Euro-Dollar Left Behind in Yield Hunt as Economic Divergence Weighs

- Written by: James Skinner

- EUR left behind amid growth divergence, hunt for yield.

- December retail sales slump in soft 2019 finish for EUR.

- French services PMI revised down as growth woes mount.

- After Italian and French economies contract in final quarter.

- Data brings attention back to growth divergence with U.S.

- EUR slips Vs USD and GBP as markets shun low-yielders.

Commerzbank HQ dominates the Frakfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

- EUR/USD Spot rate: 1.1017, down 0.24% today

- Indicative bank rates for transfers: 1.0633-1.0710

- Transfer specialist indicative rates: 1.0854-1.0920 >> Find Out More About This Rate

The Euro underperformed Tuesday after being left behind in a global hunt for yield as uber low interest rates and fresh signs of economic divergence between the Eurozone and U.S. economies tempered appetite for the single currency.

Eurozone retail sales fell by a sharp 1.6% in December, Eurostat revealed on Wednesday, when markets had looked for only a 0.5% decline. And adding insult to injury Eurostat also revised down its earlier estimate of sales growth for the Black Friday month of November from 1% to 0.8%.

"Not all of the variation is explained by Black Friday and even though sales are volatile and we’ll probably need January data before anything sensible can be said about the trend, there are also concerns hindering the retail outlook. The slowing down of the labour market has a direct effect on the potential for sales growth and of course there is the big uncertainty around the coronavirus," says Bert Colijn, an economist at ING.

Investors widely expected a sales decline given the trend of households doing Christmas shopping in November when Black Friday promotions are running, which can set a too-high bar for sales to overcome the next month, but Wednesday's numbers were dire even when that's taken into account.

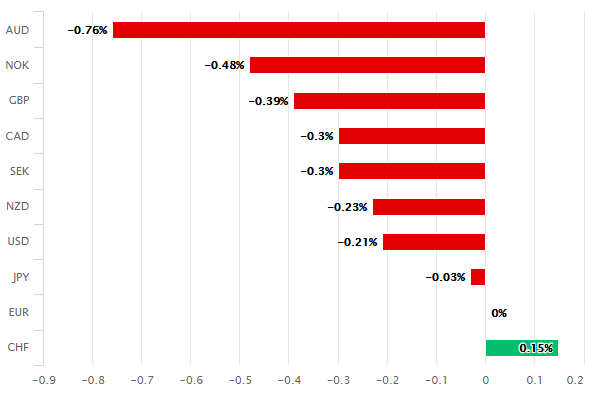

Above: Euro performance against major rivals Wednesday. Source: Pound Sterling Live.

"The pair staged a rather remarkable decline (in low-vol terms) during the London morning, which gave the impression that the EUR is negatively correlated with risk appetite. Perhaps the EUR's "funding attributes" are to blame, as it tends to decline when Asian currencies are on the rebound," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "We think the pair is basically a 1.1000/1.1100 trade for now."

The data was released as investors bid for almost anything with a yield and shunned low-yielding assets like the Euro, partly in response to speculation that Chinese researchers have found some form of 'cure' or treatment for the new coronavirus that's ravaging the world's second largest economy. The World Health Organization susbequently said there's "no known effective therapeutics against the virus," before announcing a press conference for 15:00 GMT.

Wednesday's figures also come just days after Eurostat reported a final quarter slowdown, with growth dipping from 0.2% to 0.1% on a quarterly basis while coming in at just 1% in annualised terms. That annual expansion is less than half the 2.1% seen in the U.S. for the same period and has served the market a stark reminder of the Eurozone's economic deficiencies while threatening to further entrench the currency's yield disadvantage relative to most rivals.

"This all changes where US growth resilience starts to crack," says Kit Juckes, chief FX strategist at Societe Generale. "The option market is now contemplating that a USD fall could be more turbulent than a rise, even against non-safe haven currencies. This is a significant change. The latest time that the skew was so high was in 1H 17 when investors rushed on call options to take advantage of the euro rebound from 1.06."

Above: Euro-to-Dollar rate at 4-hour intervals. Falling even as negative yield on German bonds becomes less negative.

"Euro area final January PMIs point towards further normalisation of manufacturing sentiment and (fairly) stable services business confidence. After penciling in the positive revisions, today's print is consistent with GDP growth of 0.2% q/q, in line with our Q1 forecast," says Ludovico Sapio at Barclays.

U.S. economic outperformance has sustained a steady increase in the value of the Dollar since early in the second quarter of 2018 although the Euro-to-Dollar rate has largely traded between 1.10 and 1.12 since October.

The economic divergence is Euro-to-Dollar negative because it sustains the 1.75% cash rate of the Federal Reserve at a time when the European Central Bank deposit rate sits far below zero.

That range-trading reflects investor hopes of a turning of the tables from economic divergence, to economic convergence in the months ahead, which is widely expected to drive a slow but steady depreciation of the Dollar. Consensus is looking for the Euro-to-Dollar rate to finish the year at 1.15 but a lot might have to go right for the Euro in the months ahead and wrong for the Dollar if an upside break of the range is to materialise and that target be achieved.

And in the meantime, investors, traders and analysts will take some of their cues from charts that are indicating yet more range-trading ahead.

"EUR/USD continues to be thwarted by the 55 day ma at 1.1094 and is effectively side lined very near term. Last week the market sold off towards and recovered just ahead of the 1.0981 29th November low and we suspect is trying to base but at current levels remains fairly neutral. Only above the 55 day ma will attention revert to the 200 day ma at 1.1125," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Above: Euro-to-Dollar rate shown at daily intervals.