Euro-Dollar Week Ahead Forecast: Clambering Back from Brink as Market Seeks 'Blue Wave' Election Win

- Written by: James Skinner

- EUR/USD enters pivotal week near key supports after heavy losses.

- Tipped for recovery ahead of U.S. election as market eyes Biden win.

- But a tight race in battlegrounds, slow results both risks to EUR/USD.

- Biden win lifts EUR to 1.18, Trump win sees 1.15 & below beckoning.

Image © Adobe Images

- EUR/USD spot rate at time of writing: 1.1645

- Bank transfer rate (indicative guide): 1.1237-1.1319

- FX specialist providers (indicative guide): 1.1470-1.1540

- More information on FX specialist rates here

The Euro-to-Dollar rate enters the new week near two-month lows but with a bullish market looking for it to be resuscitated by a Democratic Party win in Tuesday's U.S. election, although the risk is that a surprise victory by President Donald Trump leads it to unravel anew.

A fifth consecutive decline and its longest run of unbroken losses for more than two months left the Euro nursing its wounds back at late September lows on Friday, after new 'lockdowns,' in major Eurozone economies weighed on risk assets like stocks as well as the currencies that follow them, like the Euro.

Warnings from the European Central Bank (ECB) of policy easing in December also helped the Euro unravel, but after falling nearly two percent last week, the single currency now benefits from a cluster of nearby technical support levels that may help prevent it declining further ahead of election day.

"EUR/USD has recently failed at the 21st September high at 1.1871, and has now eroded the 1.1688 low from last week. Failure here increases near term risk on the downside and implies losses to the recent low at 1.1612," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "Intraday Elliott wave counts are now negative and implying scope even for this to be eroded. Below 1.1612 would target the 1.1495 March high, which, if seen, is expected to hold.

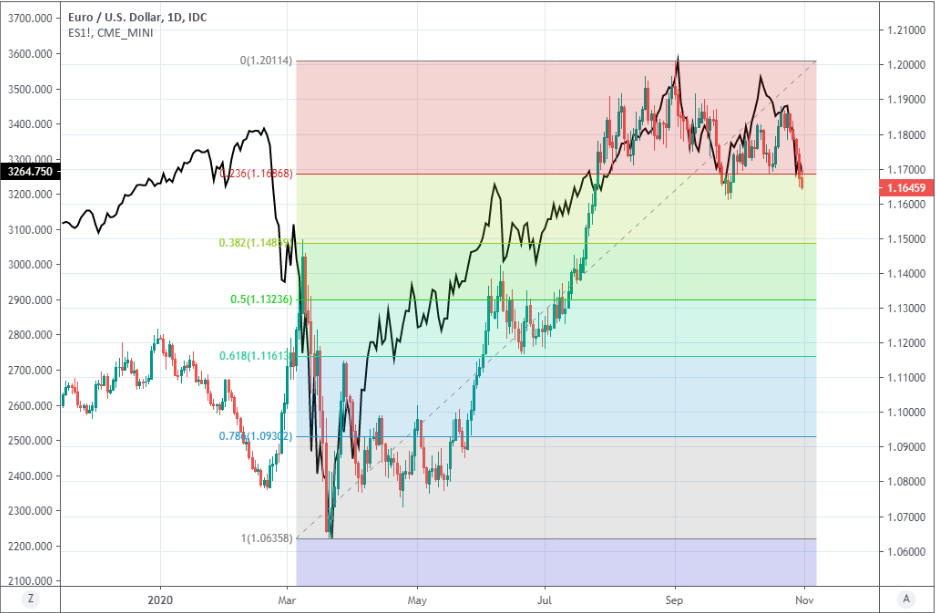

Above: Euro-Dollar rate shown at hourly intervals with S&P 500 index futures (black line, left axis).

Tuesday's vote and the subsequent drip feed of results is the main event for all exchange rates this week and will have an impact on price action in the currency market long after. The consensus expectation is for a 'clean sweep' that sees the opposition Democratic Party take control of both houses of Congress, which is seen as likely to weigh on the Dollar while lifting risk currencies like the Euro in the year ahead. However, weekend reports suggested President Trump is closing the gap with Biden in key swing states.

"We are going to trust the pollsters and expect a risk-friendly Biden win on Tuesday (negative for USD, positive for pro-cyclicals), but the risk of a delay in the results may be underestimated," says Petr Krpata, chief EMEA strategist for FX and bonds at ING. "The Blue wave outcome is likely to be positive for EUR/USD (largely due to its negative impact on USD) and should push the pair back towards/above the 1.1800 mark. While positive for EUR/USD, the euro should nonetheless lag most of its G10 peers."

ING's Krpata says there's chance that delayed results from key swing states including Pennsylvania, Michigan and Wisconsin cast a cloud of uncertainty over the currency market from mid-week, which could potentially constrain the Euro-Dollar rate if-not engineer outright weakness in the single currency. The aforementioned states won't begin counting mail-in votes until election day and for this reason it could be a number of days if-not the next week before the actual results are confirmed. The ING team will be watching Florida and Texas on the night given that both began counting mail-in votes before election day, which means they may be among the first with confirmed results.

"On the one hand, a “blue wave” scenario in the US election and vaccine confirmation (expected in November) would likely boost all cyclical assets, including the Euro. On the other hand, near-term Euro Area GDP growth could badly underperform other regions, and we would expect markets to partly price in a deposit rate cut, even if the Governing Council ultimately “recalibrates” other instruments," says Zach Pandl, co-head of FX strategy at Goldman Sachs.

Above: Euro-Dollar at daily intervals with Fibonacci retracements of March recovery, S&P 500 futures (black line, left axis).

Like ING, the Goldman team also see the Euro lagging many developed world counterparts after Germany and France, the Eurozone's two largest economies, joined Italy and Spain by going back into a form of lockdown last week. Newly tightened restrictions are seen as likely to snuff out the economic recovery for at least this quarter, while enabling the U.S. to pull further ahead of Europe in the transatlantic growth race.

As a result the bank is no longer betting on an increase in the Euro-to-Dollar rate, having told clients to remove the single currency from a basket of trades that would have paid out most handsomely if the Euro as well as as Australian and Canadian Dollars rose against the greenback in the months ahead. The Goldman team is still betting that the latter two will rise against the U.S. Dollar in the coming months.

"Despite the potential short-term volatility, a softer USD over the medium-term is a view we would still hold, even if the outcome is Trump winning with a Republican senate. Fundamental drivers of a weaker USD remain the substantial US twin deficits, USD FX overvaluation, deglobalisation and diversification, and likely Trump threats if there is consistent USD strength," says Jordan Rochester, a strategist at Nomura. "Weakness of USD is likely to be mainly against other G10 currencies, as Trump’s stance against China could result in RMB underperformance."

Analysts are decidedly bearish on the Dollar, alongside the currency market, with the extent of the U.S. government's coronavirus-related spending and the resulting Federal Reserve (Fed) money creation having led many to anticipate a lengthy and damaging blowout in the budget and current account deficits. But when it comes to the election, a win by the opposition Democratic Party is seen as the more bearish outcome because both deficits are likely to widen the furthest with Joe Biden in the White House.

Above: Euro-Dollar rate shown at daily intervals with Joe Biden polling average (black line, left axis).

Biden is also less hostile to the European Union and Chinese government than the incumbent President Donald Trump, making him the preferred candidate for European policymakers. But not all analysts see him as positive for the Euro or stock markets. Some are concerned about the impact that his tax and regulatory policies would have on the stock market and U.S. economy, while also seeing the European backdrop as deserving of currency weakness.

"If EUR-USD is to break higher, the US election is likely where EUR bulls are looking," says Daragh Maher, U.S. head of FX strategy at HSBC. "However, we do not see a Democrat “clean sweep” outcome as necessarily driving the USD weaker and EUR-USD higher. Instead, we expect the EUR to remain under selling pressure as the local backdrop becomes increasingly unsupportive."

Others are mindful of the difference between the Democratic Party majority suggested by pollsters and the lesser advantage implied by betting markets. Both proved to be wrong in 2016, with bettors having followed pollsters in looking for a Democrat win only to be upset on the night by President Donald Trump's victory, which resulted in a five percent Dollar Index rally between early November 2016 and year-end.

Few appear to have entertained the idea that 2016 could be repeated this time out, which would weigh on the Euro and potentially enough so to see it falling back to the 1.15 level tipped as a prospect by Commerzbank technical analysts.

"Are betting markets dumb or not? Or are they perhaps criminally insane? We'll hopefully find out during the coming week. Perhaps we will know the results already Wednesday morning European time, but the Supreme Court's decision to allow some/several states to keep counting mail-in ballots for days afterwards means we might not know for sure until late in the week or even the week after," says Andreas Steno Larsen, chief FX strategist at Nordea Markets. "We are still looking for a move lower in the pair - possibly a painful move - before considering reflation longs. Maybe the timing will be optimal just around the ECB meeting in December. For now, we lean short in EUR/USD."

Above: Euro-Dollar rate shown at weekly intervals with Dollar Index (black line, left axis).