The Euro-Dollar Rate Bounces into Weekend but Inflation Surprise Won't Deter the ECB from More QE

- Written by: James Skinner

© European Central Bank, reproduced under CC licensing

- EUR advances after Eurozone inflation rebounds in June.

- But economists say not enough to avert more ECB stimulus.

- ECB seen cuttting rates, restarting QE program this summer.

- MUFG sees EUR gains ahead as Barclays looks for new lows.

The Euro rebounded Friday after official data revealed a surprisingly strong pickup in inflation during June, although some economists doubt it's enough to avert more interest rate cuts and a fresh quantitative easing program from the European Central Bank (ECB) this summer.

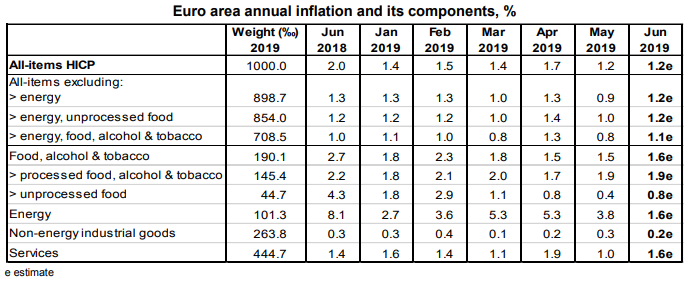

Eurozone inflation remained steady at 1.2% in June, unchanged from the previous month and in line with the consensus, but the more important 'core' rate of inflation surprised on the upside when it bounced from 0.8% to 1.1%. Markets had looked for it to rise only to 1%.

The core number is thought to provide a truer measure of organic price pressures in the domestic economy because it ignores commoditised food and energy items as well as alcohol and tobacco, prices of which are influenced more by government taxes than consumer demand.

"Details are not available in the advance report, but higher inflation in German package holidays and in the hospitality sector as well as normalisation in French rent inflation, as base effects from last year’s reduction in social costs were eliminated, likely were the key drivers," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Above: Eurostat inflation statistics released on 28 June.

"The French statistical official attributed much of the increase there to higher transport prices, and state-level data suggest that much of the increase in German inflation was due to higher prices of package holidays and airfares, reflecting the larger number of public holidays in June this year. Much of this may be reversed in July," says Andrew Kenningham, chief Europe economist at Capital Economics.

Markets care about inflation data because it determines ECB interest rate policy, which is the primary tool policymakers use to control price pressures. Lower rates are used to stimulate economic growth and inflation pressures.

However, lower rates also tend to see investors driven out of a currency because capital flows move in the direction of the most advantageous or improving returns. And inflation is as sensitive to changes in economic growth as it is supply side factors.

Eurostat is not expected to provide a detailed breakdown of national inflation rates and their contributors until the end of the month but both Pantheon and Capital Economics suspect June's bounce was largely due to one-off and temporary factors, with price pressures likely to cool again in the coming months.

Above: Euro-to-Dollar rate shown at daily intervals, alongside EUR/GBP rate.

"The first quarter in the EZ economy was characterised by a slide in the survey data, while the monthly industrial production, retail sales and construction numbers comfortably beat expectations. Q2 is shaping up to be the exact opposite," says Pantheon's Vistesen. "By contrast, the hard data stumbled at the start of the Q2, and we think they will continue to struggle in the coming months. Our baseline for Q2 GDP growth is for an increase of just 0.1-to-0.2% quarter-on-quarter.

Eurozone inflation has been stuck below the near-2% target since November 2018 when oil prices began reversing earlier gains. If not for volatility in oil, the headline rate might not have seen the target level for a number of years.

And core inflation, which is seen as the truer measure of price pressures, has not been above 1.3% at all in the four years since the European Central Bank began its now-shuttered quantitative easing programme. Meanwhile, the economy is slowing.

The Eurozone's low levels of inflation, when combined with weakness in the economy, risk turning what was a headache for the European Central Bank into a migraine because faster economic growth, that is above 'potential growth', is a prerequisite of higher consumer prices.

Above: Eurozone GDP quarterly and annual growth rates. Source: Pantheon Macroeconomics.

"We now expect the ECB to cut its deposit rate by 10bp and to announce a new asset purchase programme at its 12 September meeting," says Florian Hense, an economist at Berenberg. "In the absence of a big fiscal stimulus and amid very low core inflation, ECB doves believe it is worth trying."

Eurozone economic growth picked up from 0.2% to 0.4% in first-quarter of 2019 but surveys have since suggested strongly that the economy turned lower again at the start of the second quarter. Official data for the three months to the end of June won't be available until mid-August.

