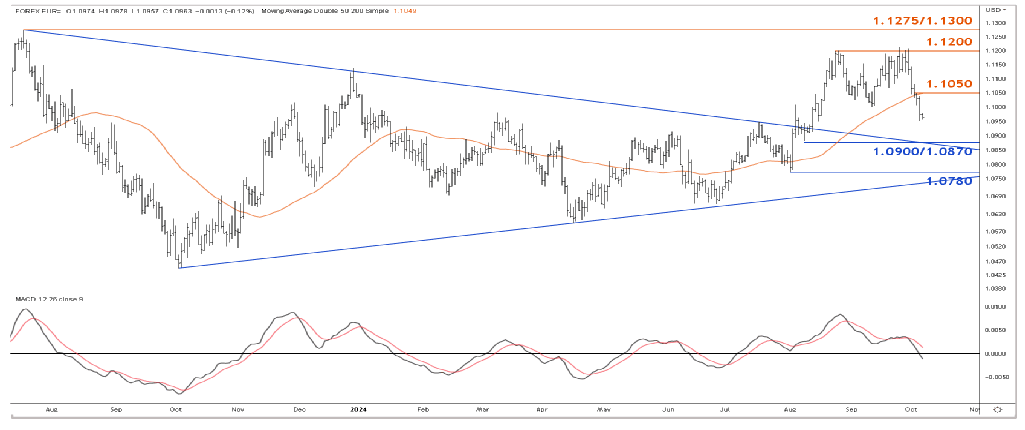

Euro-Dollar Forecast Targets: 1.0780 on the Radar

- Written by: Sam Coventry

Image © European Union - European Parliament, Reproduced Under CC Licensing.

The Euro to Dollar exchange rate is forecast to see further losses in the coming days and weeks, with one saying a return to 1.0780 is not impossible.

The Dollar's resurgence brings an end to the Euro's 2024 rally, at least in the near term, according to Tanmay Purohit, a technical analyst at Société Générale.

"EUR/USD struggled to overcome the peak of August near 1.1200 in a recent attempt to form a double top," says Purohit.

Subsequently, the Euro-Dollar gave up the 50-DMA (1.1050) and dipped below the neckline of the pattern, denoting the risk of a deeper pullback.

The developments follow a strong of better-than-forecast U.S. data points that confirm the U.S. economy is not about to fall into recession, and that there is little pressing need for further interest rates cuts from the Federal Reserve.

To be sure, more cuts are coming, but not as thick and fast as once thought.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

At the same time, the European Central Bank (ECB) will be under pressure to act again given the slowdown in the Eurozone economy, with a potential consecutive rate cut coming at next week's meeting.

The divergence in rate path expectations puts Euro-Dollar back under pressure, and technical analysts are tasked with assessing the market levels that will come into play.

"If EUR/USD fails to reclaim the MA near 1.1050, the down move is likely to extend. Next potential supports could be located at 1.0900/1.0870, the 50% retracement from April and 1.0780," says Purohit.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

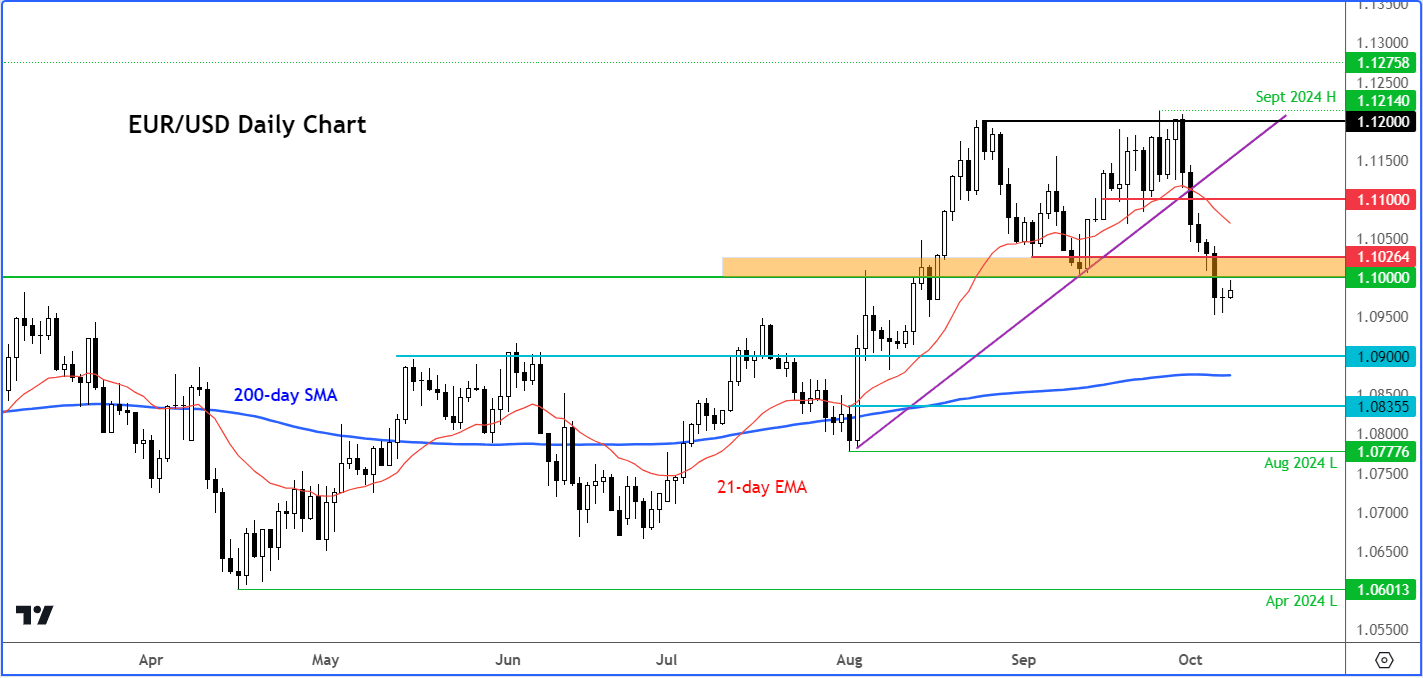

"The technical EUR/USD forecast has turned bearish," says Fawad Razaqzada, FX analyst at City Index.

He explains that EUR/USD has now broken a support area between 1.1000 to 1.1025, meaning it has therefore created an interim lower low.

"Unless the exchange rate gets back above this area, the path of least resistance remains to the downside despite the small uptick in rates so far this week," says Razaqzada.

The next key support level to watch is around 1.0900, followed by the 200-day average around 1.0875, he adds.