EUR/USD Week Ahead Forecast: Constrained by Economic Headwinds

- Written by: James Skinner

- EUR/USD supported at1.0967, 1.0942 & 1.0887 on charts

- Chart resistances & economic worries hamper beyond 1.11

- Slowing economy & ECB weigh as U.S. inflation risk looms

Above: King Charles III coronation procession travels along The Mall, London. Image © John-Parnell-Flickr,

The Euro to Dollar exchange rate entered a holiday-shortened week treading water around 1.10 but economic headwinds on the continent could lead the single currency back down to the round number of 1.09 or so in the days ahead.

Europe's single currency underperformed all major counterparts barring the Dollar for the week to Tuesday while rising in relation to only the Chinese Renminbi, Brazilian Real and Turkish Lira when measured on a broader G20 basis but could also be set to remain a laggard in the near future.

Losses built after European Central Bank (ECB) President Christine Lagarde said on Thursday that interest rates are likely to be raised further up ahead and until it becomes clear that monetary policy is "sufficiently restrictive" for returning inflation to the 2% target in a reasonable timeframe.

But the Euro came under additional pressure when Destatis said German factory orders fell more than 10% in March, their largest decline since the earliest economic closures of the pandemic, and after Eurostat said European retail sales fell more than one percent the same month.

"I am starting to think the broad EUR rally is done. We continue to bang up against 1.1100 in EURUSD and most EUR crosses have turned unambiguously lower," says Brent Donnelly, CEO at Spectra Markets and a veteran trader with a career spent at global banks like Lehman Brothers, HSBC and Nomura.

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of March rally and selected moving averages indicating possible areas of technical support.

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of March rally and selected moving averages indicating possible areas of technical support.

"German inflation is toppy, the ECB meeting is in the rearview, and German manufacturing and Retail Sales data haven’t been this bad in combination in a single month since 2008," Donnelly writes in Monday's am/FX daily macro diary.

It's not yet clear if recent data means an economic crunch is underway but that is the risk and direction of travel as the European Central Bank's most hawkish monetary tightening on record begins to be felt in the real economy.

This heightens the importance of the economic data emerging up ahead and particularly from Europe's largest economies but would become a more pressing risk for the Euro if any economic deterioration leads the market to reprice the outlook for ECB interest rates.

"In YoY terms, the ECB's balance sheet contracted at more than double the pace of the Fed's in April. That divergence probably won't persist to the same extent, but it still represents another short-term hurdle for the USD," says Stephen Gallo, a global FX strategist at BMO Capital Markets.

The week ahead is a quiet one in the European calendar but Wednesday's U.S. inflation figures could impact the Euro to Dollar rate and will be bookended by speeches from ECB executive board members Philip Lane and Isabel Schnabel.

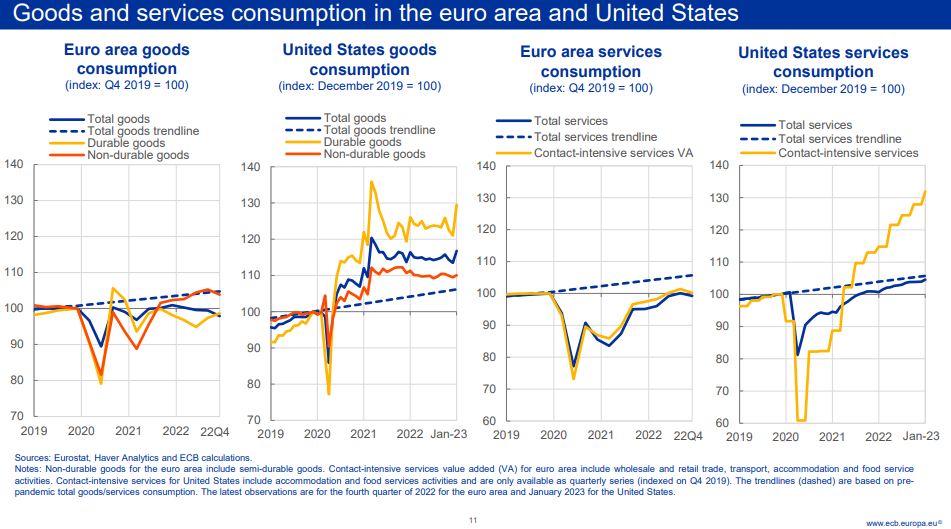

Source: European Central Bank.

Source: European Central Bank.

"I don’t want to be long USD this week with US inflation the main story and the debt ceiling in the background. Therefore a EURUSD short doesn’t work for me, even though it’s easy to risk manage with a stop above 1.1125," Donnelly says.

"I think the same way economists underestimated the speed of the rise in US inflation, they will underestimate the speed of the fall. Therefore, short EURUSD does not make sense," Donnelly writes.

Donnelly tipped the EUR/MXN pair as a sell in the options market on Monday fearing that Dollar sales could keep EUR/USD from falling much this week if U.S. inflation extends its nine-month downtrend by falling further on Wednesday.

The economist consensus is that inflation was likely unchanged at 5% last month while the more important core inflation rate is seen managing only a meager reversal of its prior tick higher from 5.5% to 5.6%.

That sets a low bar for a downside surprise and further pressure on the U.S. Dollar if softening price pressures offer partial vindication to financial markets for betting heavily in recent weeks that the Federal Reserve is likely to cut its interest rate as many as three times by year-end.