Why Trump is Seen as Positive for the Dollar

- Written by: Gary Howes

Above: Trump's tariff measures when president triggered a market selloff, which tends to support USD. Official White House Photo by D. Myles Cullen.

Analysts are saying the Dollar weakness that follows the Trump vs. Harris debate signals markets think the Democrat contender won.

But why is the market reacting this way? A first point to make is that a Harris presidency is not an outright negative for the Dollar, rather, a Trump presidency is more supportive of the Dollar.

Ultimately, this is because Trump is seen as being far more hawkish on international trade, particularly with regard to China.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The US' policy on China is one of the key issues of the US presidential election," says Carol Kong, an economist at Commonwealth Bank. "President Trump has already flagged a 60% tariff on Chinese imports which, if realised, may trigger a second trade war with China."

That said, there is now a bipartisan consensus in the U.S. on China, explains Kong, President Trump started a 'trade war' with China in 2018 by imposing tariffs on some Chinese goods.

President Biden then expanded trade restrictions, especially on China’s advanced manufacturing sector.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"Regardless of who becomes the next President, the U.S. is likely to remain tough on China," says Kong. "However, President Trump will likely adopt a more aggressive approach than Vice President Harris."

Trump, on September 09, ramped up his anti-trade rhetoric, saying he would levy tariffs of 100% on imports from countries that were moving away from using the dollar.

He has already committed to raising a 10% universal tariff on all imports while seeking to levy a 60% tariff on imports from China.

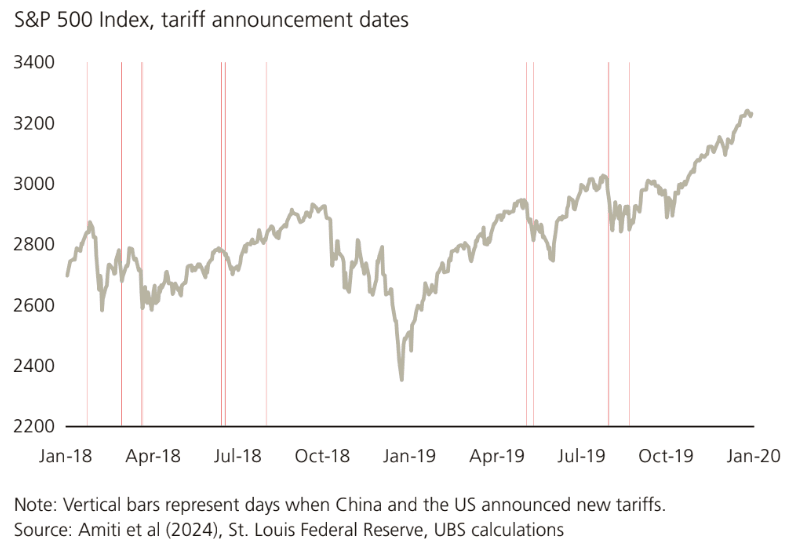

Above: US stocks reacted negatively to 2018/19 US-China tariff announcements. This prompts safe haven seeking behaviour, which supports USD.

"If realised, may trigger a second trade war with China. The implication is CNH can be one of the biggest losers against the USD if President Trump wins," says Kong.

USD/CNH is a powerful driver of broader dollar currents, and strength here can weigh on other crosses, such as GBP/USD and EUR/USD.

However, one analyst says any hike in tariffs could end up backfiring on the Dollar in the longer-term.

"Under a universal tariff scenario, we would expect bond yields to decline and U.S. equities to fall by around 10%, with the biggest impact on retailers, auto manufacturers, tech hardware, semiconductors, and parts of industrials. Beyond the initial risk-off shock, universal tariffs are likely negative for the US dollar," says Paul Donovan, Chief Economist, UBS Global Wealth Management.

Such a 'risk off' market sentiment traditionally boosts the Dollar.

But, "beyond the initial shock effect, U.S. tariffs are likely to be USD negative as time progresses," says Donovan.

He expains that retaliatory tariffs from trading partners will hit U.S. exports and exacerbate the USA's trade deficit. "If this results in a larger US trade deficit, we expect the USD to come under pressure," says Donovan.