Euro-to-Dollar Week Ahead: Correcting Lower as Greenback Breaks Losing Streak

- Written by: James Skinner

- EUR/USD snaps winning streak after U.S. jobs surprise.

- Turns away from 200-week average as USD steadies.

- Faces correction after swing back into black for 2020.

- Fed policy decision and Eurogroup meeting in focus.

Image © European Union 2018 - European Parliament, Reproduced Under CC Licensing.

- EUR/USD spot rate at time of writing: 1.1287

- Bank transfer rates (indicative guide): 1.0893-1.0972

- FX specialist rates (indicative guide): 1.1119-1.1186

- More information on attaining specialist rates here

The Euro rode a wave of optimism to a hat-trick of gains over the Dollar last week and swung back into the black for 2020 in the process but it was halted on Friday by the 200-week moving-average and faces a correction lower over the coming days as the greenback recovers its footing.

Europe's single currency closed +1.75% higher for the week on Friday, taking it back into the black by a modest order of 0.59% for 2020 after three-week rally that was born when France and Germany proposed a €500bn coronavirus recovery fund that would've provided grants to member states who're struggling financially. But the single currency couldn't sustain a move past the 200-week moving-average at 1.1332 and was found in retreat ahead of the weekend.

The Euro's advance had been bolstered last week when the German government said it will loosen its purse strings by a further €130bn and after the European Central Bank (ECB) surprised markets with a larger-than-expected increase to its coronavirus-related quantitative easing programme that took the total value of its emergency bond buying war chest to €1.35 trillion, which further reigned in still-elevated 'periphery' bond yields and will offset much of the extra issuance expected as a result of the virus.

But the single currency's advance came to a halt on Friday as the Dollar steadied ahead of the May non-farm payrolls report, which prompted a sharp pullback that pushed the Euro back below the 1.13 handle ahead of the weekend. The Euro's gains were previously the Dollar's pains but the tables turned when the Bureau of Labor Statistics announced a jobs report that confounded market expectations for a loss of more than 7 million jobs and another spike in the unemployment rate.

"The US dollar is now very oversold and hence we are cautious over very near-term EUR/USD correction lower. That would make sense technically considering the two-week percentage gain as of 12 noon London time is just short of 4%. Excluding the tumultuous COVID-related volatility in March, this gain is the largest two-week gain since Feb 2016 and on most of the occasions when such a gain is recorded, spot corrects the following week. But if that does materialise it may provide opportunity to buy on dips," says Lee Hardman, a currency analyst at MUFG. "It seems to us that a repricing of fragmentation risks that have beset the EUR for a considerable period of time is now under way. Our stance now has shifted and we view corrections lower in EUR/USD as an opportunity to position for upside."

Above: Euro-to-Dollar rate shown at daily intervals with various moving-averages.

The Euro has been driven higher by a reduced sense of pessimism about the political and economic prospects of the currency bloc as well as a sharp weakening of the Dollar, but the problem for Europe's unified unit now is that its domestic rally is close to having run its course and the Dollar might have recovery potential for the week ahead at least.

"The US Dollar has begun to turn lower, alongside a broader pro-cyclical rotation across markets. In light of its high valuation the currency’s downside could be substantial if the depreciation trend continues—perhaps in excess of 20% on a trade-weighted basis. However, further Dollar weakness will likely be uneven across regions initially. We currently see the most attractive long opportunities in non-Asia pro-risk currencies with favorable FX fundamentals—especially NOK and MXN. The Euro should benefit from Dollar weakness over time, but we would not anticipate a sharp move higher over the near-term," says Zach Pandl, global co-head of foreign exchange strategy at Goldman Sachs.

The Dollar has been sold heavily and although the outlook for it remains in question, Friday's payrolls report marked the beginning of a jobs rebound that came sooner than markets expected and could be a gamechanger for sentiment toward the currency in the short-term given the pre-virus trend of U.S. economic outperformance. The U.S. economy created 2.5 million new jobs last month and the unemployment rate fell from 14.7% to 13.3% when consensus was for 7.7 million jobs lost and a jobless rate of 19.4%.

