Euro-Dollar Slides into the ECB

- Written by: Gary Howes

ECB President Christine Lagarde. Image: Andreas Reeg/ECB.

The Euro to Dollar exchange rate (EURUSD) hits its lowest level in more than two months as investors anticipate another European Central Bank (ECB) interest rate cut.

The Euro has fallen for 13 out of the past 15 days in an evolving downtrend that takes EUR/USD to 1.0849, and buyers will be wondering if there is anything the ECB can do to arrest the slide.

This will be the second cut in succession from the ECB, which is responding to clear evidence of a slowing Eurozone economy and slumping inflation rates.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

By now, the cut is well priced, meaning there's limited potential for significant volatility in reaction to the decision itself, leaving it to ECB President Christine Lagarde and her colleagues to shift the dial.

Already, markets expect a relatively steady path of rate cuts going forward, with the next move anticipated in December.

Analysts at ING Bank note the EUR OIS curve (which guagues investors' expectations for the future of the ECB policy rate) is close to pricing in back-to-back ECB cuts at each of the next four meetings.

"We doubt this week’s ECB guidance (or lack thereof) will trigger much further dovish rerating," says ING.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

To what extent does Lagarde push back against these expectations? If she does, expect the Euro to recover.

But she has little ammunition at her disposal to do so, with Germany's economy in stagnation (at best) and France and Spain's inflation rates crashing well below the ECB's 2.0% mandated target.

The only straw any 'hawkish' assessment could hinge on would be that wages have not quite fallen to where they need to be to ensure confidence that inflation won't be stubborn going forward.

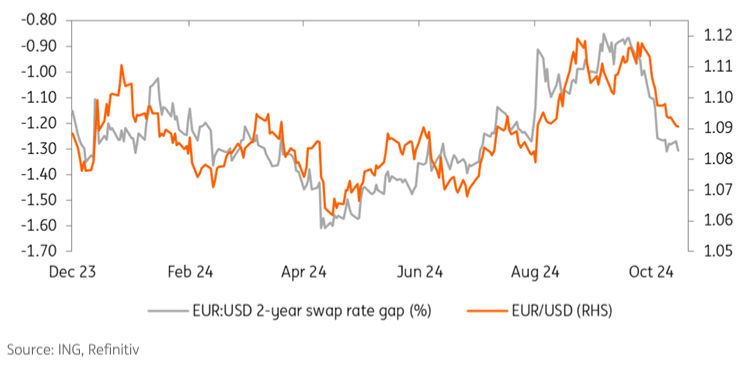

Above: EUR/USD and relative interest rate expectations.

This should prompt the ECB to maintain a message that it remains data-dependent when considering future decisions.

"We struggle to come up with a bullish argument for the pair," says ING strategist Francesco Pesole of EUR/USD's prospects.

At the same time, he says a short-term rate rewidening in interest rate expectations between the U.S. and Eurozone has probably little room to widen further.

This can mean the ECB's decision will have a limited downside impact on the EUR/USD, which tends to track relative interest rate expectations.

"In other words, the rates picture is bad for the EUR, but we don’t see it getting much worse," says Pesole.