EUR/USD Week Ahead Forecast: Short-Term Bullish Potential

Image © Adobe Stock

- EUR/USD probably to rise in short-term

- But sustained upside to be limited by trendline

- Euro to be moved by German data

- U.S. Dollar by trade talks and CPI

The Euro-to-Dollar exchange rate is trading at around 1.0976 at the start of the new week after rising 0.33% in the week before. Studies of the charts are showing the potential for marginal upside in the short-term followed by a mixed outlook thereafter.

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair has risen quite strongly after making new lows on October 1.

The completion of two sets of higher highs and higher lows is sometimes a signal the trend has reversed.

If so, the new short-term uptrend is likely to continue a little higher - subject to a break above the October 3 highs at 1.1000 - perhaps as far as up to the trendline at 1.1025.

The trendline is likely to act as a barrier to further upside and after touching it there is a high risk the pair may start falling again.

A break below the October 3 lows at 1.0940 would negate the minor bullish bias and see a potential sell-off down to the lower trendline at circa 1.09.

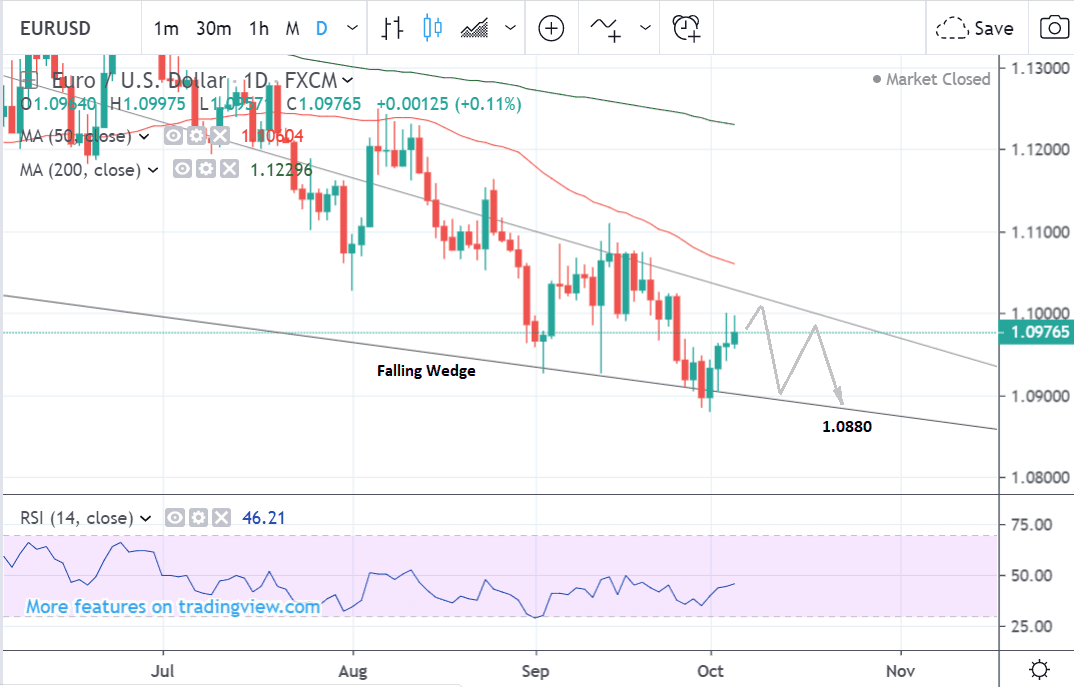

The daily chart shows how the pair is sliding lower and more-or-less respecting the confines of a falling wedge pattern.

It might very well oscillate lower to a medium-term target at 1.0880.

Momentum remains quite buoyant, however, suggesting bears should act with caution.

The RSI failed to make a new low when the exchange rate did at the October 1 lows creating a bullish convergence which suggests a reduced chance of more downside.

Yet at the moment there is no sign the pair could go higher either.

