Euro-Dollar Cheers ZEW Survey as Italian Unrest Ebbs, though Risks Linger

- Written by: James Skinner

- EUR leads majors higher as political risk ebbs, ZEW surprises.

- Outperformance comes as USD falters, market waits on Yellen.

- Charts warn EUR correction has further to run ahead of ECB.

Image © Adobe Images

- EUR/USD spot rate at time of writing: 1.2124

- Bank transfer rate (indicative guide): 1.1657-1.1742

- FX specialist providers (indicative guide): 1.1899-1.1995

- More information on FX specialist rates here

The Euro-to-Dollar exchange rate led the Euro to outperform non-European currencies on Tuesday after Germany's ZEW survey surprised on the upside of expectations and as Italian political risks ebbed, although technical analysts warned the Euro's correction could have further to run.

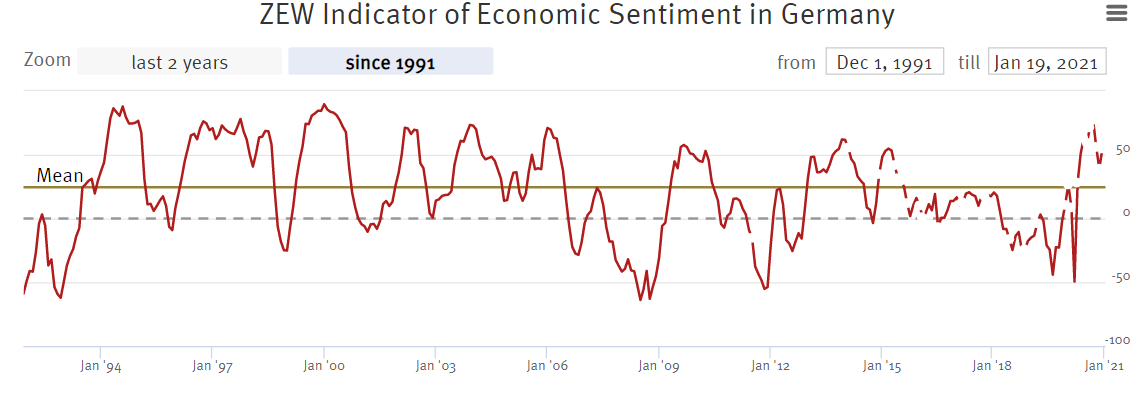

Europe's unified unit was higher against all major rivals barring the Norwegian Krone, Swedish Krona and East European currencies on Tuesday after Germany's ZEW expectations index rose from 55.0 to 61.8 for the month of January, when it had been expected to edge higher to only 55.1.

Meanwhile, the Eurozone expectations index rose by 3.8 points to 58.3 after investors upgraded their expectations for Europe's economies amid the early stage rollout of coronavirus vaccines on the continent.

"History suggests that expectations will roll over soon, which tends to be associated with more difficult conditions for equities, though the underlying trend, supported by very loose economic policy, shouldn’t be under threat," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Above: ZEW Index between 1994 and 2021.

Europe's single currency advanced further on the Dollar after stabilising in the prior session when Italian Prime Minister Giuseppe Conte survived the first of two confidence votes in Rome. The Italian leader was believed to be on course to survive a vote of confidence in the Senate on Tuesday, which would bring an end to a political row over the EU recovery fund which had been threatening to bring down the coalition government.

"The Eurozone ZEW expectations (6‑month ahead) of economic growth survey improved in January to a five‑month high primarily due to vaccine optimism," says Elias Haddad, a London-based FX strategist at Commonwealth Bank of Australia. "Italian Prime Minister Giuseppe Conte appears to have enough votes in the Senate to cling to power and avoid early general elections. The result of the Senate confidence vote is due shortly after 1:00pm New York time."

The Euro had faltered earlier in the New Year as investors took profits on wagers against the Dollar, although Tuesday's gains appeared to draw a line under what was a hat-trick of losses and its worst week since October. The recovery came ahead of an address by incoming Treasury Secretary and former Federal Reserve Chair Janet Yellen in Washington, anticipating of which was seen weighing on the U.S. Dollar.

Above: Euro-to-Dollar rate shown at hourly intervals alongside WTI crude oil price (blue).

"Intraday rebounds are indicated to struggle around 1.2140. Beyond this we would allow for losses to extend to 1.2014 the September high and even the 1.1969 2020-2021 uptrend, which we suspect will hold the initial test," warns Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "Assuming that the uptrend (1.1969) and 23.6% retracement of the move up since March 2020 (1.1945) holds; medium-term the market continues to track higher whilst targeting the 1.2556 2018 high and 1.2624, the 200 month moving average, which remains our longer term target."

The Euro was nearing the technical resistance at 1.2140 flagged by Jones on Tuesday and still faces a number of risks this week including the inauguration of President Elect Joe Biden and January's European Central Bank (ECB) policy decision that could see recent gains by the currency under scrutiny.

"EURUSD often drops in the aftermath of a presidential inauguration, maybe due to fading momentum for stimulus," says Martin Enlund, chief FX strategist at Nordea Markets. "We are less gullible buyers of risk for now, but would consider using levels around 1.1950 in EUR/USD to go long again (or to add to short USD/EM positions around those levels)."

Above: EUR/USD at daily intervals with Fibonacci retracements of November extension higher and 2020-2021 trendline.

Europe's unified unit had risen to its highest since April 2018 when trading at 1.2350 in the opening week of January, although this move lifted the trade-weighted Euro above its September 2020 peak and also over the top seen in the 2017 EUR/USD rally. Currency strength is unlikley to be welcomed by the ECB, which will have a chance to remark on the Euro on Thursday when its latest policy decision is released at 12:45 and President Christine Lagarde leads a press conference at 13:30.

Lagarde already said last week that the bank will be watching Euro exchange rates closely in the months ahead, which could be a constraint for EUR/USD in the absence of a further rally in either the Chinese Yuan, Pound Sterling or both. However, many analysts see the ECB being limited in what it can do to reign in the Euro and expect the currency to go on benefiting from a recovery of the global economy and all of the related likely inflows into the Eurozone manufacturing sector and financial markets.

"The ECB has already talked down the currency and it didn't do much to stop EUR’s trend. The ECB missed the opportunity to cut rates in December and without that risk the market should be comfortable holding EUR longs over the meeting," says Jordan Rochester, a strategist at Nomura. "While it was the speculative market’s 2020 consensus trade, so a position squeeze is at some point probably inevitable, the flows described above are larger, more consistent and better signals for EUR’s medium-term trend."

Above: GBP/EUR rate at weekly intervals with EUR/USD (orange), EUR/CNH (blue). Click image for closer inspection.