EUR/USD in First Weekly Advance in Five Following U.S. Job Downgrades

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate (EUR/USD) consolidated its first weekly gain in five weeks after U.S. job numbers disappointed and bolstered Federal Reserve rate cut bets.

The Dollar index - a measure of broader USD performance - dropped after official figures showed the U.S. added just 12K jobs in October, which was well below consensus expectations for 113K and sharply down on September's 223K.

Euro-Dollar rose to as high as 1.0905 before subsiding to 1.0870, taking the week's gain to 0.72%.

The market was always expecting a slowdown in October owing to hurricanes landing in Southern states. The Dollar might have chosen to ignore the miss were it not for some sizeable downgrades to August and September payrolls to 78K and 223K, respectively, from 159K and 254K.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The downgrades in the previous data are where the real story lies, as this shows a trend of softer-than-forecast outcomes that will bolster expectations for further interest rate cuts at the Federal Reserve.

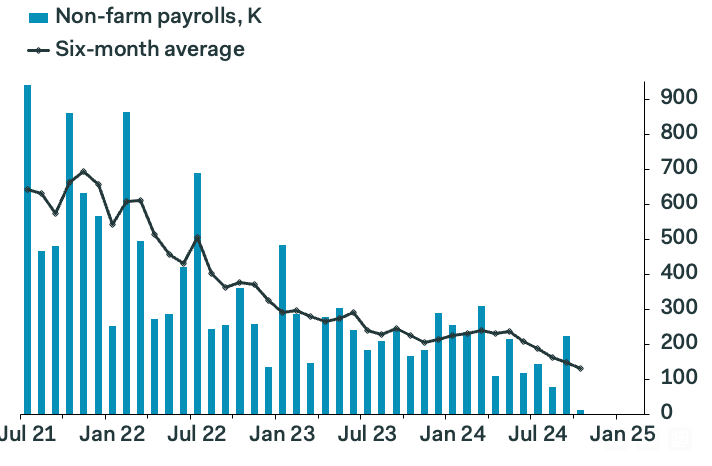

"As things stand, the six-month average in September—before the Boeing strikes and hurricanes—was just 148K, down almost 100K from the previous six months. It would be unsurprising if that number were to be revised a bit lower too, given the pronounced pattern of downward revisions lately," says Samuel Tombs, Chief U.S. Economist at Pantheon Macroeconomics.

Tombs says a further slowing in the trend looks likely, given that small businesses' hiring intentions remain depressed, large businesses still face a rise in borrowing costs as low-rate corporate bonds mature, and job openings in the health and education sectors have fallen.

Knut Magnussen at DNB Markets says the large negative revision to total payrolls growth in August and September indicates that the recent trend in employment is weaker than shown in the September reading one month ago.

"We expect that the Fed will look through the noise and continue to lower the Federal funds rate by 25bp next week. The 10-year yield fell c5bp after the release, and a 25bp cut is now fully priced in by the markets," he says.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Dollar exchange rates rose through October in response to a series of above-consensus U.S. economic data that saw a shar reduction in Fed rate cut bets.

These figures could put a cap on that trade, potentially underpinning EUR/USD.

However, Dr. Thomas Gitzel, Chief Economist at VP Bank, warns that we are by no means witnessing a breakdown in the U.S. labour market.

"Stripping out the one-off effects, employment growth remains robust. Despite the weak increase in employment, there are still no clear signs of weakness. The labour market reflects the robust performance of the US economy. Despite the Fed's rate hikes, there are no signs of an economic slowdown," he explains.

Regarding next week's Fed rate cut, he says the move was always "set in stone".

"The policy rate range is well above the current inflation rate, so there is room for monetary easing regardless of labour market developments. The healthy economy and robust labour market therefore have medium-term rather than short-term implications. Even if the rate cuts continue next year, key interest rates are unlikely to return to pre-coronavirus levels for the time being," he adds.

The next key event for the Dollar will be next week's U.S. election, where analysts say a Donald Trump victory can bolster the Dollar.

Should his Republican party win Congress, the move could be exacerbated.

Economists are meanwhile in agreement that the Dollar will fall sharply in the event of a win by Kamala Harris, which would erase the recent 'Trump trade' premium that has built up in currency markets.