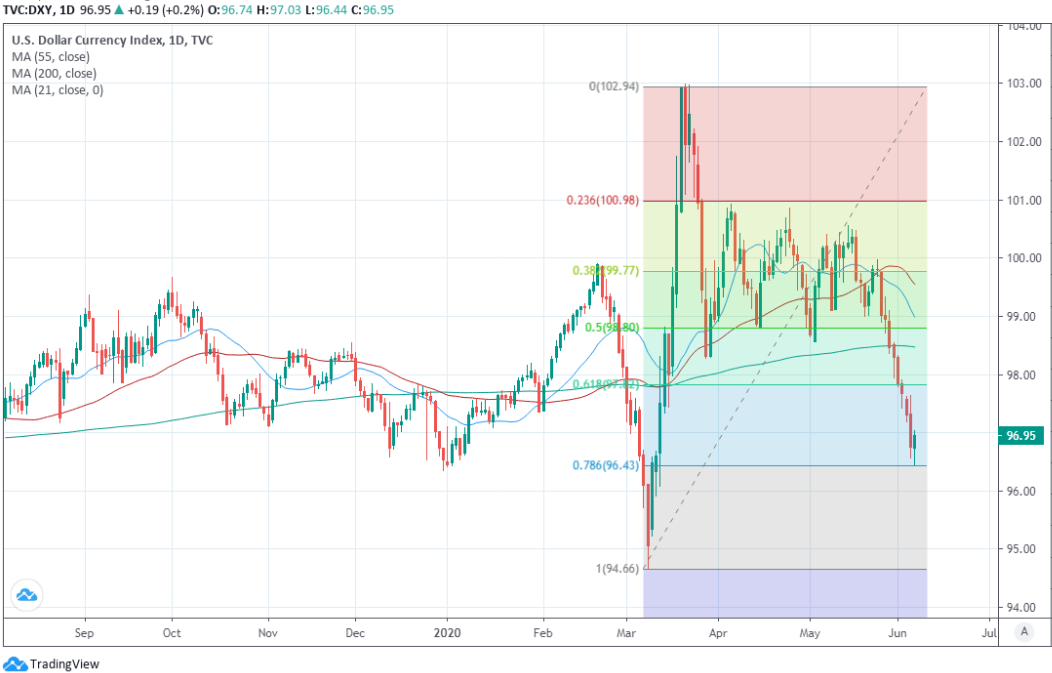

The Dollar Index tested the 78.6% Fibonacci retracement of its March surge early Friday but bounced off it convincingly ahead of the close which could indicate that a more protracted correction is in the pipeline. The Euro accounts for 57% of flows measured by the ICE Dollar Index so would almost always struggle in a scenario where the greenback is recovering its footing.

"We have had nine days of higher highs in EUR/USD driven by a combination of reflationary vibes and increasing momentum for the “Next Generation EU” debt deal. If we get another high in the Monday session, it would be the first streak of ten consecutive higher/highs since October-2010. Usually, it is reasonable to look for a pause in momentum after such a run. This time will likely be no different," says Andreas Steno Larsen, a strategist at Nordea Markets.

Above: Dollar Index shown at daily intervals with Fibonacci retracements of March surge and select moving-averages.

Beyond the very short-term, the Dollar has been undermined by the optimistic mood among investors who've chosen to look past the coronavirus collapse being borne out in economic data, to position for the beginning of a new business cycle. And the broader outlook has been undermined by the colossal amount of Dollars unloaded onto the market by the Federal Reserve (Fed) during the acute stage of the coronavirus crisis back in March.

These factors could argue for a higher Euro-to-Dollar rate further down the line and will mean Wednesday's Fed policy decision is scrutinised closely.

"Berenberg estimates the euro/dollar to be 1.15 at year-end 2020. Even though the U.S. has a high current account deficit, higher expected rates of return on dollar denominated assets remain attractive and U.S. interest rates remain higher, reflecting the U.S.’s higher potential economic growth," says Dr Mickey D. Levy, chief U.S. economist at Berenberg.

Investors will be looking for guidance on how long bond yields and benchmark interest rates are likely to be kept at current historic lows and if the Fed neglects to take any action, or commit to an extended period of zero rates, the greenback could welcome the 19:00 announcement and tip the Euro lower.

Once past the Fed, the Eurogroup will be in focus from Thursday. The market and the Euro will likely listen closely to any statements that emerge given national leaders will debate the European Commission's proposal for a 'Next Generation EU' and coronavirus recovery fund on June 18/19.

Markets will look for signs of compromises being in the pipeline given there has been opposition to the commission's proposals, which must be endorsed unanimously and simultaneously alongside the next seven-year EU budget.

"It may make sense to remove a few EUR positive chips from the table ahead of the Eurogroup meeting on Thursday, even if the scope for higher EUR/USD remains clearly intact over the next 4-5 months, if the “Next Generation EU” debt deal eventually comes into fruition," Larsen says.

Above: Euro-to-Dollar rate shown at weekly intervals with 200-week moving-average in green.