The Euro-to-Dollar Rate: Analyst Views On What Corona Bond Can-Kicking Means for the Outlook

- Written by: James Skinner

Image © European Union 2018 - European Parliament, Reproduced Under CC Licensing.

- EUR/USD spot at time of writing: 1.0796

- Bank transfer rates (indicative): 1.0414-1.0495

- FX specialist rates (indicative): 1.0631-1.0694 >> More information

The Euro recovered off the week's lows ahead of the Friday close but faces an uncertain outlook after the European Council deferred key decisions on a European coronavirus recovery fund until next month, prompting a range of responses from analysts and economists.

Europe's single currency climbed steadily through the final session of the week after having entered on the back foot, with price action coming alongside declines in Italian and Spanish government bond yields, which had risen earlier in the week and posed as a headwind to the Euro.

Friday's moves came after the European Council agreed in principle to endorse an eagerly-awaited recovery fund but deferred decisions over the size and nature of its financing until May 06, which was a widespread disappointment to a market that was hoping leaders would agree to a form of mutualised financing for loans or grants to the member states hardest hit by the coronavirus crisis. EU leaders also endorsed the Eurogroup's €540bn aid package.

The outcome of Thursday's meeting means the recovery fund, if it materialises, won't operate before January 2021 despite that many economists expect the actual recovery from the coronavirus-lockdown-induced economic collapse could begin as soon as next month. This is after the debate ahead of the meeting helped to stoke the fires of Euroscepticism in Italy, given a perceived lack of solidarity and that the €540bn rescue package requires Eurozone members to use a crisis era bailout fund.

There are myriad potential consequences that could arise from this, for the economy, currency and the various peoples of Europe and just as many views on where the Eurozone and single currency might end up as a result. Below is a small handful of those views as expressed on Friday.

"USD/JPY remains locked in a narrow range, but EUR/JPY drifts lower amid concern that a European fiscal rescue package won't be big enough or joined-up enough. That the euro hasn't fallen more speaks to the depths of negative sentiment," says Kit Juckes, chief FX strategist at Societe Generale.

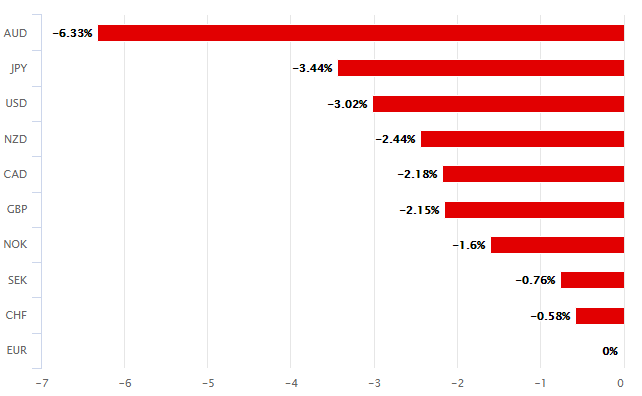

Above: Euro performance against major rivals in 20 trading days to April 24. Source: Pound Sterling Live.

“Shortly put, the meeting offered absolutely no answers to the longer term existential questions for Europe,” says John Hardy, head of FX strategy at Saxo Bank. "Italy’s leader Conte went home declaring the meeting a success, but this looks a rather political move to shore up his own government’s political fortunes. And let’s be honest – what is Italy’s choice in the near term here? It is in the teeth of the Covid19 crisis and has likely not drawn up any serious plans for how it would deal with an exit from the EU or launch of an alternative currency and can fund significant fiscal stimulus in the short term with the reasonable assumption that the ECB is going to pick up the tab with PEPP purchases anyway. Still, headline risk remains across southern Europe."

Despite its gains the Euro failed to sustain a reclaimation of the 1.08 handle for a second time in 24 hours Friday and Saxo Bank's Hardy says the gravitational pull of the "cycle low of 1.0636" could now become stronger. He and the Saxo team are looking for that level to be revisited along with 2017 lows around 1.0350 but they've also warned that "if existential strains continue to ratchet higher," then parity for the Euro and Dollar cannot be ruled out.

Above: Euro-to-Dollar rate shown at weekly intervals.

