Month-End is Dead: HSBC's Donnelly

Image © kasto, Adobe Images

- Month-end flows a recognised phenomenon in FX

- Evidence this is no longer the case

- Effect has been ‘arbitraged away’

The impact of month-end flows on foreign exchange markets is not as predictable as it once was says Brent Donnolly, a trader at HSBC in New York.

Month-end flows, caused by portfolio managers rebalancing their portfolios, was traditionally considered a key factor driving FX markets in the last few days of the month.

The impact on certain pairs was so predictable that it was possible to create trading strategies to profit from them.

Donnelly's research shows those strategies no longer appear to be working as widespread adoption appears to have “arbitraged away” the opportunity, suggesting month-end flows are not a driving factor any longer.

The classic set-up to profit from month-ends was to buy the U.S. Dollar two days before the end of the month and then if U.S. stocks had gained more than 2% on the last day of the month, to sell the USD position between 7am and 11am on the final day.

The strategy worked the other way too, so if stocks fell 2% you bought Dollars on the last day.

This strategy used to return a consistent profit for years, however, over the last 12 months it stopped working.

“Both standard models of month end USD behaviour have broken down in the last 12 months,” says Donnelly. "It was a source of significant alpha for both human and systematic traders since at least 2006 but it appears to have been arbitraged away."

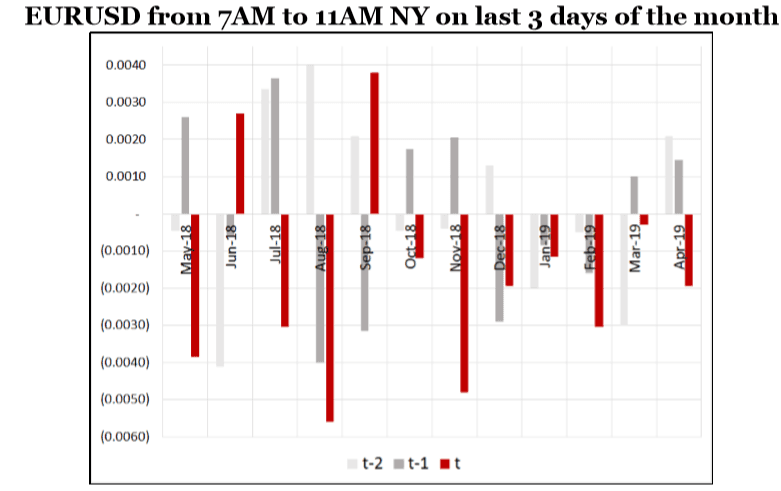

EUR/USD actually fell on ten out of the last twelve months despite U.S. equities gaining over 2% on ten of the last 12 months. The chart below shows the results of the strategy over the last 12 months, with red bars the focus as they show how EUR/USD traded between 7-12am on the final day.

It seems widespread knowledge and participation in the strategy has undermined its effectiveness. This could be because of high-frequency trading systems front-running the market.

“I am slowly coming to the view that these month-end effects are dead, as they are front page news on the New York Post by this point, and after many years it’s time to mostly ignore these effects,” concludes Donelly.