Euro Stranded by a Dwindling Rhine

- Written by: Gary Howes

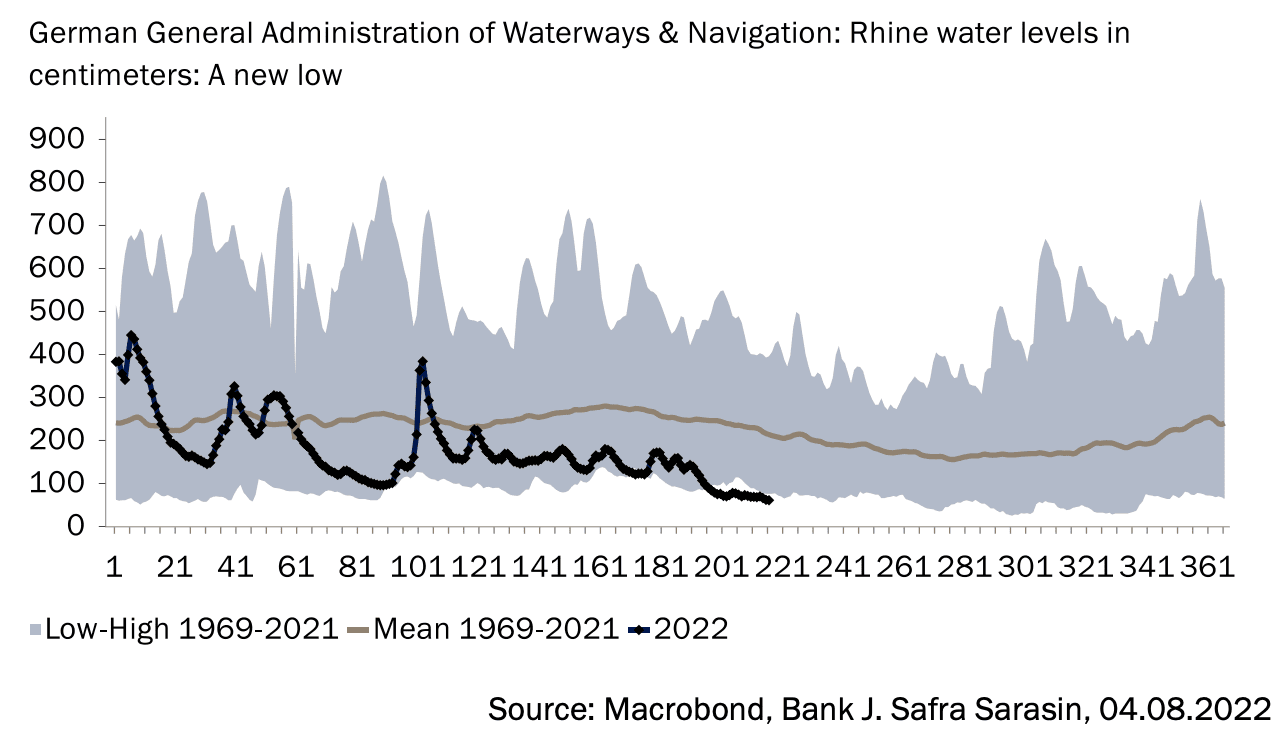

- Rhine levels perilously low

- Hampering German economic outlook

- Provides additional headwinds to EUR

- But EUR/USD still largely dependent on USD leg

Image (C) Adobe Images.

Foreign exchange analysts say falling water levels on the river Rhine provides another reasons to be bearish on the Euro.

The Rhine is a key transport artery for the Germany economy and low seasonal rainfall across Europe has meant it is running perilously low.

"Growth concerns in Euro-area, energy woes and hawkish Fed are restraining EUR’s up move. In Germany, the water levels on the Rhine River have dropped to its lowest level since 2018 and is coming close to being impassable for coal, sand, chemicals and other commodity shipment. This can affect trade, growth and add to energy woes," says Frances Cheung, a strategist at OCBC Bank.

Water levels on the Rhine look set to fall close to the point at which it would effectively shut to traffic.

The key waypoint for the shipment of commodities at Kaub, Germany, is set to drop to 47 centimeters by the weekend, reports Bloomberg.

That would take it to within 7cm of being all but impassable.

The developments lead Cheung to maintain a slight bias to the downside for the Euro to Dollar exchange rate (EUR/USD).

"Germany will likely be hit harder than other countries. Industrial production might stall as the heatwave has led to extremely low water levels in the Rhine, which makes it difficult to navigate, adding to supply problems. Also, its gas inventories are lower than in other countries such that rationing gas this winter remains a serious risk," says Karsten Junius, Chief Economist at J. Safra Sarasin.

German energy supplier EnBW AG says coal shipments are already restricted by low water levels because fewer ships are available, and the ones that are ready to use carry less cargo. "Shipment costs for coal are therefore increasing, which in turn inflates the costs of operating coal plants," the company said in a statement.

German power prices rose to a record as utilities are increasingly reducing electricity output in western Europe because of the hot weather.

Year-ahead electricity contracts rose as much as 2% on Friday as a number of electricity generating companies reported issues, including Uniper SE, which is struggling to get enough coal up the river Rhine.

"This river is now only centimetres away from being entirely unnavigable and causing yet further commodity supply and price constraints in Europe. Far from a drop in the ocean, in a time of fragile European and general growth sentiment, bad news continues to pile up for Europe," says Charles Porter at SGM Foreign Exchange Ltd.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Despite the ongoing challenges facing Germany and the wider Eurozone EUR/USD is well off its sub-1.0 levels, aided by a broader retracement in the U.S. Dollar.

The Dollar has retreated through July amidst an improvement in global market sentiment as investors start to see a peak in the U.S. Federal Reserve's hiking agenda.

This is in turn informed by observations that inflation might be peaking as a multi-week decline in commodity prices starts to feed into the price pipeline.

So while the Euro faces a multitude of challenges the EUR/USD could remain rangebound as long as the Dollar retracement extends.

However, some analysts remain of the view it is too soon to call an end to the longer-term trend of Dollar strength.

"We stick to our conviction that the overall global macro backdrop remains favourable for the dollar," says Junius.

Although markets might be pricing in a peak in Fed rate hike expectations the cycle is by no means over.

"Given the persistence of high inflation, the market will likely refocus on the Fed’s need to tighten monetary conditions further down the road, which should equally weigh on risk sentiment and be dollar supportive," says Junius.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes