Euro-Dollar Forecast Back to 1.14 by Bank of America

Image © Adobe Images

- EUR/USD spot rate at time of writing: 1.1841

- Bank transfer rates (indicative guide): 1.1427-1.1509

- FX specialist rates (indicative guide): 1.1700-1.1734

- For more information on specialist rates, please see here.

The Euro-to-Dollar exchange rate's rejection at the big round number of 1.20 might be a high-water marker for the single currency, which is being tipped to head back to levels last seen in mid-July over coming weeks.

According to Evelyn Herrmann, Europe Economist at Bank of America in Paris, says a key factor behind the view that the Euro's outperformance of the U.S. Dollar has ended lies with the rising covid-19 cases in Europe following a summer respite.

"We have often heard in recent weeks that Europe is ok - not only until the end of the summer, but beyond. The lower virus count leading into the summer, especially compared with the US, seemed to feed into that. But recent developments no longer quite match that assumption. Daily cases are falling in the US and rising in Europe," says Herrmann.

Spain and France are carrying the majority of the Eurozone's new infections, with France on Wednesday reporting 7,017 new cases in 24 hours and Spain reporting 8581 in the same period.

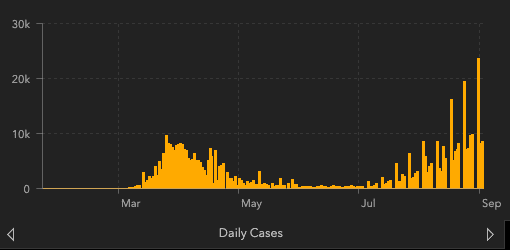

Above: Daily cases in Spain, source: Johns Hopkins University

The rise in infections have resulted in increased restrictions in these countries, denting the economic recovery that had been gaining traction in previous months.

"The signs are multiplying that the recovery is already plateauing," says Herrmann. "Increased virus count probably stopped the reopening process, and may even partially reverse it. In France, for instance, changes to restrictions coincide with the monthly GDP trajectory."

Meanwhile the infection rate in the U.S. continues to decline, allowing for a smoother reopening in the world's largest economy over coming weeks.

The European Central Bank is meanwhile seen as another headwind to the Euro's appreciation, amidst signs that the central bank is unhappy with the currency's rise over recent weeks.

We note here that the ECB is widely tipped by analysts to emerge as an additional headwind for the currency, but there is little direct action that can be taken by the Bank to devalue the Euro. Instead, further easing in the form of increased quantitative easing aimed at boosting the economy will likely weigh on the currency.

Bank of America says buying assets under the ECB's Pandemic Emergency Purchase Programme (PEPP) has slowed over the summer, maybe taking the pressure off the ECB to top up again at next weeks meeting. However, they think an additional EUR500bn of PEPP will follow in December, with an extension until end-2021.

"Formally acknowledging the long-term challenge in the September meeting, would be a first step to a more comprehensive package, maybe then even coming combined with the PEPP top-up in December," says Herrmann.

Furthermore, Bank of America says further interest rate cuts cannot be ruled out, a development that would provide additional downside pressure on the single-currency. "We cannot rule out ECB speakers (including Lagarde) reiterating that the lower bound has not been reached to keep the threat of another cut alive, even if such a move is very unlikely," says Herrmann.

Bank of America foreign exchange strategists expect the Euro-Dollar exchange rate to retrace to 1.14 into year-end.