Euro-to-Dollar Week Ahead: Charts Neutral as Analysts Eye Dollar Recovery and EU Meeting Looms

- Written by: James Skinner

- EUR/USD charts neutralising after weak recovery from earlier losses.

- But close above 1.08 and possible 'pennant" pattern argue for upside.

- Fundamental analysts warn of USD bounce on over-optimistic market.

- Thursday's EU' meeting offers EUR prospect of last minute turnaround.

Above: Giuseppe Conte. © Pound Sterling Live. Still courtesy of Euro News

- EUR/USD spot at time of writing: 1.0873

- Bank transfer rates (indicative): 1.0333-1.0408

- FX specialist rates (indicative): 1.0673-1.0739 >> More information

The Euro-to-Dollar rate lost just more than half a percent last week after Friday's bounce proved too tepid to backfill the downside seen earlier in the week while bearish forecasts are still coming in thick and fast, although Thursday's EU leaders's meeting offers a lingering prospect of recovery in Europe.

Europe's single currency fell victim to fresh concerns about an absence of unity among leaders of the currency bloc, which could impose financial and political costs on the Euro over the medium-to-long-term, although it ended the week on its front foot against the greenback after stock markets rallied in response to a strong performance by remdesivir, an antiviral drug produced by Gilead Sciences, in clinical trials ran by The University of Chicago Medicine.

That stoked optimism about a possible lessening of the human cost of the virus at a point when daily infection numbers are increasingly confirming that a peak has been reached for outbreaks in the major economies, all of which has aided a recovery of investor risk appetite and the Euro. However, bearish forecasts are coming in thick and fast for the Euro-to-Dollar rate so a reversion to the downside cannot be ruled out for the week ahead.

"There are risks aplenty that could serve to dent this optimism in the coming weeks. Emerging markets remain vulnerable, especially if COVID-19 is to spread more aggressively in EM countries that have generally escaped the worst until now. Falling crude oil prices is another risk that could unsettle financial markets while the underwhelming policy response in Europe could unsettle periphery bond markets further after selling this week. The good news is that any renewed risk-off trading conditions will likely be contained given the ‘do whatever it takes’ stance of the Federal Reserve," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "Still, over the short-term, we see prospects for renewed dollar strength despite the selling evident today as risk sentiment remains positive."

Some analysts have warned that markets are getting ahead of themselves and that a peak in major economy coronavirus outbreaks does not necessarily mean a return to normal life will come quickly. Normalisation is expected to be staggered, potentially leading to a slow as well as uneven global economic recovery and a return of exchange rate volatility, while many also increasingly tip a fresh increase in demand for the Dollar.

Above: Euro-to-Dollar rate at hourly intervals.

This Dollar-favourable outlook is augmented by American steps toward the lifting of lockdowns in states that feel able to, with even New York State Governor Andrew Cuomo having admitted at the weekend that his locality appears to be over the worst of its outbreak. New York state has by far the largest number of coronavirus infections in the U.S., with many of them centred in New York City, although daily numbers of new infections have plateued across the country.

The Dollar faces stiff competition from the Euro when it comes to exiting 'lockdown' measures imposed on people and economies the world over given that even Spain, Europe's most afflicted country, has now taken small steps to return to normal since reaching the 'peak' of its outbreak earlier in April.

Spain said this weekend that from April 27 children will be able to go outside subject to certain conditions but also that a third extension of its lockdown will likely keep most people confined to homes for another three weeks. This comes as Germany, Austria, Denmark and others each take steps to restart their economies following national shutdowns aimed at containing the virus sufficiently for health systems not to be overloaded by patients.

"We are bearish EURUSD primarily because of our bullish USD view, but we are also concerned about unsustainable debt dynamics in some Eurozone countries," says Athanasios Vamvakidis, head of FX strategy at BofA Global Research. "Mutualization through a Eurobond-Coronabond is what the Eurozone needs today in our view, but this is currently off the table. The so-called recovery fund, the details of which will be decided in the EU Summit next week is a step in the right direction, but does not fully/directly address insolvency risks. The debt dynamics of some of the Eurozone periphery countries are very challenging based on our debt sustainable analysis. We don't believe the market is pricing these risks now, but it is a matter of time."

Above: Euro-to-Dollar rate at daily intervals, erodes support denoted by upward-sloping trendline.