The early 2019 performance came hard on the heels of a disappointing 2018 year where GDP growth declined from 2.3% to 1.8%. Growth fell by half in the latter part of the year, with third quarter GDP growth declining from 0.4% to 0.1% and then coming in at only 0.2% in the final quarter.

"The 5yr/5yr inflation swap plunged to a record low of 1.13% on 14th June before rebounding on monetary easing hopes. However, this measure is now declining once again," says Derek Halpenny, head of research at MUFG. "Worryingly for the ECB, since the ECB embarked on unorthodox monetary easing measures with the start of negative rates in June 2014, the 5yr/5yr has declined by 100bps."

Above: 5-year Eurozone inflation expectations Vs U.S. and UK (red) inflation expectations.

ECB President Mario Draghi said in June the bank will embark upon fresh interest rate cuts and another bond buying program if the inflation outlook does not improve. Since then financial markets have bet the ECB's deposit rate, which is the negative one of its three main interest rates, will be cut to a new record low in September.

The ECB has already left the refinancing rate, marginal lending rate and deposit rate unchanged at 0%, 0.25% and -0.4% for a number of years now, which are some of the lowest interest rates in the developed world.

However, what's got less attention than Draghi's comments on interest rates is the statement on bond buying, or quantitative easing, presumably because investors have long thought the ECB had already acquired about as much of the entire European bond market as it could prudently manage to buy.

Many economists are now also looking for the ECB to restart its quantitative easing program before the year is out.

"Given the limited scope to use forward guidance and interest rate cuts, the ECB is likely to resort to the most powerful tool in its toolkit: quantitative easing. We now think Mr Draghi will announce in October that the ECB will resume its net asset purchases, though the purchases themselves may begin in November," says Capital Economics' Kenningham.

Above: Market expectations of Eurozone inflation in five years time. Source: Capital Economics.

QE saw the ECB buy European bonds en masse to incentivise borrowing by forcing down bond yields, which are market interest rates, between January 2015 and December 2018. The idea was that this would lift inflation toward the target of "close to but below 2%" by stimulating faster economic growth.

However, it's debatable whether the policy ever worked at all given that Eurozone inflation has remained far below the ECB's 2% target except in times when oil prices have been rising sharply because of global factors.

QE has the same effect on a currency as traditional interest rate cuts do, in that it lowers borrowings costs for governments, companies and consumers by forcing down the yields on their existing bond market debt.

Capital flows, which drive exchange rates, tend to move in the direction of the most advantageous or improving returns. A threat of lower yields normally sees investors driven out of and deterred away from a currency and vice versa.

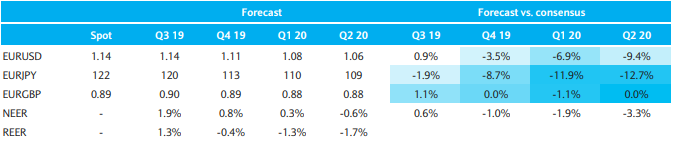

"With the Fed likely to be still more active than the ECB, action in July may have limited impact on EUR/USD. We still expect a modestly higher EUR/USD ahead but ECB action will help limit the upside rather than fuel any renewed EUR depreciation," says MUFG's Halpenny.

Above: Euro-to-Dollar rate shown at weekly intervals, alongside EUR/GBP rate.

Halpenny and the MUFG team say the Euro could be left unscathed by any forthcoming ECB rate cuts and QE program because the Federal Reserve is also expected to cut U.S. borrowing costs steeply during the same time period.

However, this could be more of a curse than a blessing for the single currency because if the Euro rises against the Dollar and Pound Sterling then the bloc's already-weak inflation pulse will be further undermined because a strong currency makes imported goods cheaper to buy.

The Euro rose 10% in the second half of 2017 when ECB President Mario Draghi hinted that the old QE program of 2015-2018 was going to be wound down because the move gave markets some hope of seeing the gap between Eurozone and U.S. bond yields narrow.

Fed rate cuts would drive a similar narrowing of the gap between bond yields on either side of the Atlantic but there aren't any analysts who're suggesting that a rally of the 2017 magnitude is in the cards. Nonetheless though, any meaningful pickup in the single currency will still work against the ECB.

"While more ECB easing is likely on its way, we doubt it will have a meaningful impact on growth. As a result, we expect only a shallow and short-lived EUR rally in Q3 and broad depreciation thereafter, with EURUSD breaking 1.10 and re-testing previous cycle lows over our forecast horizon. A constrained ECB, decelerating EA growth and the bloc’s high vulnerability to escalating US-China trade tensions are the primary drivers of our bearish EUR view," says Nikolaos Sgouropoulos at Barclays.

Above: Barclays' forecast table for Euro exchange rates.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement