Powell Sounds Dovish, But Euro-Dollar Unable to Capitalise

- Written by: Sam Coventry

Image © Your Image for the ECB.

Federal Reserve Chair Jerome Powell struck a 'dovish' note in his most recent interview. But the Euro was unable to capitalise on the comments.

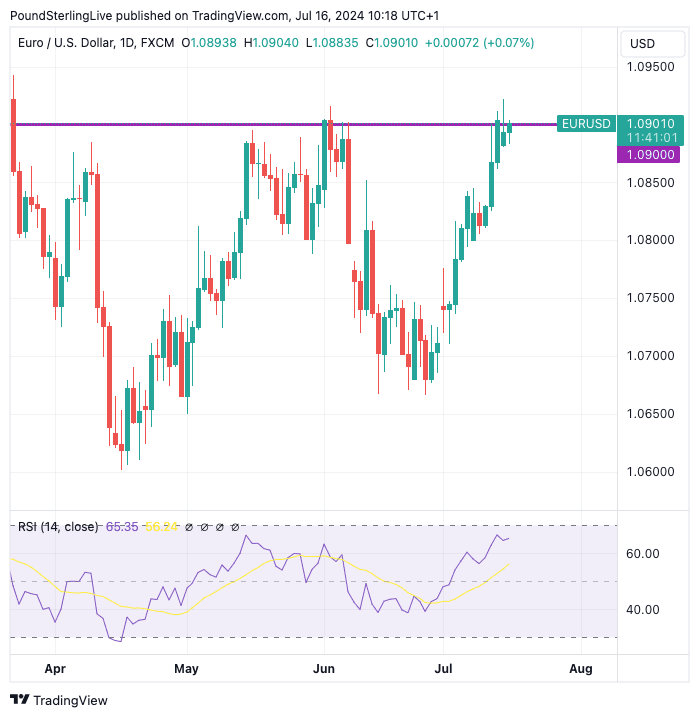

The Euro to Dollar exchange rate is stuck below resistance at 1.0900, unable to break higher despite soothing words from Powell who has said the U.S. inflation picture is improving amidst a more balanced labour market.

Powell gave an interview to the Economic Club of Washington DC, in which he was able to reflect on the softer-than-expected U.S. inflation numbers from last week.

"Powell sounded dovish," says Sam Hill, Head of Market Insights at Lloyds Bank. "He reflected on the improvements in the path of data the Fed had seen over the course of Q2, specifically the last three inflation prints."

The Dollar fell after U.S. inflation printed -0.1% month-on-month in June, down from 0% in May and below expectations for a 0.1% rise.

Powell thinks that these data have added "somewhat" to confidence that inflation is on track to return to target.

Combined with a cooler labour market this means the Fed will be "looking at both mandates" when determining policy.

Much of the Dollar's recent softness has come from signs that the Fed might cut interest rates before inflation falls to 2.0% in order to protect the labour market. The fear is that keeping rates too high for too long will result in a rise in unemployment.

"We want to get this right," said Powell.

The Dollar is proving less sensitive to these kinds of remarks. It fell noticeably after Powell told the ECB's forum on central banking on July 03 that considerable progress had been made on inflation and that the disinflation process was back on track.

He said in Sintra, Portugal, that if the labour market were to be "unexpectedly weak... this will also cause us to respond."

Above: EUR/USD at daily intervals. Track EUR/USD with your custom alerts; find out more here.

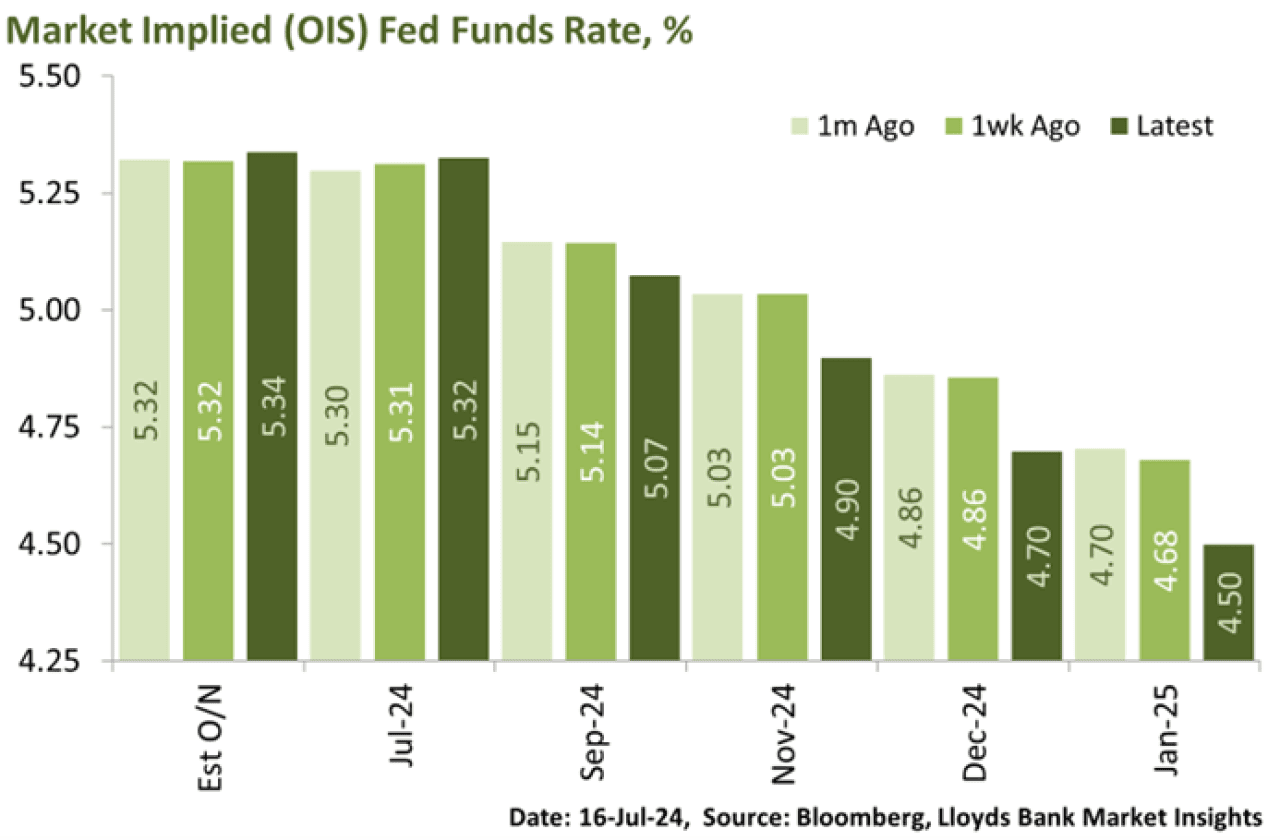

Powell also reaffirmed his view that the neutral level of interest rates was probably higher than it had been but reiterated that policy was still restrictive. "Market pricing continued to shift towards more cuts this year after he spoke, with an easing cycle seen starting in September and delivering at least two cuts over the year as a whole, with around a 60% probability of three," says Hill.

The Euro to Dollar exchange rate has risen amidst greater confidence that the Fed will cut interest rates in September. However, the failure to break above 1.09 on a sustained basis suggests the cut might already be 'in the price'.

This could mean the Dollar consolidates around current levels and those wanting a stronger Euro might have to await further catalysts.

All eyes will be on the European Central Bank on Thursday when it delivers its next rate decision. Rates will be left unchanged but markets will be looking for hints that further rate cuts are incoming.

A September rate cut at the ECB is also nearly fully priced by the market, which suggests even this is unlikely to shift Euro-Dollar materially, which can keep the exchange rate poised below 1.09 and ready to make a fresh break higher.