EUR/USD Week Ahead Forecast: Choppy Market Action in Midst of Downtrending Channel

Image © Adobe Images

- EUR/USD choppy and trend difficult to judge

- Break below last week’s lows could confirm

- Main release for Euro is retail sales; for USD CPI

Short-term direction in EUR/USD is forecast to be choppy, however, the broader outlook remains consistent with further declines in the Euro.

The Euro-to-U.S Dollar rate is trading at 1.1188 at the start of the new week, over half a cent up from the week before. The pair rose mainly because the U.S. Dollar weakened after the Federal Reserve policy meeting and the broader trend of Dollar strength eased.

Some had been expecting a more upbeat assessment of the economy to come from the Fed, that might hint at further interest rate rises in coming months, but in the end the Fed stuck with their patient stance.

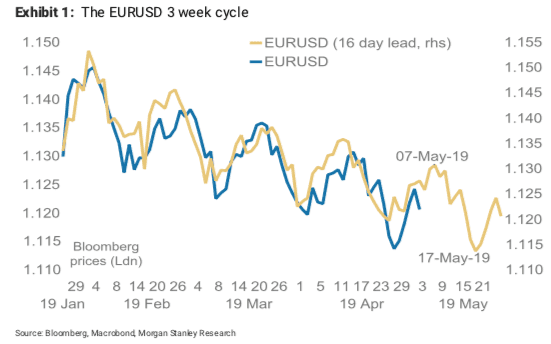

From a technical perspective, "FX markets are trading on technicals," says Sheena Shah, a strategist with Morgan Stanley. "EUR/USD has been trading in a downtrend since the start of the year. Analysts and press may find a macro reason for the currency to go up or down on a given day but, in reality, using simple support and resistance trendlines this year has provided a good guide for many pairs, particularly the EUR."

"The chart is striking in that the five EUR/USD up and down cycles have been very similar in both magnitude and time. If there is little divergence in monetary policy in coming weeks and equity volatility stays low then very likely the peak in EUR/USD will be here in a few days, before falling to a new low by mid-May," says Shah.

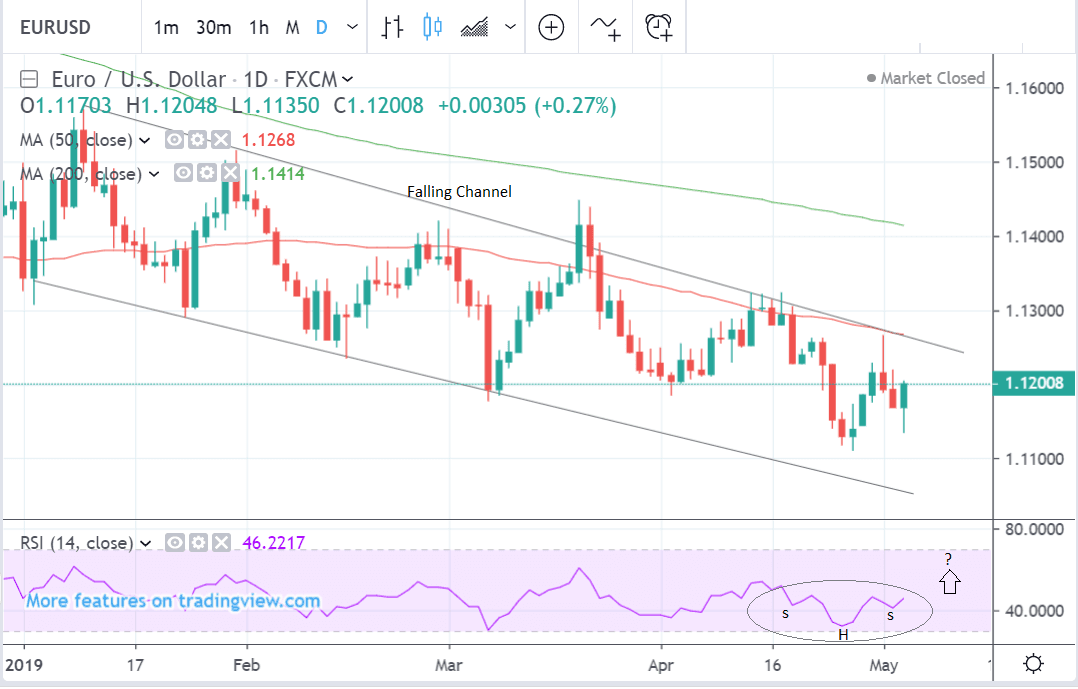

Our studies suggest last week’s recovery has brought the short-term downtrend into doubt.

