Euro-Dollar Forecasts Slashed at Barclays as German Economy Struggles and ECB Eyes More QE

- Written by: James Skinner

Benoît Cœuré. Image © European Central Bank, reproduced under CC licensing

- EURUSD forecasts slashed after G20 boost for U.S. outlook.

- USD seen stronger for longer, keeping pressure on the EUR.

- Pantheon eyes German contraction in Q2 and ECB talks QE.

The Euro softened Tuesday and is set to go on declining into year-end, according to forecasts from Barclays, which were downgraded this week in response to an improving outlook for the U.S. economy.

America's Dollar is set to trade on a stronger footing for even longer than was seen as likely at the time of Barclays' last forecast update in June. Meanwhile, Europe's single currency will face numerous headwinds of its own on home shores over the coming months.

"What a difference a week makes. The outcomes of bilateral heads of state meetings at the G20 in Japan universally surprised to the upside, while US data, albeit mixed overall, have demonstrated that the US economy retains strong momentum, particularly in employment. But more informative to us has been the greenback’s behaviour both before and after the G20," says Marvin Barth, head of FX strategy at Barclays, in a note to clients.

Above: Dollar Index at 5-hour intervals, annotated for recent events.

Presidents Donald Trump and Xi Jinping agreed at the end of June to return to the negotiating table and to avoid imposing new tariffs on each other while talks are ongoing, enabling the global economy to breathe a sigh of relief.

Previous to the meeting President Trump had threatened to put tariffs on more than $300 bn of China's annual exports to the U.S. each year if it didn't agree to a deal addressing its "unfair trading practices", after already having lifted from 10% to 25% the tariff levied on $250 bn of goods trade with the U.S.

"The US-China agreement to go back to the negotiating table is a near-term positive, as it delays the imposition of tariffs and technology sanctions," says Barth. "But ultimately, we expect negotiations to fail to resolve the fundamental tension between the two superpowers over technological dominance. The main uncertainty, in our minds, is when, not if, talks will break down."

The May use of company 'blacklists' against each other marked the beginning of a descent from trade dispute toward all-out economic conflict, which hurt business confidence and economic growth the world over including in the U.S.

With the world's two largest economies hurtling toward a damaging conflict, markets had begun to bet the Federal Reserve (Fed) would need to help tide the U.S. economy over with a series of interest rate cuts later this year but the G20 agreement and a strong jobs report have seen such expectations ebb.

Above: Euro-to-Dollar rate shown at daily intervals.

"When growth concerns were the dominant narrative, the USD’s depreciation was surprisingly limited, despite a rapid and large compression of the US interest rate advantage," Barth says. "But since growth expectations rebounded postG20 – and further following US payrolls – currency markets have focused on the relative growth advantage of the US despite a relatively small rise in US rate expectations. It appears that the dollar wins whichever way growth expectations turn."

Barth and the Barclays team say the Fed will now be less minded to cut rates quite so radically as it might have been looking to before the G20, when Barth and his colleagues were forecasting three cuts before the year is out.

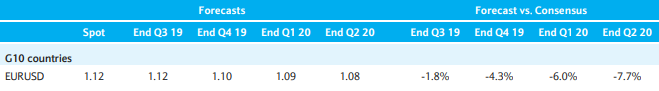

This means the Dollar will be less inclined toward weakness this year, which has negative implications for the Euro-to-Dollar rate. Barth forecasts the Euro will trade around 1.12 until the end of September, a downgrade from June's forecast of 1.14, before declining further to 1.10 in time for year-end.

The Euro is expected to reach a low point of 1.08 by the end of June 2020 as the domestic economy struggles, inflation remains below the official target and the European Central Bank (ECB) is forced to cut its already-negative deposit rate three times by March 2020. Barclays sees the ECB falling to -0.70%.

Above: Barclays Euro-to-Dollar rate forecasts.

"Judging by the monthly data, everything went wrong in the German economy in Q2. Consumption almost surely slowed sharply," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "Weakness in manufacturing won’t come as a surprise to anyone, but yesterday’s report, and the April revisions, indicate that construction stalled too."

Industrial production and trade balance data released in Germany on Monday showed the Eurozone's largest economy enjoying a sharp rebound in its trade surplus during May and an uptick in industrial production, but Pantheon's Vistesen says the headline numbers masked a dire set of details.

German industrial output rose 0.3% in May but much of this was simply "mean reversion" from a low base after previous falls. Meanwhile, the details of the report revealed the construction sector output began to decline that month after previously having supported the economy.

Moreover, the trade balance also mean reverted, rising from €16.9 bn to €18.7 bn in May thanks to a 1.1% increase in exports and a 0.5% decline in imports. However, this was only after exports fell 3.4% in April, which still leaves "net trade" as a drag on second quarter GDP growth.

"It is difficult to escape the idea that GDP fell outright in the second quarter. Our base case is a 0.2% decline, driving the year-over-year rate down by 0.6pp, to zero," Vistesen says. "More pertinently, a hit to the German economy would feed negatively into the EZ headline—we look for Q2 growth of 0.1% q/q—which, in turn, supports our forecast for the ECB to ease further."

Above: Pantheon Macroeconomics graph showing GDP forecasts.

Benoit Coeure, a member of the executive board of the European Central Bank, told BFM Business Radio in France MondayBFM Business Radio in France Monday the ECB could restart its quantitative easing program if "new negative downside risks materialise". The comments echoed the tone of ECB President Mario Draghi from June.

The ECB left its refinancing rate, marginal lending rate and deposit rate unchanged at 0%, 0.25% and -0.4% respectively that month but Draghi told an audience in the Portuguese city of Sintra that if inflation doesn't pick up toward the target of "close to but below 2%" then additional stimulus could be required.

He specifically mentioned the prospect of further deposit rate cuts and another quantitative easing program, which would see the bank buy European bonds in an effort to stimulate economic growth and inflation by forcing down government and corporate bond yields.

"The analysis above immediately raises the spectre of a recession, but this is not our base case," Vistesen says. "That said, if this forecast is correct it would push our full-year growth forecast down further, to a paltry 0.5%, assuming a quarter-on-quarter run-rate of some 0.3% in the second half of the year."

Now, Barlcays, Pantheon and a range of other firms are forecasting that it won't be long before the ECB turns on the printing presses once again in an effort to revive the Euro area economy. That would almost certainly be bad for the Euro.

Changes in interest rates are only normally made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the influence they have on capital flows and their allure for short-term speculators.

Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

Above: Euro-to-Dollar rate shown at weekly intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement