Euro and European Central Bank Outlook: Analyst and Economist Views

- Written by: James Skinner

© European Central Bank, reproduced under CC licensing

The Euro remained one of the top performing major currencies of the week on Friday but analysts and economists are divided in their views about the outlook since the European Central Bank (ECB) interest rate decision on Thursday.

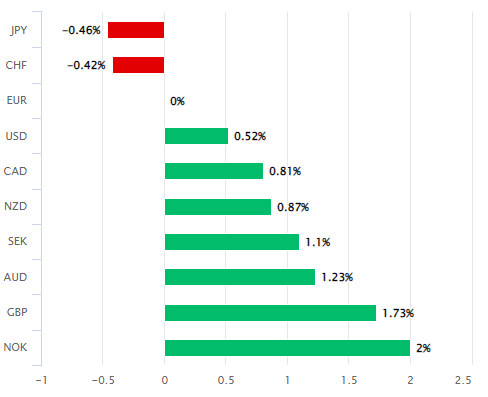

Europe's single currency ceded ground to the Japanese Yen and Swiss Franc this week while advancing against all others in the G10 basket with its largest gains coming in relation to the Norwegian Krone and Pound Sterling.

But the Euro softened on Thursday despite President Christine Lagarde being clear that a 0.5% March increase in interest rates is likely to be followed by additional steps of an undetermined size over subsequent months.

That did nothing to disturb pricing in the interest rate derivative market, which envisages the ECB deposit rate rising from 2.5% on Friday to almost 3.25% by year-end, but did leave analysts and economists somewhat split about the outlook for ECB policy and the single currency.

Above: Euro performance relative to G10 and G20 currencies this week. Source: Pound Sterling Live.

The ECB's objective is to raise benchmark borrowing costs "into restrictive levels and stay there for sufficiently long so that we are confident that at those rates we will actually deliver the 2% objective," for inflation.

But the definition of "sufficiently restrictive" is yet to be agreed collectively by the ECB Governing Council and will depend in part upon the European inflation figures due out later in February after those released this Wednesday omitted the numbers for Germany.

Wednesday's figures suggested inflation fell from 9.2% to 8.5% in January while remaining unchanged at 5.2% once changes in energy, food, alcohol and tobacco prices are overlooked, although some economists are warning these numbers could be revised higher once the Germany data is included.

However, that's just one reason for why analysts and economist currently differ in their ECB and Euro outlooks, some of which are summarised below.

Silvia Ardangna, chief Europe economist, Barclays

"Given the tentative pre-committment for a further 50bp hike in March, we think the risk of a step-down to 25bp is low and would require a significant improvement in the inflation outlook and/or a significant deterioration in the economic sentiment."

"We maintain our view that the ECB will reach a terminal rate of 3% in March, based on our more benign view of inflation. However, we see risks of a further 25bp hike at the May meeting in case inflationary dynamics prove more persistent than we currently expect."

"Inflation projections may be revised down in March. We think a downward revision in the inflation forecast will be underpinned by, among others, the following factors: 1) more benign recent energy price developments; 2) the fact that some fiscal measures will no longer be binding under current conditions and will thus not result in an increase in inflation once they are removed next year; and 3) the appreciation of the currency."

You-Na Park-Heger, FX analyst, Commerzbank

"The ECB actually committed surprisingly firmly to planning another 50bp hike for March. However, by doing so it was merely able to confirm the market in what the majority had already expected anyway, so that the surprise element was somewhat limited."

"Core inflation stubbornly remains at high levels, but that is why the ECB has more or less committed for the March meeting as the current data suggests that significant improvement of inflation levels seems unlikely until then. What the situation in May might be like is a completely different matter though."

"It therefore makes sense that Lagarde left open by how much the ECB will hike its key rate at the May meeting. There will be updated projections for growth and inflation in March which surely will have an effect on future monetary policy steps."

Francesco Pesole, FX strategist, ING

"It’s been quite clear that markets have doubted both Fed Chair Jerome Powell’s and ECB President Christine Lagarde’s attempts to hang on to hawkish communication, although dovish bets on the Fed appear more strongly founded at this stage."

"Lagarde’s press conference brought more fog than clarity. And we think it is indeed the communication hiccups in Frankfurt that is driving EUR/USD weakness."

"We remain of the view that at least 75bp of extra tightening will be delivered by the ECB, which still puts EUR/USD in a position for a big rally in the second quarter – when US short-term rates may come off more steadily. The ECB communication troubles may cap EUR/USD before then."

Alexandre Stott, economist, Goldman Sachs

"Today’s communication reinforces expectations for a further 50bp step in March and we maintain our forecast for a step-down to a final 25bp hike in May given the sharp improvement in the outlook for headline inflation and diminished risks of strong second-round effects."

"While a higher terminal rate than our 3.25% baseline remains possible if growth and labour markets turn out more resilient than we expect, shifting risks around the inflation outlook lower the risk that the Governing Council will need to extend the hiking cycle into the summer."

Stephen Gallo, European head of FX strategy, BMO Capital Markets

"We don't rule out further upside in EURUSD above 1.10 in the very near-term, simply given how the USD has traded YtD. However, our view is that the pair needs the Euro Area to be clear of sticky inflation pressure and global monetary tightening (amongst other factors) in order to sustain significant strength above the figure. We're even more confident of this now that ECB QT [quantitative tightening] is commencing."

Reinhard Cluse, chief European economist, UBS Investment Bank

"When the Governing Council looks back at today's market reaction, they might wonder whether they actually delivered policy easing, rather than tightening."

"Effectively, for a sell-off in rates, the market needed to see an additional challenge to current terminal rates pricing (as was done in December)."

"Looking ahead, the German January inflation print and its implications for Eurozone headline and core revisions will be closely watched alongside commentary from key ECB officials who may push back against the market’s dovish take on today’s decision."

Marco Valli, Global head of research, UniCredit

"The key part of the introductory statement pertains to the policy outlook beyond March. The central bank confirmed that rates will still have to rise “significantly” from current levels and Ms. Lagarde dismissed the idea that the deposit rate might peak at 3%."

"In March, the ECB will very likely reduce its (overly aggressive) inflation projections."

"We assume that the ECB will want to play it safe and make sure disinflation is for real, before pausing the hiking cycle. We think this will require one final 25bp step in June to 3.50%, although we now see this as more uncertain."