One thing that could prove decisive in determining the Euro-to-Dollar rate's fortune this week is the outcome of the European Council video meeting of national leaders set for Thursday, in which they will either reject or endorse collectively the bloc's €540bn response to the coronavirus crisis. That response package was agreed by the Eurogroup of finance ministers just more than a week ago but Italy had initially indicated it would reject it in this week's meeting due to upset over the fact it requires countries who're in need of aid to tap the crisis era bailout fund that aided the hijacking of 'periphery' economy finances during the debt crisis and foisted often unwanted austerity upon them.

"EUR/USD has seen a minor erosion of the near term support line, which implies that its upside attempt has already dissipated and attention is reverting to the downside. Intraday Elliott wave counts are conflicting and we will stand aside today. Near term support lies 1.0778/73, the mid-February low," ," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, in a Friday morning note to clients.

Italy's Prime Minister Guiseppe Conte has implied several times since that he could support the package in the EU leaders' meeting this week, potentially easing concerns about possible financial instability on the 'periphery' as well as a political rift that had lifted anti-Euro sentiments in Italy. That might provide the Euro-to-Dollar rate with respite from any strength in the greenback that might materialise in the early days of the new week although quite what happens in amongs all of that will also depend on technical signals coming off the charts, which have turned neautral in recent days.

"We think a close above 1.08 for the week could set it up for a minor rebound on Sun night/Mon morning although price action since the latter part of March suggests the EUR will not make a definitive move above 1.09 any time soon. Resistance is 1.0880/90," says Scotiabank's Juan Manuel Herrera.

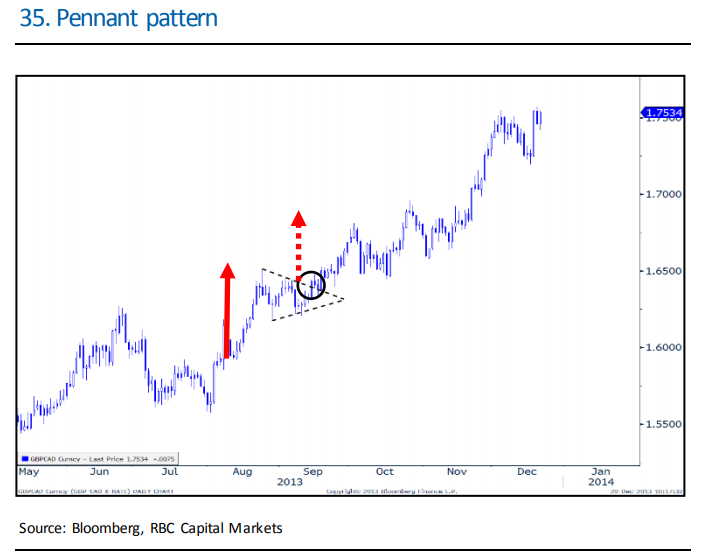

Above: Euro-to-Dollar rate at daily intervals, with possible 'pennant' pattern forming.

The Euro entered last week with an "accelerated downtrend" blocking its path higher and inciting a correction that played out early last week, although the tepid nature of the recovery into this weekend has injected ambiguity into the technical outlook. Scotiabank says Friday's close above 1.08 offers scope for an early bounce up to 1.0880 where the Euro's likely to meet resistance, while Commerzbank's Jones says the market needs to overcome the 200-day moving-average at 1.1052 to alleviate pressure on the exchange rate.

Whether the Euro garners enough upward momentum from Thursday's European Council outcome to lift itself above those technical barriers remains to be seen and may depend as much on price action beforehand as it will whether EU leaders actually endorse the shared fiscal response, although the formation of a possible "pennant" pattern on the daily and weekly charts speaks in favour of continued extension to the upside on the part of the single currency.

A pennant pattern being confirmed on the charts would imply a Euro bounce up to around 1.1500 being in the pipeline, given the height of the flag pole marked out on the chart is worth some 6% for the single currency relative to the Dollar. Extrapolating that from Friday's closing level implies a breach of 1.15 up ahead. Technical analysts at RBC Capital Markets say the following about this pattern in a brochure that explains key technical concepts to clients.

"A pennant pattern is also formed when prices pause during a very sharp market move. While the period of consolidation slopes againstthe previous trend before resuming in the same direction as the trend, the resulting support and resistance trendlines converge (as opposed to being parallel as in the case of the flag). Pennants are often short-term in nature and can be bullish or bearish. Implications: Once the pennant pattern has broken out, the price objective is said to be equal to the “flagpole” – which is the previous sharp advance or decline that took place. Exhibit 35 presents an example of a bullish pennant pattern," writes George Davis, chief technical strategist at RBC.

Above: RBC Capital Markets graph shows typical 'pennant' pattern..