Keep Buying Euro-Dollar: Credit Suisse

Image © Adobe Images

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Foreign exchange strategists at Credit Suisse are looking to buy exposure to the Euro on any weakness, viewing the Democrat win in the Georgia Senate race as an additional supportive development.

"We continue to hold a USD bearish outlook," says Jonathan Pierce at Credit Suisse.

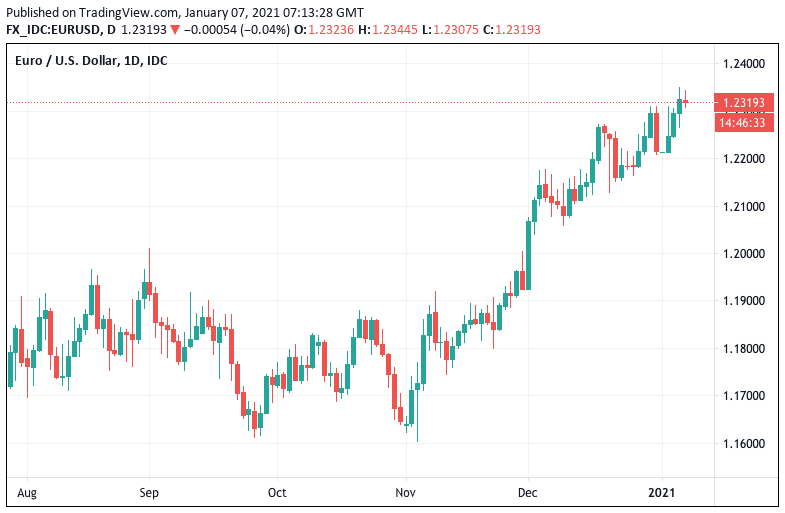

The Euro-to-Dollar exchange rate (EUR/USD) has recorded three successive days of gains in 2021 and now finds itself at 1.2321, where it appears to be pausing for breath.

Credit Suisse strategists hold a core EUR/USD 'long', meaning they are buyers of the exchange rate.

They hold a preference to add to this exposure on any dips as they view the break above 1.2310 as being a bullish development.

"Price action remains constructive and positioning after day 1 gyrations rather lighter, I suspect, than 48 hours ago," says Pierce, referencing the exchange rate's choppy start to the year.

The update comes as the Democrat Party wins the two seats being contested in the Georgia Senate runoff election, giving Joe Biden's party effective control of both the executive and the legislature which is expected to allow the incoming President to be ambitious in his policy making.

The vote result means Biden can now seek to deliver a generous stimulus to the economy in the early days of his presidency, an outcome market analysts view as being supportive of stocks but negative for the Dollar.

Euro-Dollar price action over the course of the past 24 hours suggests the Euro is also a beneficiary of the developments.

"The path of least resistance seems to be upwards for the cross. Keeping a core long, looking to buy a dip back into the 1.2280/00 zone and run a stop at 1.2240," says Pierce.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}