Euro-Dollar Rate Gains Ahead of Key Georgia Senate Race

Above: U.S. Senator David Perdue of Georgia. Image copyright Gage Skidmore.

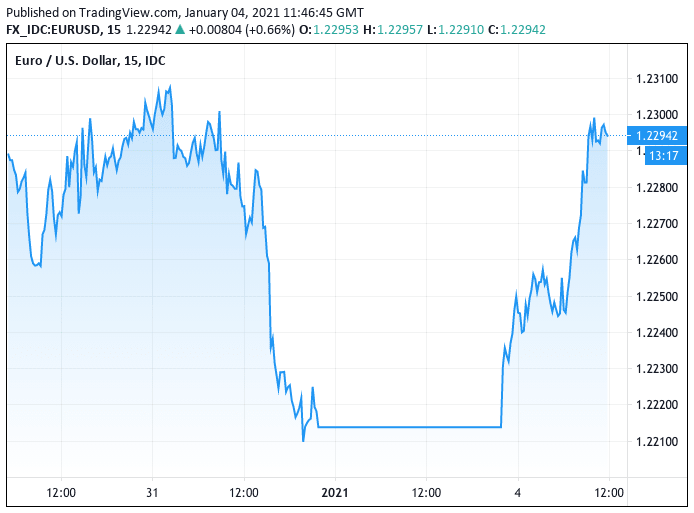

- EUR/USD spot rate at time of writing: 1.2297

- Bank transfer rate (indicative guide): 1.1860-1.1950

- FX specialist providers (indicative guide): 1.2200-1.2210

- More information on FX specialist rates here

The Euro jumped by over half a percent against the Dollar at the start of 2021, with gains coming amidst a rise in global stock markets and commodity prices which hinted at a confident mood amongst investors just hours ahead of a critical vote for two senate seats in the U.S. state of Georgia.

A constructive investor environment helped the Euro-to-Dollar exchange rate (EUR/USD) rise 0.60% higher to reach 1.2296, as the Euro reversed a decline of similar magnitude suffered on Dec. 31.

The assessment made by a number of the foreign exchange analysts we follow is that the move higher in EUR/USD is more a function of Dollar weakness than any obvious strength in the Euro, suggesting the macroeconomic backdrop and issues pertaining to the U.S. Dollar specifically are what will drive the exchange rate near-term.

"Dollar weakness has been seen throughout the FX market as traders prepare for a year of economic recovery," says Joshua Mahony, Senior Market Analyst at IG.

Above: EUR/USD at 15 minute intervals

The Dollar tends to display an inverse relationship with investor sentiment, rising when investors are fearful and markets are falling. The current environment of rising markets is therefore typically a negative backdrop for the Dollar.

The rally in the EUR/USD exchange rate comes as much of Europe continues to grapple with the covid-19 pandemic and lockdown restrictions in its most important economies are extended.

"The Euro continues to defy gravity based on the bloc’s economic fundamentals, trading at a near 3-year high against the greenback. It must be stressed that, with the eurozone remaining unattractive on its own merits, the move is largely a result of the significantly weaker Dollar," says Michael Brown, Senior Market Analyst at CaxtonFX.

The Dollar therefore remains the key factor in the exchange rate's outlook, meaning attention will this week likely fall on the outcome of the twin Senate electoral reruns taking place in the U.S. state of Georgia.

The outcome of the vote will determine which party wins control of the Senate, meaning the Democrats could soon take control of both the legislative and the executive branches in the U.S.

"Should the Democrats win both of the runoffs, the resulting 50/50 split in the Senate would allow Vice President-elect Kamala Harris to cast the tie-breaking vote, handing the Democrats control; essentially, this would be a delayed version of the 'blue wave' election scenario coming to fruition," says Brown.

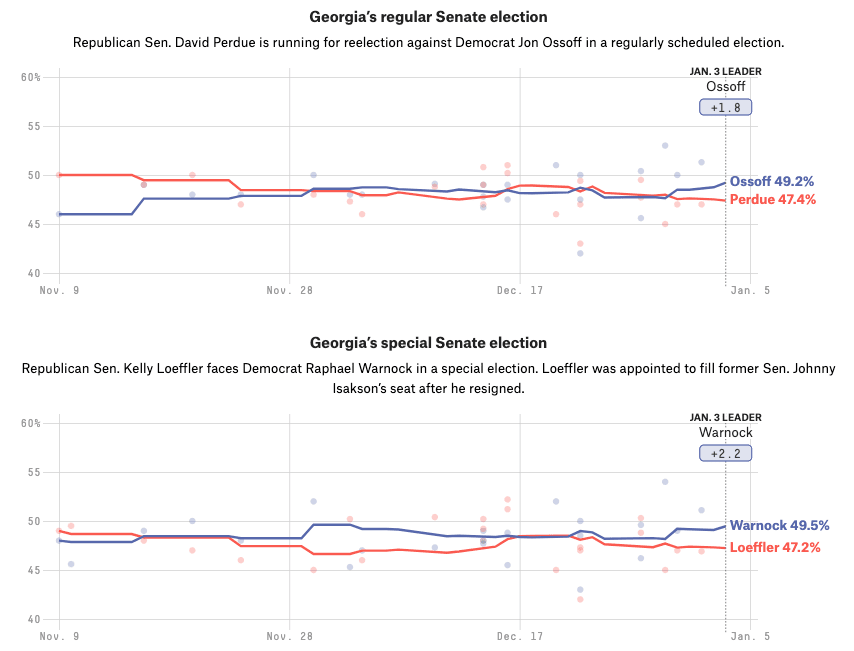

Image courtesy of FiveThirtyEight.

The general rule of thumb the market has adopted since 2020 is that a 'blue wave' would be positive for stocks and commodities and negative for the U.S. Dollar as increased stimulus measures are positive for economic growth, at least in the short term.

According to poll modelling at FiveThirtyEight, the race is too close to call in both seats.

Democrat Raphael Warnock has a narrow lead of around 0.5 percentage point over Republican Senator Kelly Loeffler in the Special Senate selection. Republican Senator David Perdue meanwhile lags Democrat Jon Ossoff in the race for the regular Senate seat.

According to analysts at investment bank MUFG, the outcome of the vote could be "pivotal" for markets.

"One of the biggest market reactions is likely to be in the US Treasury market if the Democrats exceed expectations and take both seats. It would open the door to a much bigger fiscal stimulus package under incoming President Joe Biden," says Lee Hardman, Currency Analyst at MUFG in London.

"In the short term, the prospect of US fiscal stimulus is likely to be welcomed by risk assets as it would help to strengthen the global recovery. It should ensure that the US dollar continues to weaken for now even if US yields move higher. In contrast, the market reaction should be limited in the Republicans hold on to control of the Senate," adds Hardman.

However, one analyst warns that the market's assessment of a 'blue wave' outcome might have shifted and a Democrat clean sweep might in fact be taken as a negative by the stock market, i.e. a positive for the Dollar.

"To date, it may be argued that a Republican-controlled senate would offer a balance against the potentially more progressive agenda of the Democrats under President-elect Biden. If the Democratic Party candidates both win, then we could see an equity market correction should investors worry that such a check won’t exist. This could precipitate risk-off behaviour in the FX markets, potentially lending the USD some safe-haven strength," says Clyde Wardle,

Senior EM FX Strategist at HSBC.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}