Euro Forecast to Remain Supported as Looming ECB Action can only Disappoint

- EUR rally not yet done says analyst

- ECB unable to hamper further gains

- ECB almost ineffectual in face of coronavirus slowdown

- EZ governments however look to boost spending

Image © European Central Bank

- Spot EUR/USD: 1.1173, +0.31% Spot EUR/GBP: 0.8642, -0.06%

- Bank transfer rates (indicative): 1.070-1.0855 | 0.8440-0.8500

- FX specialist rates (indicative): 1.10-1.1060 | 0.8555-0.8565

- Find out more

The Euro exchange rate complex has been a standout performer in the global FX space since markets caught the coronavirus bug and drastically sold off in the final week of February, and yet further gains are possible as economists warn next week's European Central Bank meeting will disappoint.

The European Central Bank (ECB) is widely expected to follow the lead of the likes of the U.S. Federal Reserve, Bank of Canada and Reserve Bank of Australia and cut interest rates at their March 12 meeting in an attempt to shore up the Eurozone and global economy.

Typically, an interest rate cut would exert downside pressure on a currency and therefore the text book reaction by currency markets would be to sell the single currency in anticipation of the cut. However, economists warn that unlike the U.S. Fed, Bank of Canada and Reserve Bank of Australia the ECB has long since run out of ammunition to fight shocks to the Eurozone economy.

Years of ultra loose monetary policy that has culminated in the cutting of interest rates to -0.50% mean any further rate cuts at the ECB are likely to be as good as useless in boosting economic activity. A multi-billion euro programme of buying up government and corporate bonds in the ECB's quantitative easing programme has meanwhile been so extensive the ECB has at times struggled to find high-quality debt to purchase.

"Pressure is on for the ECB to deliver more monetary stimulus, but the new measures are likely to fall short of expectations," says Daniel Bergvall, Economist at SEB.

As such it is little wonder why those backing a higher Euro have not been spooked by impending promises of action at the ECB: the Euro-to-Dollar exchange rate has rallied to as high as 1.12 at the start of March and is currently consolidating at 1.1172 and looks poised to move higher still.

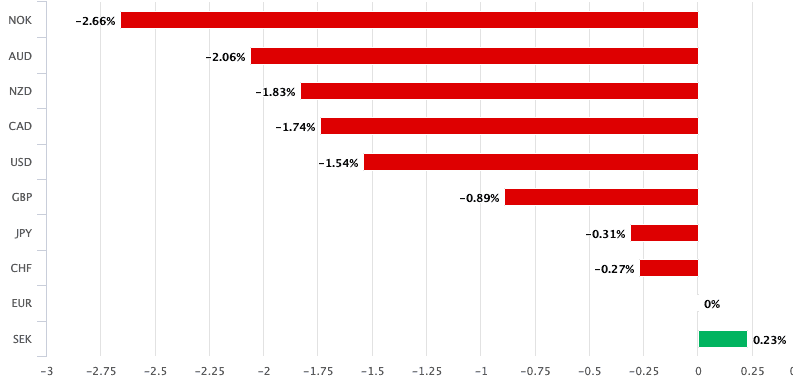

Above: The Euro has outperformed major peers in the current environment of heightened coronavirus anxiety.

"Despite the spreading of the coronavirus across Europe, the Euro has strengthened significantly against most major currency peers over the past week or two," says George Vessey, Currency Strategist at Western Union. "Investors aren’t attracted to the Euro – slow Eurozone growth, high unemployment and low interest rates – it is rather the relentless unwinding of carry trades causing the spike in the common currency’s value."

Vessey explains that typically carry trades are put on in stress-free market conditions, when investors are confident in global growth and higher yielding assets appreciating.

"Investors sell lower-yielding currencies (like the Euro) to buy higher-yielding currencies (like the USD). The rapid reversal of this trade effectively means traders are buying back Euros, causing the currency to rally," says Vessey.

The Pound-to-Euro exchange rate has meanwhile melted in the face of the Euro's recovery with the pair fading back to the 1.14-1.15 level, having been as high as 1.20 in late February.

"Options markets are also signalling more Euro strength is possible because of the narrowing rate differentials between the U.S. and the Eurozone due to the Federal Reserve’s emergency rate cut on Tuesday. If the big unwind of carry trade continues, we might expect EUR/USD to inch towards $1.14, which could drag GBP/EUR towards €1.12," says Vessey.

Analysts at Germany's Commerzbank have this week told clients that the outlook for the Euro has improved drastically of late.

"The ECB has reached the end of the interest rate policy line. Everyone knows that. It might take other measures (extending QE, TLTROs etc.), but they are not very relevant from an FX point of view," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

Therefore the downside risks to Euro exchange rates posed by next week's ECB meeting are greatly reduced.

"The ECB in particular has very little scope for cutting interest rates. A 10bp step might just be possible but even that is likely to be accompanied by a rise in the banks’ exemption levels thus becoming economically almost irrelevant," says Leuchtmann.

"The outlook for the European single currency has improved significantly," adds Leuchtmann.

What to Expect from the ECB

Because interest rates have been slashed to the floor, the ECB has over recent years developed increasingly exotic tools to try and boost the Eurozone economy.

It is these tools that should ultimately be where foreign exchange markets will be focussed.

SEB expects the ECB to expand its monthly Asset Purchase Programme (quantitative easing) by €10bn and cut the deposit rate by 10%, the former being more probable than the latter.

"At this juncture we see it as more important for the ECB to assure that it keeps the liquidity ample, possibly changing the TLTRO schedule. In addition, we expect the ECB to re-start the ABS program to provide targeted liquidity to SMEs particularly hit by the coronavirus epidemic," says Bergvall.

While many in the market see the ECB as now being ultimately ineffectual, particularly as the latest economic crisis stems from a disease outbreak as opposed to failure of financial markets, Bergvall says the central bank still has a role to play.

"The mission for monetary policy in the short term is to stabilise financial markets, guaranteeing ample liquidity, mitigate the increase in the price of credit and in general reduce a negative impact on the real economy due to a plummeting confidence," says Bergvall.

Yet, Bergvall says it could well be up to Eurozone governments to do the heavy lifting by opening their purses and injecting money through increased expenditure.

"The ECB has much less room to manoeuvre but also a much softer underlying economic development to lean on. The ECB has stated the assurance to find targeted and timely measures and we believe the bank is reluctant to over deliver by using traditional monetary policy tools at this point, despite earlier statements that all the measures can be used to fulfil the mandate. In the euro area, fiscal policy is probably more effective than monetary policy, and we expect Brussels to take a laxer approach when it comes to countries’ deficits and debt limits," says Bergvall.

The new president of the ECB, Christine Lagarde, has emphasised that further support for the Eurozone economy might have to come from Eurozone governments, a sign that Lagarde knows the central bank she inherited from Mario Draghi had exhausted its armoury.

Eurozone countries do however appear to be getting the message, with the coronavirus outbreak prompting finance members to consider deploying exceptional budget measures to shield the Eurozone.

Eurogroup president Mario Centeno said Wednesday, "we will coordinate our responses and stand ready to use all appropriate policy tools to achieve strong, sustainable growth."

"This includes fiscal measures – where appropriate, as they may be needed to support growth," said Centeno.

Standing in the way of the ability of Eurozone governments to increase spending is a fiscal rule that states member countries must maintain public deficits of no more than 3% of their gross domestic product, and national debt of no more than 60% GDP.

However, Centeno said the Eurozone's fiscal rules "provides for flexibility to cater for ‘unusual events outside the control of government’."

That provision "can be used to the extent needed, provided that additional spending is proved to be linked with the unusual event and if it is only of temporary nature," added Centeno.