Euro-Dollar: "Time to talk about parity" says ING

- Written by: Gary Howes

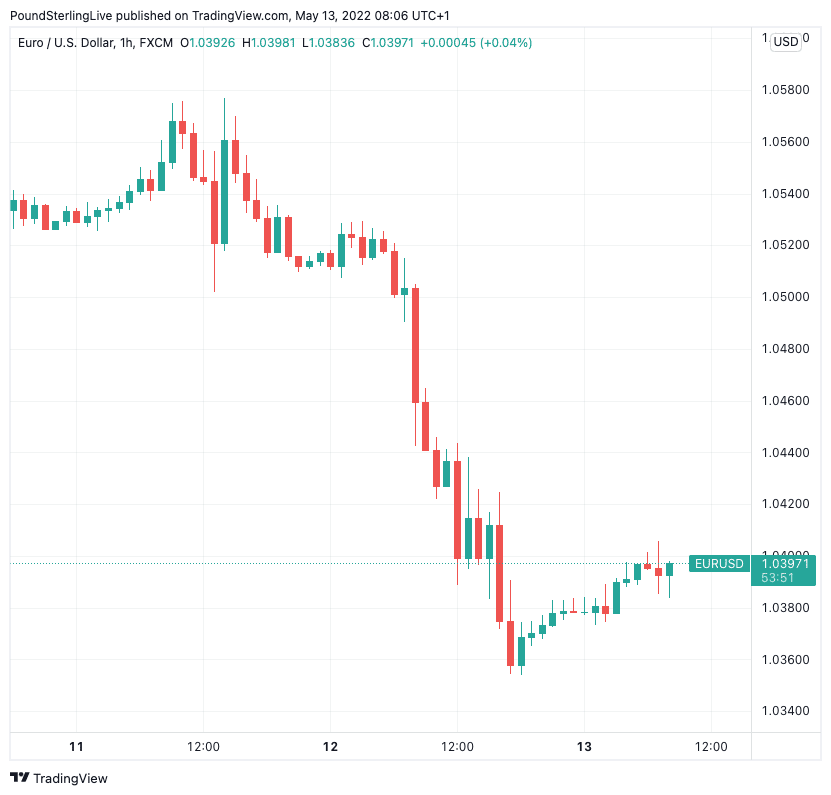

"EUR/USD is close to the 1.0340 key support, below which would see the prospect of parity become quite material" - ING.

Image © Adobe Stock

The Euro to Dollar rate (EUR/USD) dipped a sizeable 1.26% to trade in the 1.0350s on Thursday, its lowest levels in five years, leading analysts to consider more carefully the prospect of a fall to 1.0.

"EUR/USD is close to the 1.0340 key support, below which would see the prospect of parity become quite material," says Francesco Pesole, FX Strategist at ING Bank.

Pesole looks for support at the 1.0340 January 2017 low to hold today as risk assets correct higher.

Above: EUR/USD at one hour intervals.

Global markets are trading in the blue ahead of the weekend, with traders seemingly buying into heavily discounted stocks.

However markets are still ultimately pointed lower according to a host of technical indicators, suggesting further downside is possible.

For the Euro, this could spell further weakness, particularly if global investors continue to fret about surging European gas prices.

"Parity in the near term wouldn't be a shock," says Pesole in a regular daily FX market briefing. "After losing the 1.0500 “anchor”, EUR/USD volatility may well increase again." (Set your FX rate alert here).

The Euro has come under pressure against Pound Sterling, the Dollar and other currencies as surging gas prices threaten to trip the Eurozone economy into recession later in 2022, in turn limiting the European Central Bank's ability to raise interest rates.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Money markets now predict less than 80 basis points of European Central Bank (ECB) rate hikes by year-end, compared to 95 bps at the start of the week, as fears of Eurozone stagflation rise.

The repricing was triggered by another spike in European gas prices, the result of Russia's decision to squeeze gas supplies to Europe this week in retaliation for sanctions.

"The bottom line is that we can't accurately price the risk of a disruption to Europe's gas supplies, but if it happened, the risk of EUR/USD breaking parity would be substantial, and that keeps the natural urge to start building a long-term position in euros at bay," says Kit Juckes, FX Strategist at Société Générale.

Analysts warn the Euro could be in for further weakness were Russia to further squeeze European gas supplies, an outcome that is increasingly likely given an abject failure by Russian forces to make progress in eastern Ukraine.

The war is dragging on and Russian President Vladimir Putin has little to show for his efforts apart from a hollowed out army.

Desperation could see Russia lash out against the West and one area of strength remains Russia's dominance over European gas supplies.

It is reported Finland is preparing for Russia to cut off gas supplies after leaders in Helsinki backed entering Nato "without delay".

A further tightening of gas supplies would materially impact the Eurozone's growth outlook and sour sentiment towards the Euro further.

"In this environment, another technical break lower in EUR/USD in the coming days is a very material risk," says Pesole.