Euro to Dollar Rate: Big Losses Forecast On a Trump Victory

- Written by: Gary Howes

Official White House Photo by Shealah Craighead

The Euro to Dollar exchange rate (EUR/USD) stabilises just below 1.09 ahead of the all-important U.S. presidential vote, but a Donald Trump win would ignite significant selling pressures again.

By Wednesday the vote result should be known, and were Trump to win, we forecast EUR/USD could approach 1.0760 ahead of the weekend.

However, a Harris win, an outcome which has been rising in likelihood over the weekend, would extend the Euro's rebound.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro starts Monday with a small gain against the Dollar as markets track falling odds of a Trump win.

A number of polls released over the weekend were more favourable to Kamal Harris, with one even suggesting she would register a shock win in Iowa.

"EUR/USD has opened the week higher after having fallen for four consecutive weeks. The bounce back from $1.0760 to $1.0880 is a function of the falling winning odds of a Trump presidency," says Boris Kovacevic, Global Macro Strategist at Convera.

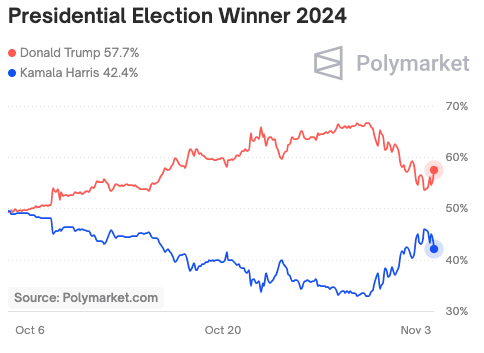

The retreat in betting market odds favouring Trump would better reflect the uncertainty in the polls, where the margin of error still suggests a 50/50 toss-up for the outcome.

The Dollar is tracking betting market odds closely, given they have called the winner 80% of the time in the past 35 years, rising when the odds of a Trump win are up and falling when his odds retreat.

This speaks of the USD-supportive policy mix proposed by Trump, which would include inflationary import tariffs.

Analysts at TD Securities say a second Trump Presidency would kick-start a sizeable USD rally.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"It would rekindle memories of US Exceptionalism, anchored by tariffs, tax cuts (on Red Wave), deregulation and negative impacts on the global growth outlook. A Harris Presidency brings some USD weakness as Trump risk premia gets unwound with a Blue Wave accentuating the decline in the USD," says TD Securities.

Should Harris win, the Euro can extend its recovery as high as 1.10, we are told.

"EUR/USD and GBP/USD could slump to their Q124 lows or head lower still in response to a Trump victory accompanied by a ‘red wave’ in the US Congress. In contrast, their upside could be limited to 1.10 and 1.33 in the event of a Harris victory and a divided US Congress," says Valentin Marinov, an analyst at Crédit Agricole.

"FX markets are currently minded towards a red sweep. Were that not to materialise, we suspect the dollar could be handing back some of its recent gains," says Chris Turner, Global Head of Markets at ING Bank.