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

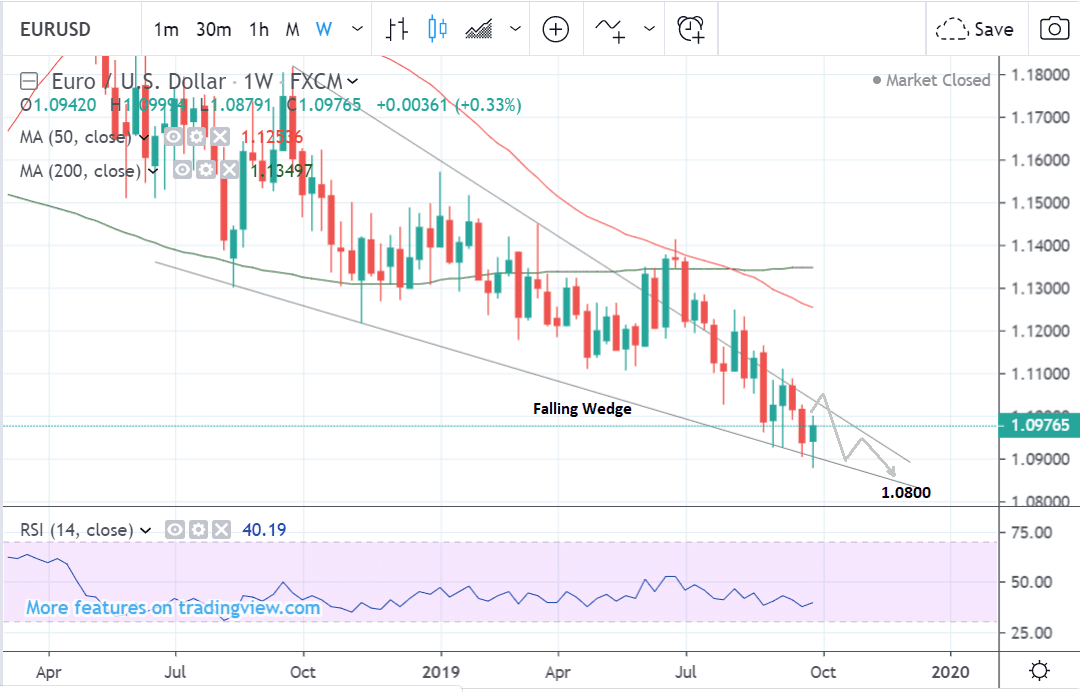

The weekly chart shows a similar picture. The pair is continuing to fall within the confines of a possible wedge pattern.

If it continues to decline it could reach a target as low as at 1.0800.

As the wedge tapers there is a chance of a volatile breakout either higher or lower, but at the moment there is insufficient evidence to provide a direction.

The weekly chart is used to give us an idea of the longer-term outlook which includes the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Euro: What to Watch

German data - factory orders and industrial production - are the main data releases for the Euro whilst an overarching risk factor are threats of the U.S. widening tariffs on European imports.

The German economy continues to struggle and there will be several important data releases in the week ahead which could either intensify or ease concerns about the welfare of Europe’s largest economy.

Factor orders in August are forecast to fall 0.3% from 2.7% in the previous month, when data is released on Monday at 9.30 BST.

German industrial production is expected to show a 0.3% fall in August when data is released at 7.00 on Tuesday. In the previous month it declined 0.6%.

Another key release is German inflation in September which is forecast to show a 0.2% decline when released at 7.00 on Friday.

If any of these prints come out lower-than-expected they will potentially weigh on the Euro - if higher they may offer support.

The Eurogroup meeting of Eurozone finance ministers starts on Thursday. This has the potential to support the Euro since a current hot topic that may gain exposure is the possibility of more fiscal stimulus in Europe to drive up growth.

The U.S. Dollar: What to Watch

The main drivers of the U.S. Dollar in the week ahead are likely to be the outcome of U.S - China trade talks, the release of Federal Reserve policy meeting minutes on Wednesday, and CPI data on Thursday.

A fresh round of trade talks between the U.S. and China are scheduled to kick off on Thursday with the possibility of deal being done.

There may be incentives for both sides to agree a deal.

Trump may want to appease his base in the run up to next year’s elections; and the Chinese may wish to prevent any greater decline in growth.

If there is a deal, the Dollar will probably rise as it will suggest better growth in the U.S. and a lower probability of the Federal Reserve (Fed) having to cut interest rates to stimulate growth - a negative policy for the Dollar.

“A failure to reach a limited deal would further undermine market sentiment, likely sending stocks lower alongside the dollar, as the implied chances for more Fed rate cuts in the coming months soar. The defensive yen and gold could be the biggest beneficiaries in this scenario. The opposite reactions would likely take place if a deal is struck,” says Marios Hadjikyriacos, investment analyst at XM.com.

CPI data is forecast to show a 0.1% rise in September and core CPI a 0.2% rise. Core CPI is forecast to rise by 2.4% compared to a year ago when the data is released on Thursday at 13.30 BST.

Given the poor ISM data out last week the risks may be tilted to an undershoot rather than an above-expectations result, and if that is the case the Dollar may weaken.

The Fed policy meeting or FOMC meeting minutes out on Wednesday at 19.00 could also move the Dollar.

The minutes include the deliberations of Fed officials and sometimes contain new information about the possible future trajectory of interest rates.

Higher interest rates tend to support the Dollar and lower weaken it.

This is due to the influence of rates on net foreign capital inflows which tend to increase the higher rates rise.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement