Euro-to-Dollar Week Ahead Forecast: Low 1.02s in Sight

- Written by: Gary Howes

Fed President Powell testifies this week. File image of Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

The Euro-to-Dollar exchange rate looks set to weaken once more in a week dominated by tariff fears, U.S. inflation and Eurozone GDP data for the final quarter of 2024.

The Euro gapped lower against the Dollar at the start of this week's trading session as investors reacted to U.S. President Donald Trump's message on Sunday that new tariffs would be introduced this week.

The President announced that he would impose 25% import tariffs on all steel and aluminium imports and that further tariffs would be announced in the coming days.

Following the developments, "Treasury yields rose on inflation concerns and markets reduced the odds of seeing a second rate cut by the Fed this year. USD gained across the board as well," says Thanim Islam, an analyst at Equals Money.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Trump said he would be announcing additional tariffs later in the week that reciprocate those imposed by other countries on U.S. imports, which opens the door to tariffs on the EU.

Jean-Noel Barrot, the French foreign minister, said the EU should not hesitate to defend its interest, telling TF1 television that "the time has come" for the bloc to push the trigger on retaliatory measures.

“This is already what Donald Trump did in 2018, and we responded. We will again respond," said Barrot. "[The European Commission] is ready to push the trigger when the time has come. Now this time has come. It is in no-one’s interest to start a commercial war with the European Union."

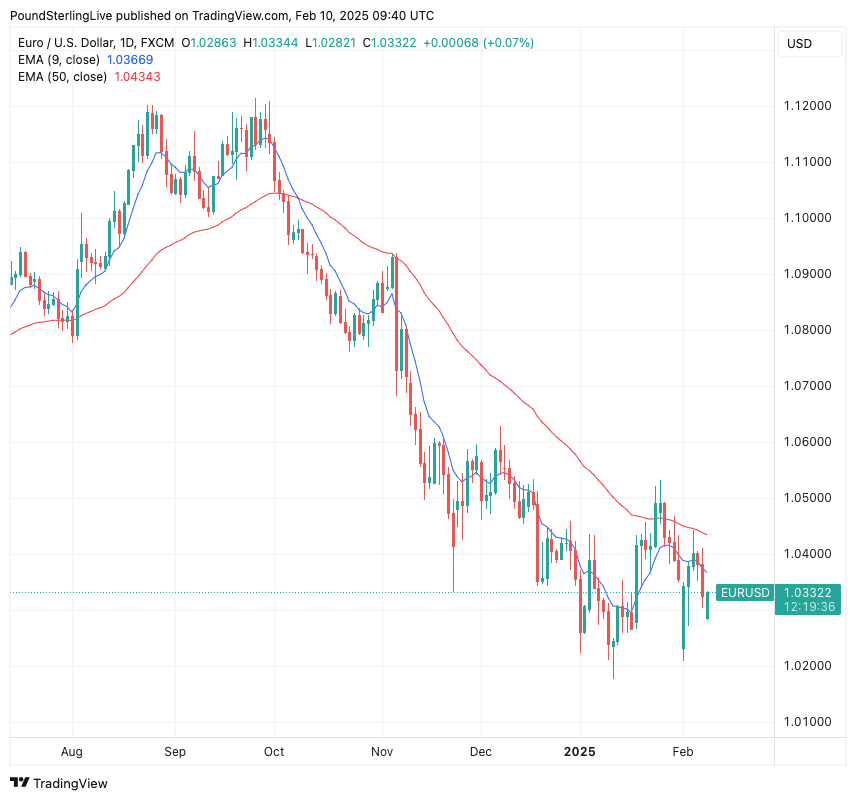

Above: Technical indicators suggest further EURUSD weakness is likely to evolve in the coming days.

Tit-for-tat tariffs are now on the cards and this bodes for further Euro-Dollar weakness.

Turning to the calendar, Wednesday's U.S. inflation data are the highlight. The expectation is for a headline print of 0.3% month-on-month, which would take the annual rate to 2.9%, and for core inflation to come in at 0.3% m/m.

