The Euro-to-Dollar Rate Sags as Virus Shuts Italy's Schools and Outlook Beset by Seismic Uncertainties

- Written by: James Skinner

- EUR/USD rate down -0.61% amid broad EUR weakness.

- As calm returns to broader markets after big Fed rate cut.

- Comes as virus closes schools in Italy, ECB sits on hands.

- Germany edges toward releasing fiscal genie from bottle.

- Tecnicals suggest EUR/USD downside back to 1.10 level.

- But 1.1240 and 1.13 possible if 1.1182 can be overcome.

Commerzbank HQ dominates the Frakfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

- EUR/USD Spot rate: 1.1107 -0.61% last week

- Indicative bank rates for transfers: 1.0719-1.0797

- Transfer specialist indicative rates: 1.0941-1.1008 >> Find Out More About This Rate

The Euro-to-Dollar rate sagged Wednesday after coronavirus was reported to have compelled the closure of all Italian schools and as calm returned to financial markets elsewhere, although the outlook is beset by seismic uncertainties and upside risks are dominating.

Europe's single currency was down against all major rivals other than the safe-haven Yen Wednesday as calm returned to markets following a decision by the Federal Reserve (Fed) to cut U.S. interest rates by 50 basis points to 1.25%, a performance that's incongruous with the Euro's traditional correlation with risk appetite. The EUR/USD rate was down -0.61% at 1.1107 although it's still up 2.2% for the last week after recovering off multi-year lows near 1.08.

The Euro's risk correlation melted away last week as emerging world currencies and stock markets collapsed amid panic about the coronavirus spreading beyond China so the Euro's Wednesday performance was arguably to have been expected, although it also came alongside reports from ANSA suggesting the Italian government has ordered the immediate closure of all schools and universities in the country until March 16 in an effort to contain the coronavirus.

The Italian government immediately denied that it intended to close down schools, although it later announced that all schools would close from Thursday until March 15.

"The EUR/USD recovery has reached the top of the 14 month down channel at 1.1182 and this has been eroded but has held on a closing basis and we have a TD perfected set up on the daily chart – a correction lower seems likely," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank in a morning note. "Dips will find some support at 1.0926."

Above: Euro-to-Dollar rate shown at 4-hour intervals.

Investors, governments and citizens are now confronting the possibility of unprecedented severe disruption to economies as the viral pneumonia that originated in China, where it has infected more than 80,000 people and killed close to 3,000, spreads across the world and throughout the continent.

Some 2,263 people had been infected in Italy as of Tuesday, of which 79 have succumbed to the disease, and it's also spreading in Germany and France among other Eurozone countries.

The Fed cut U.S. rates in a surprise effort to shore up confidence Tuesday after a G7 statement left investors and financial markets feeling as if they'd been short-changed, giving the appearance of a classic 'Fed put' option having been excercised. That's put a floor under once freefalling stock markets and weakened the U.S. Dollar against most currencies, although the Euro-to-Dollar rate was in retreat on Wednesday.

"In just seven days, the EUR left behind a nine-day stretch in oversold territory (based on the RSI) to briefly trade in the overbought area during yesterday’s session before markets checked the currency’s rise around the 1.1175/85 area—which has acted as a pivotal level for EUR since mid-Oct," says Juan Manuel Herrera, a strategist at Scotiabank.

Above: Euro-to-Dollar rate shown at daily intervals alongside USD/ZAR.

Coronavirus outbreaks in all of Europe's major economies, potentially including even the UK across the Channel, are bad news for a continent that was already economically challenged and policy constrained.

Both Italian and French economies already contracted in the final quarter while Germany's economy ground to a halt, and now all face the prospect of virus-related disruption that could empty shops and public places and possibly even the enforced isolation of entire towns or even cities. The European Commission acknowledged the risk of a 'technical recession' in Italy and France this year.

With earlier economic weakness chronic enough to have dragged European Central Bank (ECB) interest rates far below zero the above combination should arguably have come as another punishing blow for the Euro currency, although it's increased popularity in 'carry trades' has given it safe-haven like qualities that could now see it outperform in times of stress only to cede ground to riskier rivals as the market mood brightens.

"The EUR’s rally since mid-Feb came to an end in overnight trading as it continues an intraday negative trend from yesterday’s high of 1.1185, although still sitting fairly strong above its 200DMA at 1.1098," says Scotiabank's Herrera, in a Tuesday research note. "The EUR will be supported by the 1.1000 psychological mark (also matching its 200DMA) while resistance stands at ~1.1150 followed by 1.1175/85."

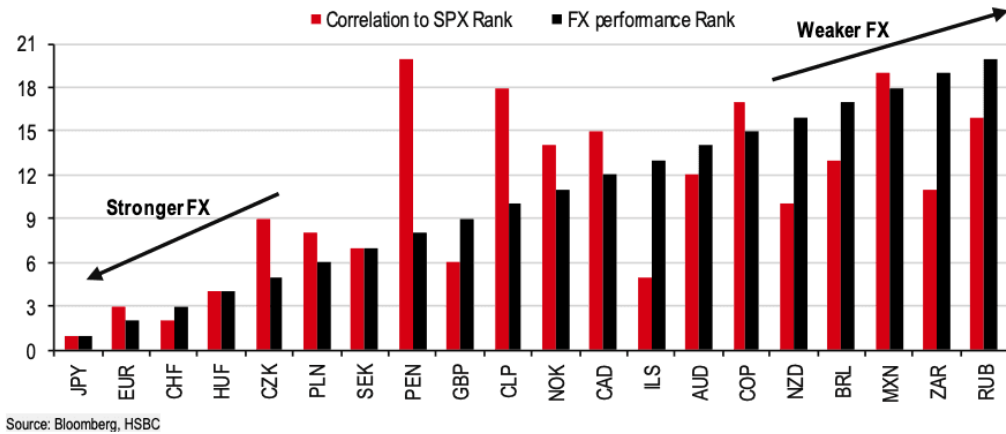

Above: HSBC Research graph ranking currencies according to their correlation with S&P 500.

Closure of 'carry trades' has helped the Euro to rise in recent weeks as markets fretted over the implications of coronavirus and it could do so again. So too could a change of heart in Berlin, if the German government breaks with precedent and allows the fiscal genie out of its long-elusive bottle in order to support Europe's largest economy through the coronavirus crisis, as Finance Minister Olaf Scholz has indicated could happen.

Investors and analysts have long lamented the German government's insistence on sticking to its budgetary framework and increasingly, as its monetary ammunition has run closer to empty in the face of chronic underperformance by the Eurozone economy, the ECB has implored that "governments with fiscal space should be ready to act in an effective and timely manner."

And a coronavirus-related fiscal stimulus in Germany could easily turn into something more protracted, with potentially significant upside consequences for the Euro-to-Dollar rate given its correlation with market expectations for the gap between EU and U.S. economic growth.

"Above the downtrend [1.1182] lies the 1.1240 recent high, the 1.1300 55 month ma and the 200 week ma at 1.1346. This is critical from a longer term perspective, a weekly close above here would target the 12 year downtrend at 1.1950. We would allow for a minor retracement to 1.1095/30 ahead of further recovery," says Commerzbank's Jones.

Above: Euro-to-Dollar rate shown at weekly intervals.