Tired of Buying Dollars, But Not Confident Enough to Buy Euros

- Written by: Gary Howes

Image © Adobe Images

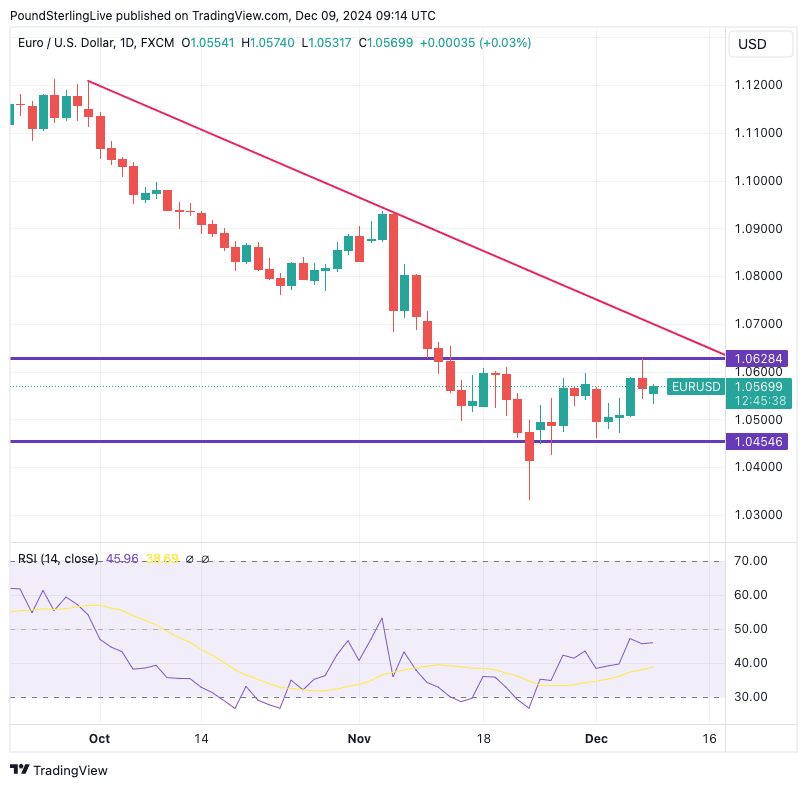

The Euro to Dollar exchange rate (EUR/USD) has formed a base following the sharp selloff of October and November. But it is too soon to suggest an outright recovery is underway.

The Euro selloff has evolved into a sideways consolidation trend, and only when it breaks above the downward-sloping trend line - which we have illustrated in the below chart - would we suggest a more meaningful rally is evolving.

Above: EUR/USD at daily intervals.

The chart also shows the boundaries of the tight sideways range that has evolved since mid-November. The tepid setup limits our ambition, and we think the coming days could see a retest of the top end of the range at 1.0628.

That said, a daily close above this level would be a constructive development for those who want a stronger euro.

"Looking at charts, the pair still needs to definitively trade above 1.06 (and even more exceed 1.0660) to halt the current downtrend in a sufficiently convincing way. Yet, the current rebound above 1.0550 is at least providing the single currency with a further buffer," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Therefore, the technical picture is one of resilience but not strength. The market seems tired of buying dollars but is not yet confident enough to buy euros outright.

"The FX price action in recent days has highlighted the limits of the so-called 'Trump trade'," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "In addition, the fact that U.S. rates and UST yields remain close to their recent lows has become a key headwind for the USD."

However, Marinov adds that investors have become excessively bearish on the Eurozone outlook. "We also see less scope for contagion from the OAT selloff and doubt that the ECB would meet the very dovish market expectations. We thus think that many negatives are already in the price of the oversold and undervalued EUR," he adds.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

An OAT is a French bond, the vehicle France uses to issue debt for borrowing. These bonds came under selling pressure amidst recent French political ructions, but the selling has since stabilised as markets anticipate France will stumble on into fresh elections towards mid-2025.

