Euro-to-Dollar Week Ahead: Vulnerable to Disappointment Over EU Recovery Fund

- Written by: James Skinner

- EUR aided by risk appetite but at risk from EU fund disappointment.

- Compromise proposal to be unveiled, leaders temper expectations.

- Friday meeting dominates agenda as market split on EUR outlook.

© Grecaud Paul, Adobe Stock

Achieve up to 3-5% more currency for your money transfers. Beat your bank's rate by using a specialist FX provider: find out how.

The Euro edged higher last week but is vulnerable to disappointment over the EU recovery fund in the coming days and for this reason may even be given a wide berth by investors before Friday's meeting of finance ministers.

Europe's single currency rose a quarter of a percent against a softening Dollar last week after edging steadily higher alongside global stock markets, although it couldn't garner the momentum necessary to overcome the 21-day moving-average at 1.1262 and may be at risk from profit-taking early in the new week.

The Euro was still up more than 4% off its late May lows on Friday despite having retreated from levels above 1.14 in early June, although with much of this gain having resulted from excitement over the EU recovery fund proposals and an improvement in global investor risk appetite.

But the EU Commission's push for a €750bn special fiscal support package is a long way from being a deliverable European policy as it still needs to win the unanimous endorsement of national leaders and there remain many lines of conflict between various member states over aspects of the proposal.

"We remain concerned that the market is pricing too much," says Athanasios Vamvakidis, head of FX strategy at BofA Global Research. "To us, including grants was the most important innovation in the Recovery Fund proposal and the heart of its political message, as it was a clear red line before. Weakening this part of the Recovery Fund, and replacing it with loans, would be a problem, in our view. EU countries do not need more loans."

With Franco-German backing the EU has proposed that €500bn of grants be made available to some of the Eurozone's most hard up members as they recover from the coronavirus shutdown has been a gamechanger for sentiment toward the single currency, in addition to €250bn of loans. But 'frugal' northern countries are insisting on a larger share of loans as well as a range of conditions for member states to access them.

Above: Euro-to-Dollar rate at daily intervals with S&P 500 futures (orange), DAX index futures (black) and moving-averages.

Demands for conditionality have drawn opposition from Southern countries including Italy and Greece, while enlargening the existing question mark over whether the fund can be delivered. Meanwhile, Chancellor Angela Merkel said last week that the fund is on a "rocky path" while Dutch Prime Minister Mark Rutte was quoted by local press saying there is no need for a deal to be done this week and that one could wait until Autumn.

"[It] just brings the total EU fiscal stimulus to what other advanced economies have been doingalready. Without it, the EU would have been at a disadvantage. We could justify a EUR relief in response, but not a strong rally," Vamvakidis says. "If there is no agreement and everything moves to the October Summit, this could question the prospects of a final deal or lead the market to price an eventual compromise that would be far from the proposals on the table."

European Council President Charles Michel is due to publish a set of compromise proposals on Thursday as the Eurogroup of finance ministers meeting gets underway and there's a danger that the new plan disappoints investors, which it would be likely to either if the proportion of grants included in the fund has been radically reduced or if the conditions imposed on use of the fund are so overbearing that they risk turning member states away from it.

Any significant disappointment caused by this week's meeting could conceivably be enough to undermine the tentative uptrend in the single currency, although technical analysts say the Euro-to-Dollar rate will remain on course for a retest of its earlier high above 1.14 so long as the market holds above 1.1168.

"We will retain our bullish bias while EUR/USD stays above its 1.1168 June 22 low on a daily chart closing basis. While this is the case we will continue to target key resistance at the 1.1422 June high. This, together with the March high at 1.1495, represents quite formidable resistance which we would expect to cap at first," says Axel Rudolph, a senior technical analyst at Commerzbank. "Below 1.1168 we cannot rule out a slide to the 200 day moving average at 1.1041 ahead of a swing higher."

Above: Euro-to-Dollar rate at weekly intervals with Dollar Index (orange) and moving-averages.

Recovery fund considerations will be an important influence on price action in the week ahead but so too will risk appetite, which will impact on demand for the Dollar. Spain placed an estimated 77k people back into 'lockdown' at the weekend, but it's not obvious that this will impact the Euro given the response of Sterling and the Aussie to similar actions in Australia and the UK last week.

The second wave of coronavirus in the U.S. and still-growing global pandemic are the greatest threats to risk appetite, although investors were undeterred from bidding for stocks and risk currencies including the Euro last week and since then U.S. case growth has slowed. This is a consolation for the Euro.

"It is hoped that an agreement on the fund will be met in a key summit on July 17-18," says Jane Foley, a senior FX strategist at Rabobank, who forecasts a EUR/USD rate of 1.09 by year-end. "The Recovery fund, along with the ECB’s determination to limit fear of fragmentation in Europe through its bond buying programme, has already propped up the value if the EUR. Another more recent supportive factor has been Europe’s better rate of success at depressing Covid-19 compared with the US. If extended this may have more significant implications for growth expectations and asset prices. That said, the greenback is still likely to benefit from any additional plunge in risk appetite."

The U.S. second wave appeared to lose momentum when Friday and Saturday brought with them two consecutive days of falling case numbers, although it's not clear if this will be enough to keep the Dollar steady once American markets reopen from the Independence Day weekend. Americans were big sellers of the Dollar last week with U.S. trading hours seeing some of the broadest and steepest losses that benefited all other major currencies while leaving the greenback the worst performer for the period.

This was as another wave of coronavirus swept across the U.S. with increased momentum, leading to four consecutive days of record total case growth that had lifted both three and seven day moving averages succesively. Although it didn't trouble stock markets much and came at a cost mainly to the Dollar.

U.S. infections rose to nearly 2.95 million Saturday but would exceed 3 million within weeks if infections continue to grow as they did last week.

"A litany of topside option expiries positioned above the market next week (1.1250-1.1350) could attract brief spikes higher for spot EURUSD prices. However, we still think that Powell’s dire post-Fed meeting press conference, June 16th’s bearish head & shoulders pattern, unresolved EU recovery fund discussions, and the overextended nature of the fund net long EURUSD position (latest COT report) continues to cast a negative shadow over this market," says Eric Bregar, head of FX strategy at Exchange Bank of Canada.

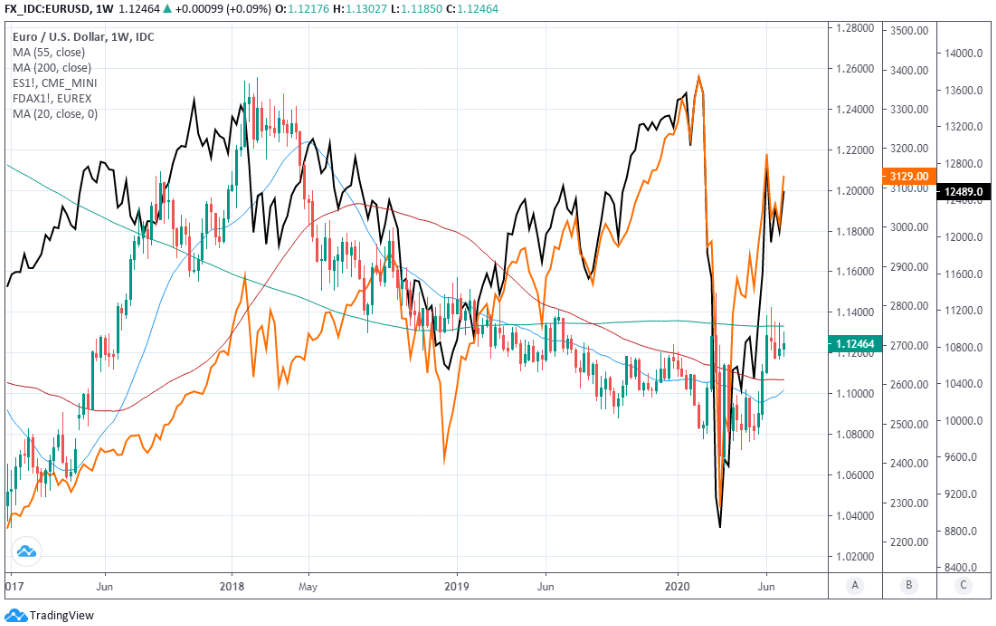

Above: Euro-to-Dollar rate at weekly intervals with S&P 500 futures (orange), DAX index futures (black) and moving-averages.