JP Morgan Forecast Euro-Dollar at and Below 1.20 in 2021

Image © Adobe Images

- EUR/USD spot at publication: 1.2116

- Bank transfer rates indicative guide: 1.1690-1.1777

- FX specialist transfer rates indicative: 1.2030

- More information on accessing specialist rates, here.

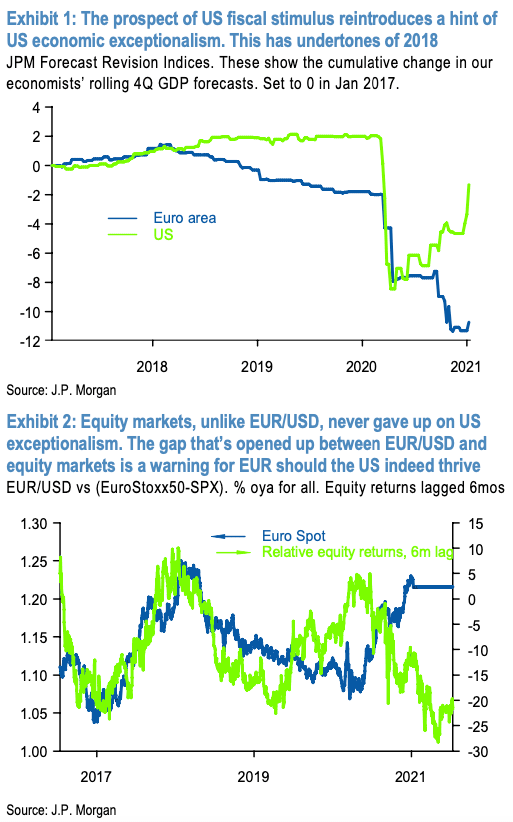

The Euro-to-Dollar exchange rate (EUR/USD) is at risk of going below 1.20 according to analysis from JP Morgan.

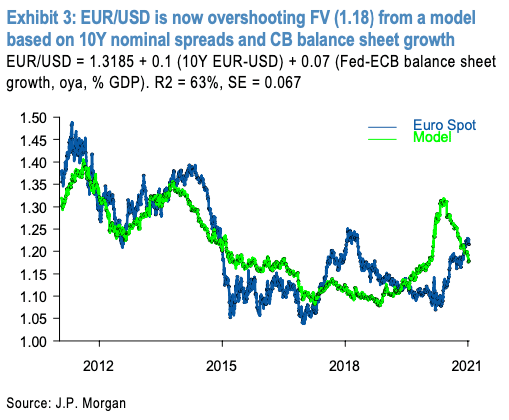

Analysts at the investment bank say fair value (FV) in the exchange rate - as measured by a number of metrics - has fallen sharply over recent weeks.

"Our preferred interest rate model for EUR/USD now puts FV at 1.1750, having been as high as 1.30 in mid-2021," says Paul Meggyesi, a foreign exchange strategist with JP Morgan in London.

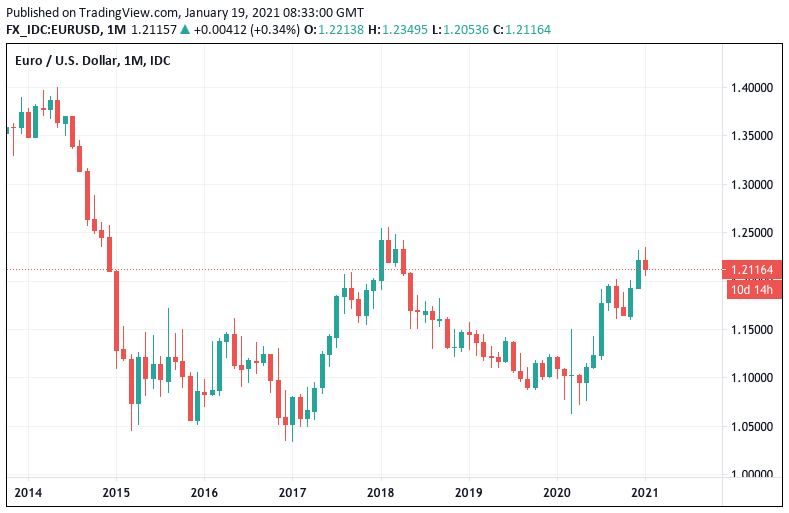

The call by JP Morgan comes as the EUR/USD exchange rate sees a multi-month uptrend stall and reverse in January. The Euro has now lost 1.0% in value against the Dollar in January, having climbed by 2.40% in both November and December 2020.

A consensus had been building in the market and amongst the analyst community that 2021 would be characterised by a notable decline in the value of the Dollar, with the Euro being tipped as a prime beneficiary.

The Euro-Dollar has fallen back from a January high at 1.2349 to record a low of 1.2056, which could put it at fairer valuation that could hold throughout 2021 suggests JP Morgan analysis.

Above: EUR/USD since 2014.

In a recent monthly foreign exchange research note Meggyesi says their modelling suggesting the Euro should be even lower looks at the difference between the yield paid on 10-year Eurozone and U.S. bonds.

In addition, the modelling takes into account he relative growth in Federal Reserve and European Central Bank balance sheets.

"Critics will doubtless argue that short-term rates are more important and that since the Fed won’t be hiking for a couple of years yet it shouldn’t really matter what bond yields are now doing, hence EUR should continue to appreciate regardless of yields," says Meggyesi.

The counterargument made by JP Morgan to such an observation is based on three observations:

1) 10-year rate differentials are empirically more relevant for EUR/USD than either 2Y or 5Y spreads says Meggyesi.

2) "EUR/USD is not undervalued even if we do use 2Y yield spreads instead of 10Y," adds the analyst.

3) Fair value for EUR/USD is falling whatever tenor of spreads one uses according to JP Morgan analysis which shows the growth in the ECB’s balance sheet is now pulling away from the Fed’s (currently 21.6% of GDP oya vs 18.6%.

JP Morgan utilise a number of models when trying to ascertain where an exchange rate might trade over coming months, and the above-mentioned model offers one, albeit crucial, insight.

The investment bank holds a forecast of 1.20 on Euro-Dollar for end-March and end-June, 1.19 for end-September and 1.18 for end-December.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}