Anything above this will likely give the Dollar some legs and push EURUSD below 1.03. On the other hand, an undershoot would weigh on the Dollar as it stabilises 'hawkish' interest rate expectations and raises hopes for more than one Fed cut this year.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

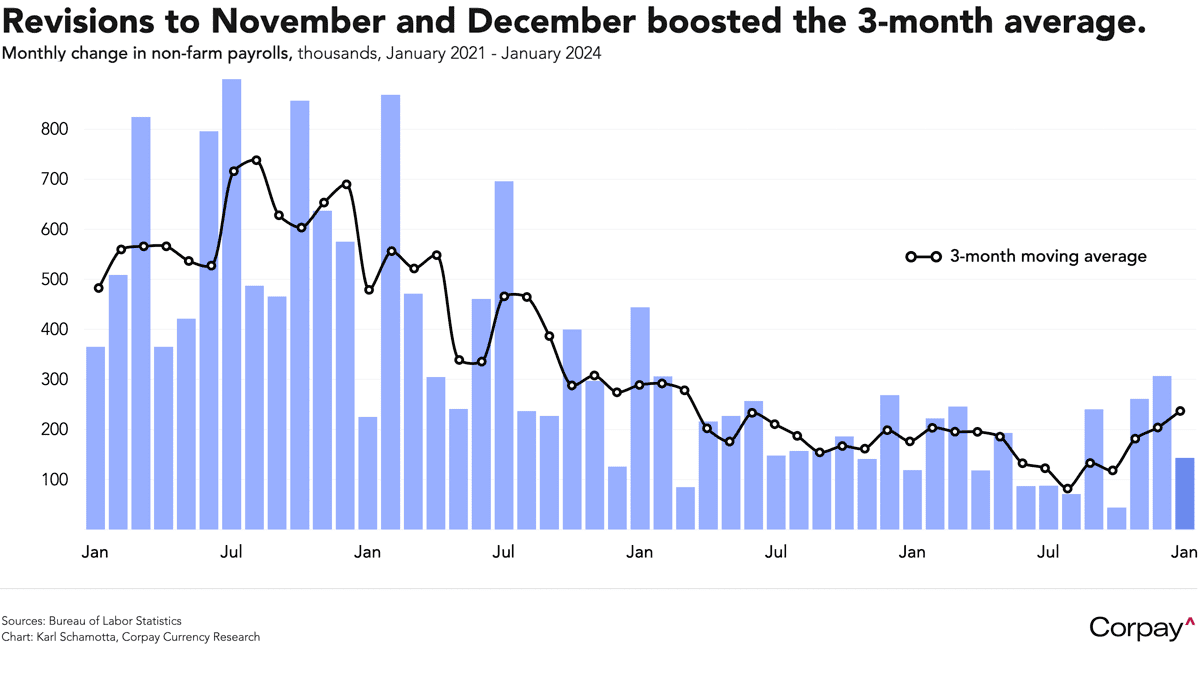

These inflation data will come on the heels of some better than anticipated U.S. job and wage figures released on Friday, which limits the space for the U.S. Federal Reserve to cut interest rates, ultimately underpinning U.S. bond yields and the Greenback.

Keep an eye on Fed Chair Jerome Powell's comments to lawmakers on Tuesday and Wednesday. We know he is keen to pause the rate hiking cycle amidst policy uncertainty, but his response to any questions relating to tariffs could be important in setting out how the Fed will approach the matter.

Above: The strength of the U.S. labour market - which is ticking higher again - is fundamentally supportive of the Dollar.

Looking at the European side of the equation, we will be watching European Central Bank (ECB) President Christine Lagarde's speech on Monday and that of Isabel Schnabel on Tuesday.

Both should reaffirm the expectation that the ECB will 'outcut' the Fed in 2025, underscoring the divergence that has been a major factor behind EURUSD's multi-year trend of depreciation.

Eurozone employment data are due on Friday, where it is expected 0% quarterly growth will be confirmed, making for a second consecutive quarter of no growth.

Alongside, employment figures will be released, where a fall from 0.2% to 0.1% quarter-on-quarter will be announced.

Euro exchange rates could come under pressure should the headline figures undershoot expectations as this would boost bets that the ECB will cut interest rates further than current expectations suggest.