"We analyse financing options and find that neither joint EU bonds nor other instruments are politically feasible for the foreseeable future," says Dr. Jorg Kramer, chief economist at Commerzbank. "Unresolved conflict between the northern and southern European EMU countries is likely to put further pressure on the prices of government bonds of southern countries. Their spreads are already at similar levels to those seen in the run-up to March 18, when the ECB decided on its 750 billion PEPP bond purchase programme. In this situation, the ECB will continue to support the highly indebted countries by buying their bonds, even though the Maastricht Treaty prohibits monetary state financing. If the stress on the markets increases, the ECB could relax its monetary policy."

Kramer and the Commerzbank team say the Southern European push for a €1.6 trillion recovery fund is pie in the sky because some EU members refuse to countenance the idea of "corona bonds" and the proposed fund is too large for other alternative mechanisms to accommodate. One alternative would be for the European Commission to issue its own bonds, they say, but this requires member states to double contributions to the EU budget and provide guarantees that would likely be too large for some members. The other alternative is the European Stability Mechanism bailout fund that's highly controversial in Southern European countries and even then that fund would also need additional guarantees from national governments that are likely too large.

Above: Euro-to-Dollar rate shown at weekly intervals.

"We think this may be enough to keep markets happy for now. This classic fudge should allow the ECB to muse on PEPP reinvestment rather than rush into a PEPP increase next week. Still, this latest fudge is particularly bland. No details on the ESM credit lines, no ballpark for the 'recovery fund'. Disagreement seems to loom large. As part of the EU budget, the recovery fund will not hit the economy before 2021, and chances are we are now facing months-long negotiations before we get any clarity," says Ruben Segura-Cayuela, a Europe economist at BofA Global Research.

Segura-Cayuela says the lack of progress toward agreeing the structure and financing of a recovery fund leaves him and the BofA team feeling discouraged as well as "concerned that 2021's recovery risks being very shallow and very asymmetric." They forecast a -7.6% Eurozone economic contraction for 2020 but are uncertain if the coveted recovery fund will ever actually appear, which is a downside risk to their forecast for an already steep 2020 contraction and for an envisaged +8.3% 2021 recovery.

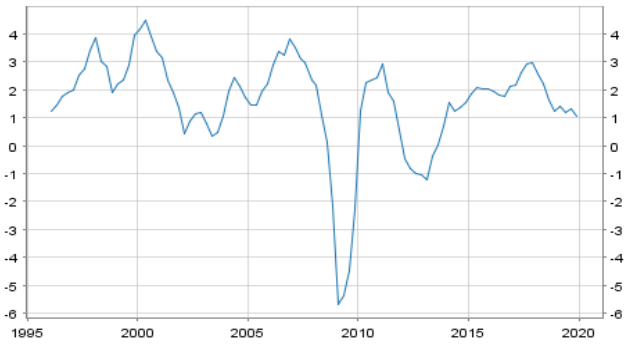

Above: Eurozone annualised GDP growth from 1998 to final quarter 2019. Source: European Central Bank.

Halpenny looks for the positives from Thursday's outcome but acknowledges that risks are still to the downside and that the 1.0636 cycle low in the Euro-to-Dollar rate is now exposed. He and the MUFG team have also warned of risks emanating from next Thursday's European Central Bank (ECB) monetary policy decision and press conference, where they're looking to receive a signal that there's "at least the probability" of more quantitative easing being on the way in light of Thursday's outcome. An enhanced ECB bond buying programme could prevent further increases in the bond yields of vulnerable economies but currencies don't normally like quantitative easing.

Above: ECB balance sheet swells from 2015 as quantitative easing (bond buying) begins. Source: European Central Bank.

"After yet another inconclusive European summit there are signs that investors’ concerns about the solidity of the monetary union continue to linger, despite the ECB’s extensive support," says Jonas Goltermann at Capital Economics. "While the yields of government bonds in Italy and other euro-zone periphery countries have fallen back a bit today, they remain higher than before the coronavirus pandemic struck."

Goltermann says recent increases in Southern European bond yields reflect not only the deterioration of creditworthiness resulting from governments backstopping economies amid coronavirus-induced shutdowns, but also fears among investors that the pandemic may ultimately lead to a break-up of the Eurozone further down the line. 'Periphery' bond yields rose this week as their prices fell, weighing on the Euro in the process, and Goltermann says "redenomination risk bears watching."