French Vote: Sunday's Exit Polls, the FX Verdict and What to Watch For

- Written by: Gary Howes

Image © Adobe Images

Markets expect a change of government in France following the upcoming legislative elections. The result of the first round this Sunday will give markets a better understanding of what the final outcome of the second round of voting on July 07, might be.

Currency markets will be the first to react when Sydney forex markets start trading around 8 PM UK time.

Provisional results of the vote are typically released when voting ends at 8 PM French time (7 PM, UK); these are based on exit polls and early vote counts but have traditionally been very accurate.

A candidate can win outright if they garner over 50% of the vote in the first round. If not, those candidates with more than 12.5% proceed. 50% is a high bar for an election where the leading party in the polls (Marine Le Pen's RN party) are polling at about 35%. In 2022's vote, just five of 577 seats were decided in the first round of voting.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

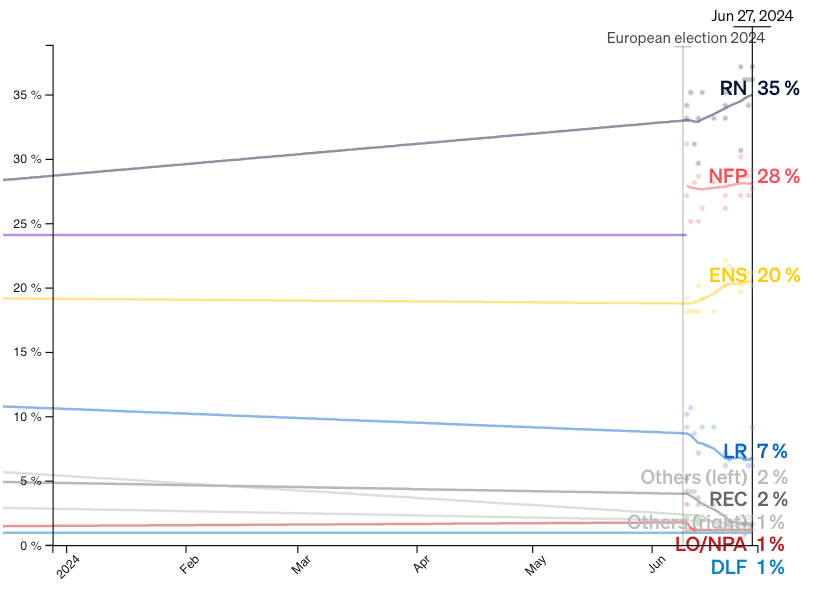

The Economist's poll tracker shows the RN leading, with 37% of the vote, ahead of the left-wing alliance of the New Popular Front (29%) and Emmanuel Macron's Ensemble (21%). Some polls suggest that RN could secure a majority once the elections are complete, although most point to a hung parliament.

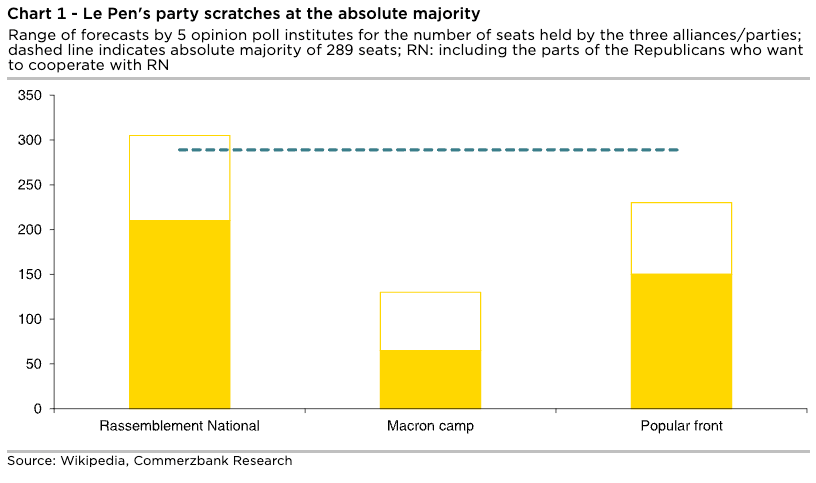

The market is positioned for a 'hung' outcome, in which no single party has the majority required to deliver real reform. This is not ideal for financial markets, which want to see France deliver the necessary changes to stabilise its growing debt pile. However, it is a consensus and 'least-worst' outcome that could allow the Euro and French assets to reclaim recent losses.

Above: Poll of polls from The Economist.

Meanwhile, an outright win for RN is not considered the negative outcome for the Euro that it once was. RN has said it will seek to ensure stability, noting that fears of an adverse market outcome would lower its chances of winning.

RN's Jordan Bardella, who would be France’s prime minister if RN secures a majority, committed to "a lot of pragmatism to ensure trust and stability for the business community."

But a full retracement of the risks that the Euro has absorbed over recent weeks, at least since the election was first called by President Macron, is unlikely.

Image courtesy of Commerzbank.

Economists point out that some of RN’s key economic promises remain unfunded, such as cutting income tax for those under 30 to combat brain drain and the repeal "in principle" of Macron’s retirement age increase from 62 to 64.

France's debt sustainability is an issue for markets, with concerns being expressed via a selloff in French bonds, which has pushed their yield sharply higher. When measured against Germany's yield, we can see the premium on French debt has shot higher in recent weeks.

The European Commission last week put France and six other countries should be disciplined for running budget deficits in excess of EU limits, with deadlines for reducing the gaps to be set in November. This means France must set out some significant spending cuts or tax rises before the year is out.

How a party from the far left or right would do so is a question markets want answered.

Indeed, the tailrisk outcome for the Euro would be the far-left New Popular Front winning the vote owing to the coalition's radical economic agenda that would pose significant challenges for France's finances.

The NFP is a coalition of left-wing parties that includes Jean-Luc Mélenchon’s France Unbowed, the Socialist Party, the French Communist Party and the Greens. It plans to raise the monthly minimum wage to €1,600, impose price ceilings on essential foods, electricity, gas and petrol, repeal Macron’s deeply unpopular decision to raise the retirement age to 64 and invest massively in the green transition and public services.

Prime Minister Gabriel Attal said their agenda would present France with a "fiscal drubbing".

"It seems like the risk of a left-wing majority is seen as a tail risk for now," says Evelyne Gomez-Liechti, Rates Strategist at Mizuho.