Euro-Dollar Rate Still on Sale at Nordea as U.S.-China Ruse No Game-changer

- Written by: James Skinner

Image © Adobe Images

- EUR still a sell at Nordea as U.S.-China deal no panacea.

- Says EUR's economic woes run deeper than the trade war.

- Says Federal Reserve stance hurts more than the trade war.

- Sticks with EUR/USD short, tips a new low before year-end.

- Follows similar wagers on EUR by BMO and Societe Generale.

Europe's single currency succumbed to the advances of a recovering Dollar Monday amid doubts over the substance of last week's U.S.-China agreement but the Euro is tipped by analysts at Nordea Markets to remain on the back foot in the months ahead, likely hitting a new low before year-end.

The Euro ceded only modest ground as the safe-haven U.S. Dollar rediscovered its footing in the wake of notable sell-off last week, although losses are expected to mount in the months ahead. The Dollar was bid higher Monday as European investors were given their first chance to express their views on the merits of the accord said to have been struck between the U.S. and China late last Friday.

"Markets will likely take short-term comfort in the “roadmap to a phase 1 agreement” between the US and China, but remember that nothing is signed yet. The roadmap may though still be seen as a conciliatory signal given the sort of light promises that no further escalation will be seen over the next 4-5 weeks. We will carefully remind you that such a “promise” is worth nothing at all, and currently it looks more likely that running for president on an anti-Chinese agenda is better/smarter (for re-election purposes) than doing the opposite," says Andreas Steno Larsen, a strategist at Nordea.

Above: Euro-to-Dollar rate shown at daily intervals.

President Donald Trump said late Friday the U.S. and China had reached "a very substantial phase one deal" that averts an increase in tariffs previously planned for Tuesday 15 October, which would have risked putting the already-slowing global economy under further pressure. But the rub for markets is that it will be weeks before accord, which is simply the first of a multi-phase deal, is written on paper and signed which means there's also still plenty of scope for the whole thing to fall apart.

Europe has arguably been the greatest victim of the 18-month long tariff fight between the world's two largest economies, which has disrupted multinational supply chains, shrank international trade and dented business confidence the world over. Europe's manufacturing intensive economy has slowed more than the two protagonists in the trade fight and its factory sector is mired in a deep recession, but Nordea says Federal Reserve (Fed) monetary policy has been a bigger factor in the old continent's woes.

"To put it bluntly, the wide-spread narrative that the global growth slowdown is caused by “Trump’s trade war” is false, which makes the current situation more dangerous than it needs to be – since the Fed is mistakenly believing in this untrue narrative. It also means that market participants will react more positively to de-escalating trade tensions than they actually should," Larsen says. "The Fed may be even more wrong on trade than it was on Quantitative Tightening."

Above: Nordea graph showing ISM manufacturing PMI's negative correlation with short-term U.S. bond yields.

Nordea's research shows there is a negative correlation between the Institute for Supply Management (ISM) manufacturing PMI and short-term U.S. bond yields, which are influenced most by changes to the Federal Reserve's main interest rate and market expectations for the rate in the years ahead.

The Fed raised rates nine times in the three years to December 2018 in an effort to contain a recovery of inflation, although the rapid increase lifted the cost of Dollar funding the world over and prompted a rally in the greenback that has made U.S. exports more expensive for everybody to buy. So far the Fed has cut rates twice due to concerns over the trade war but Nordea says it's still overlooking the impact that its own policy has had on the global economy.

"Sure, global economic-political uncertainty is bad news for capex, but we did call for a global slowdown of the manufacturing sector already back in November 2017 – a call based in part on the monetary policy tightening then put in place by the Fed, and a call well before the gradual escalation of the so-called trade war," Larsen says.

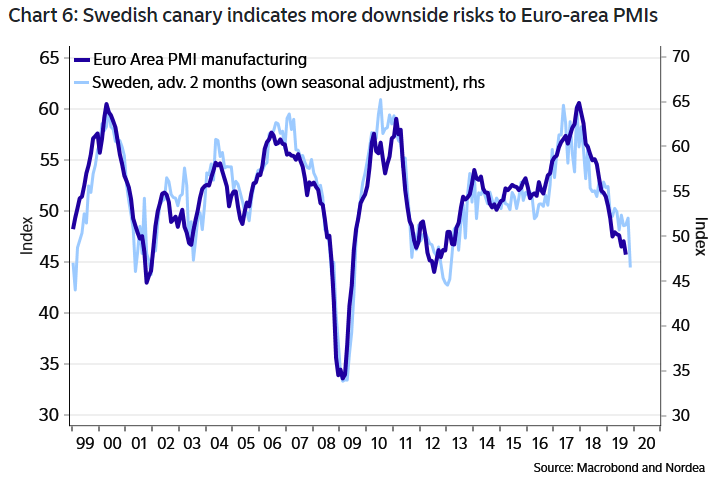

Above: Nordea graph showing correlation between manufacturing PMIs in the Euro are and Sweden.

Nordea forecast at the end of 2017 that a lesser degree of policy stimulus in China and a strong trade-weighted Euro would weigh on the factory sector in 2018, which they did alongside the trade war. Although new EU rules governing the measurement of emissions output from new cars also drove a contraction of third quarter industrial production as well as GDP growth in Germany, which was initially thought to have been temporary.

Germany's factory sector has remained in recession this year and multiple factors have been cited by various observers as being behind the downturn, which is tipped by Nordea and other firms to continue for a while yet. Nordea says this continued weakness in Europe, combined with the Fed's obliviousness to the impact its own interest rate policy is having on the U.S. and global economies, is likely to see the European Central Bank (ECB) cut rates again before long and the Euro remain on its back foot.

"On the topic of false narratives, if you think Brexit has been the main driver of a weaker euro-area, then we disagree (man do we sound cranky today!?). Tougher emission standards have likely been more important," Larsen says. "And what if the Euro area PMI doesn’t rebound even with bigger trade and Brexit optimism? This could prove to be the point when the penny finally drops in Frankfurt. We are not ready to abandon our bets on further ECB easing in December. We stay short EUR/USD."

Larsen is betting the Euro-to-Dollar rate falls from 1.1050 Monday to 1.0760 over the coming months, which would mark its lowest level since the summer of 2017. He and the Nordea team have been selling the Euro since August although they're not alone in their bearish outlook for the single currency because both BMO Capital Markets and Societe Generale said last week they were waiting for another opportunity to bet against the Euro.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement