Economic Sentiment (Feb)

Expected: 20.0

Previous: 10.3

🔹 Market Impact: A higher reading signals improving investor sentiment in Germany, which could support EUR strength.

📌 Germany ZEW Current Conditions (Feb)

Expected: -89.4

Previous: -90.4

🔹 Market Impact: A slight improvement but still deep in negative territory, indicating ongoing economic weakness in Germany.

📌 Eurozone ZEW Economic Sentiment (Feb)

Expected: Not Provided

Previous: 18.0

🔹 Market Impact: If the reading improves, it could reflect growing optimism in the broader Eurozone economy, supporting EUR.

📌 Eurozone GDP Q4 (Second Estimate, YoY & QoQ)

Expected: 0.0% QoQ, 0.1% YoY

Previous: 0.0% QoQ, 0.1% YoY

🔹 Market Impact: A weak GDP print could reinforce expectations of ECB rate cuts, potentially weighing on EUR.

Thursday, February 20

📌 Eurozone Consumer Confidence (Feb, Preliminary)

Expected: -14.0

Previous: -14.2

🔹 Market Impact: A slightly improving but still negative confidence level suggests households remain cautious, which could limit EUR upside.

Friday, February 21

📌 France Manufacturing PMI (Feb, Preliminary)

Expected: 45.3

Previous: 45.0

🔹 Market Impact: Still in contraction (<50), indicating continued struggles in French manufacturing.

📌 France Services PMI (Feb, Preliminary)

Expected: 49.0

Previous: 48.2

🔹 Market Impact: An improving services sector could provide some support for the French economy and EUR.

📌 Germany Manufacturing PMI (Feb, Preliminary)

Expected: 45.5

Previous: 45.0

🔹 Market Impact: A manufacturing PMI below 50 signals continued contraction in Germany’s industrial sector, which could weigh on EUR sentiment.

📌 Germany Services PMI (Feb, Preliminary)

Expected: 52.5

Previous: 52.5

🔹 Market Impact: The services sector remains in expansion (>50), helping offset weakness in manufacturing.

📌 Eurozone Manufacturing PMI (Feb, Preliminary)

Expected: 47.0

Previous: 46.6

🔹 Market Impact: While still in contraction, a slight improvement could ease concerns of further economic slowdown in the Eurozone.

📌 Eurozone Services PMI (Feb, Preliminary)

Expected: 51.5

Previous: 51.3

🔹 Market Impact: Services remain above 50, signaling economic expansion, which could help stabilise EUR.

Week Ahead: USD

Tuesday, February 18

📌 Empire State Manufacturing Index (Feb)

Expected: -1.0

Previous: -12.6

🔹 Market Impact: A negative but improving figure suggests continued weakness in the manufacturing sector, but if the number beats expectations, it could provide a mild boost to USD.

Wednesday, February 19

📌 Building Permits (Jan, Preliminary MoM)

Expected: -2.3%

Previous: -0.7%

🔹 Market Impact: A decline in permits suggests weakness in the housing sector, which could weigh on economic growth prospects.

📌 Housing Starts (Jan, MoM)

Expected: -7.0%

Previous: 15.8%

🔹 Market Impact: A sharp decline may raise concerns about the real estate market, potentially dampening growth outlooks.

📌 FOMC Meeting Minutes (Jan 31 Meeting)

🔹 Market Impact: The minutes will provide insight into Federal Reserve discussions on interest rates. If the Fed signals a more hawkish stance (delayed rate cuts), USD could strengthen. A dovish tone (softer inflation concerns) could weaken USD.

Thursday, February 20

📌 Initial Jobless Claims (Feb 15 Week)

Expected: 215K

Previous: 213K

🔹 Market Impact: Low jobless claims suggest a strong labor market, which could reinforce higher-for-longer Fed rate expectations, supporting USD.

📌 Philadelphia Fed Manufacturing Index (Feb)

Expected: 25.4

Previous: 44.3

🔹 Market Impact: A drop suggests slowing manufacturing activity, which may raise recessionary concerns if it continues.

📌 Eurozone Consumer Confidence (Feb, Preliminary)

Expected: -14.0

Previous: -14.4

🔹 Market Impact: If consumer confidence improves, it may reduce recession fears, stabilizing USD against EUR.

Friday, February 21

📌 Markit Services PMI (Feb, Preliminary)

Expected: 53.5

Previous: 52.9

🔹 Market Impact: A reading above 50 signals expansion, which is positive for USD as it suggests continued economic strength.

📌 Markit Manufacturing PMI (Feb, Preliminary)

Expected: 51.5

Previous: 51.2

🔹 Market Impact: A stable or rising figure may indicate ongoing manufacturing recovery, which could support USD strength.

📌 University of Michigan Consumer Sentiment (Feb, Final)

Expected: 68.5

Previous: 67.8

🔹 Market Impact: Higher consumer sentiment may indicate strong consumer spending ahead, which could reinforce positive economic outlooks and bolster USD.

📌 Existing Home Sales (Jan, MoM)

Expected: -2.1%

Previous: 2.2%

🔹 Market Impact: A decline in home sales suggests weakness in the housing market, which could temper economic optimism.