"Politics took centre stage... with a no-confidence vote toppling the French government. The market reaction was rather benign, however, especially in the EUR. For now, we do not see major euro downside from the political sagas in either Germany or France, and we expect the currency to gain ground against the US dollar from current levels around 1.05," says Dominic Schnider, Strategist at UBS Switzerland AG.

"We see the likelihood of the situation in France leading to another Eurozone crisis as low and expect a resolution in early 2025. Political worries in Europe being laid to rest in 1Q25 would be a tailwind," he adds.

UBS strategists also agree that much of the Trump trade has already been priced into the pairing. They add that German elections due in early 2025 are an upside risk for the euro as they will most likely result in a more stable government.

ECB Promises to Be Interesting

Image © European Central Bank, reproduced under CC licensing.

The main event for the Euro in the coming week will be Thursday's European Central Bank (ECB) decision, where another interest rate cut is anticipated.

The consensus sees a 25 basis point cut, although market pricing shows that some are expecting a more forceful 50bp move.

If the latter is delivered, the Euro will weaken, and EUR/USD will test the bottom of the recent range towards 1.0450.

Andrew Kenningham, Chief Europe Economist at Capital Economics, says although there is a strong case for the ECB to accelerate the pace of policy easing by delivering a 50bp cut next week, a majority of the Governing Council seems to prefer 25bp, which would bring the deposit rate down to 3.0%.

"That said, we think the policy statement will signal that, with downside risks clearly mounting, monetary policy can shift to a more neutral stance before long. And we continue to think the ECB will cut its deposit rate further than investors anticipate next year," he explains.

A 'dovish' ECB message would also be consistent with a softer Euro exchange rate complex.

However, not all roads lead to a weaker Euro and some analysts think the ECB will want to display caution, potentially boosting the currency.

Sandra Horsfield, an economist at Investec, says there is little doubt that a further rate cut is appropriate.

That being said, "the case for using up the remaining ammunition in the arsenal more rapidly, however, is not entirely compelling. There are also tactical considerations to take into account. The unstable political situation in France is not at crisis levels," she explains.

Investec also notes that French government bond spreads might be relatively wide, but yields are at their lowest since early October as part of a wider European bond rally.

"That said, the risk of a confidence crunch that could yet lead to a much steeper downturn in France, spreading through the Eurozone via trade links, has inevitably risen. Keeping powder dry for such an eventuality might be wise," says Horsfield.

She adds that, "a steep cut now might fan rather than ease market qualms. Keeping calm and carrying on cutting rates at a moderate pace rather than stepping it up would seem to send a preferable signal."

Such an approach could result in Euro strength on the day, but we think dips in GBP/EUR will be shallow.

But It's U.S. Inflation That Will be the Week's Highlight

Image © Adobe Images

The U.S. Dollar ended Friday somewhat stronger following the release of the U.S. jobs report, although the strength was not significant. This suggests that the data release was largely in line with expectations.

To be sure, news that the U.S. economy added 227K jobs in November while the unemployment rate rose to 4.2% won't prevent the Federal Reserve from cutting interest rates again next week.

But there is one more major data release that will influence the Fed's decision: Wednesday's inflation release.

"The focus shifts to this week's inflation print on Wednesday," says Schnider. "This marks the last important data point before the Federal Reserve meeting on 18 December."

The market expects headline CPI inflation to be 0.2% month-on-month and 2.7% year-on-year.

"Markets expect CPI, as well as the core measure, to remain broadly unchanged and see a 75% chance of a December rate cut. We think the Fed will lower rates by 25bps at the meeting, which would weaken the dollar into the year-end. Furthermore, the USD also seems to be consolidating from a technical perspective," says Schneider.

Should the inflation numbers beat expectations in a more convincing fashion, then the U.S. Dollar can stage a more meaningful rebound as the market would lose confidence in a December rate cut.