Euro-Dollar: Scope for Relief This Week Says City Index

- Written by: Fawad Razaqzada, Analyst at City Index

Image © Adobe Images

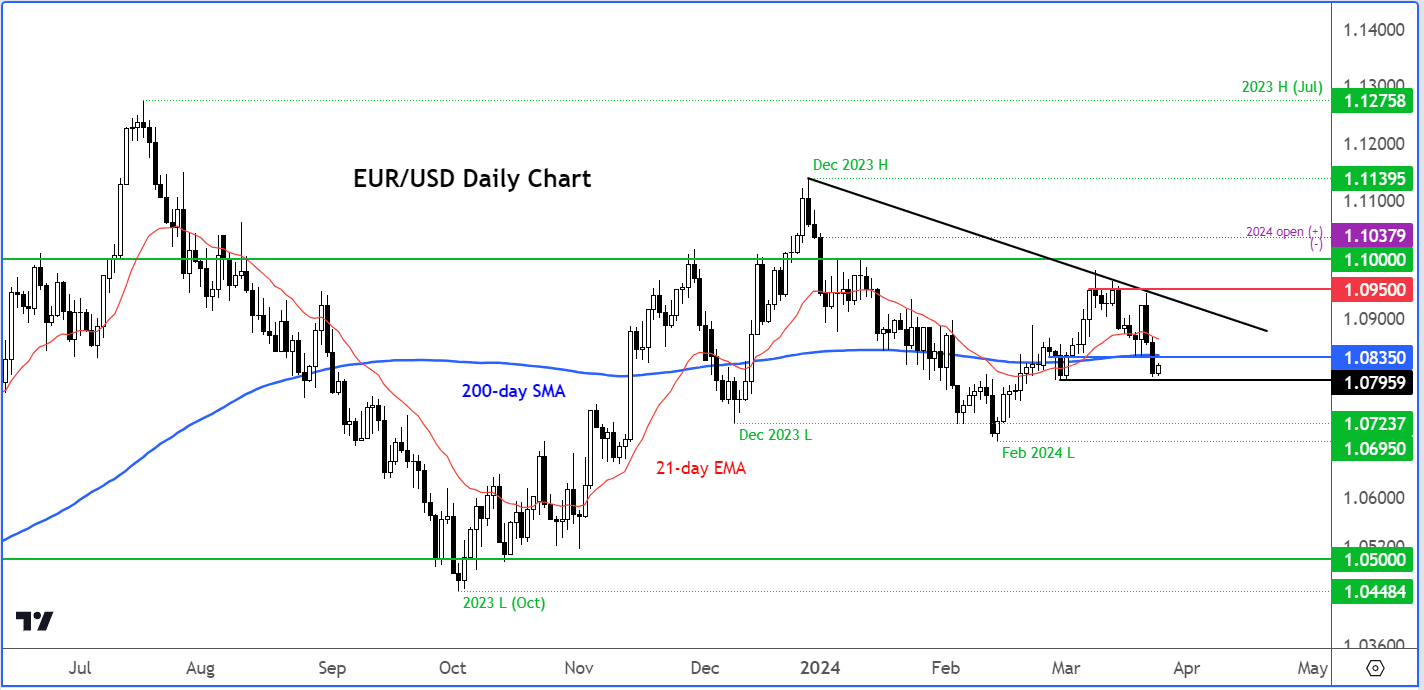

The Euro to Dollar exchange rate (EUR/USD) will be in focus as traders wonder whether Friday’s breakdown below the 200-day average was a temporary move or one that has legs.

Euro-Dollar has rebounded after breaking below the 200-day average (1.0835) on Friday. Let’s see if it can reclaim the 200-day again.

It would be a bullish outcome if it does. If so, what the bulls need to see for confirmation is a break above the bearish trend line which comes in at around 1.0925 to 1.0950 area.

On the downside, 1.0795 is now the key level to watch. This was the most recent low that was formed at the end of last month.

Image courtesy of City Index.

Ideally, the bulls will not want to see price go back below this level now. However, a clean break below this level could potentially pave the way for a larger drop towards 1.0700.

Last week, the U.S. dollar rose, even though the Fed was dovish as the FOMC maintained its projections of 3 rate cuts this year.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Part of its support stemmed from increasingly dovish external factors, including the Swiss National Bank's surprise rate cut, as well as accommodative stances from the Bank of England and Reserve Bank of Australia.

Declines in the pound, franc, euro and the Aussie dollar further bolstered the dollar's recent rise, alongside encouraging US economic indicators such as PMIs, existing home sales, and unemployment claims. However, these macroeconomic releases are unlikely to deter the Fed from contemplating rate cuts in June, especially amidst subdued inflation.

After this week’s PCE inflation data, attention will turn to the Non-Farm Payrolls report and Consumer Price Index data in subsequent weeks.

The March U.S. data set for release in early April holds considerable sway over the dollar's trajectory. Weakness in these figures, particularly forthcoming inflation data, could precipitate a sustained decline in the dollar.