The pair started falling within its descending channel three days ago after touching the upper borderline. It looked like it was just going to continue running lower until it recovered on Friday. Whether or not it is in a short-term up or downtrend is questionable.

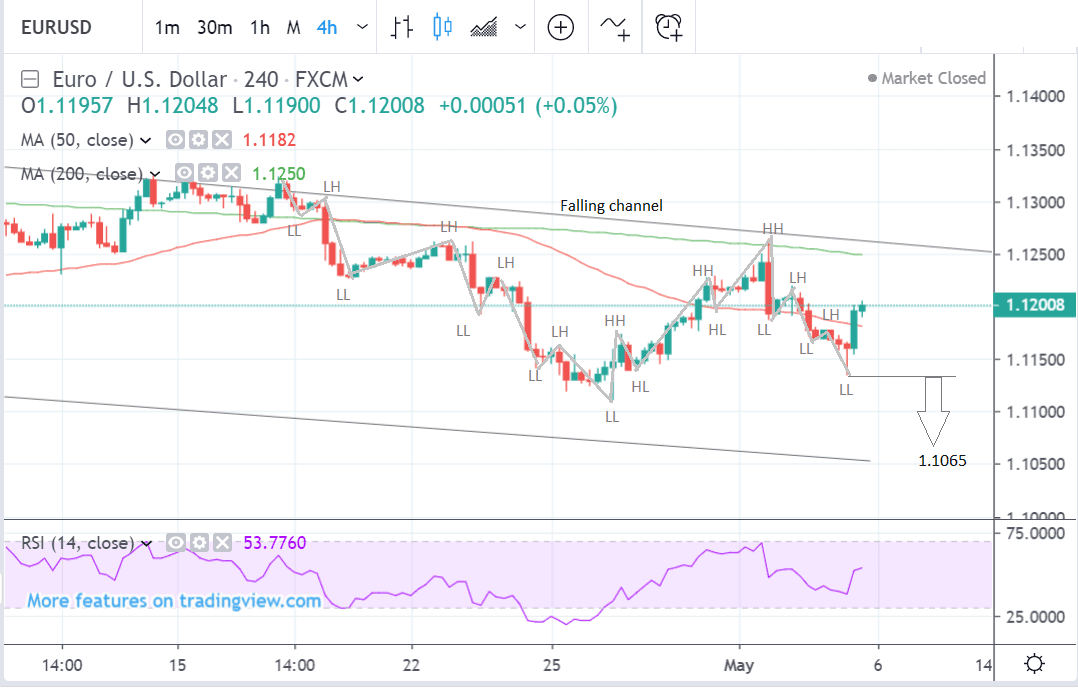

Intuitively it looks right for the market to continue lower rather than breakout higher, but taken alone that is not enough to base a forecast on, and we would ideally wish to see a break back below last week’s 1.1145 lows for confirmation of more downside. From there it could fall all the way down to the lower channel line at 1.1065.

Viewed on the 4hr time frame, which gives a short-term perspective, the market’s random walk is even clearer to see.

The most recent tranche of market action shows a bearish sequence of lower highs (LH) and lower lows (LL) from the middle of April down to the April 26 lows. This looked like an established short-term downtrend.

But it was followed by a bullish sequence of higher highs (HH) and lows (HL) up to the May 1 peak, and the fact there were more than two sets of peaks and troughs could arguably indicate the trend had reversed higher.

This was then followed by a another move down composed of two sets of lower lows and lower highs, to the May 3 low, which again, could have signalled the start of a new downtrend, but it was followed by a spike higher.

The constant flip-flopping of the short-term eschews a traditional trend-based approach, although as mentioned above a break below the lows would reinvigorate the bearish case.

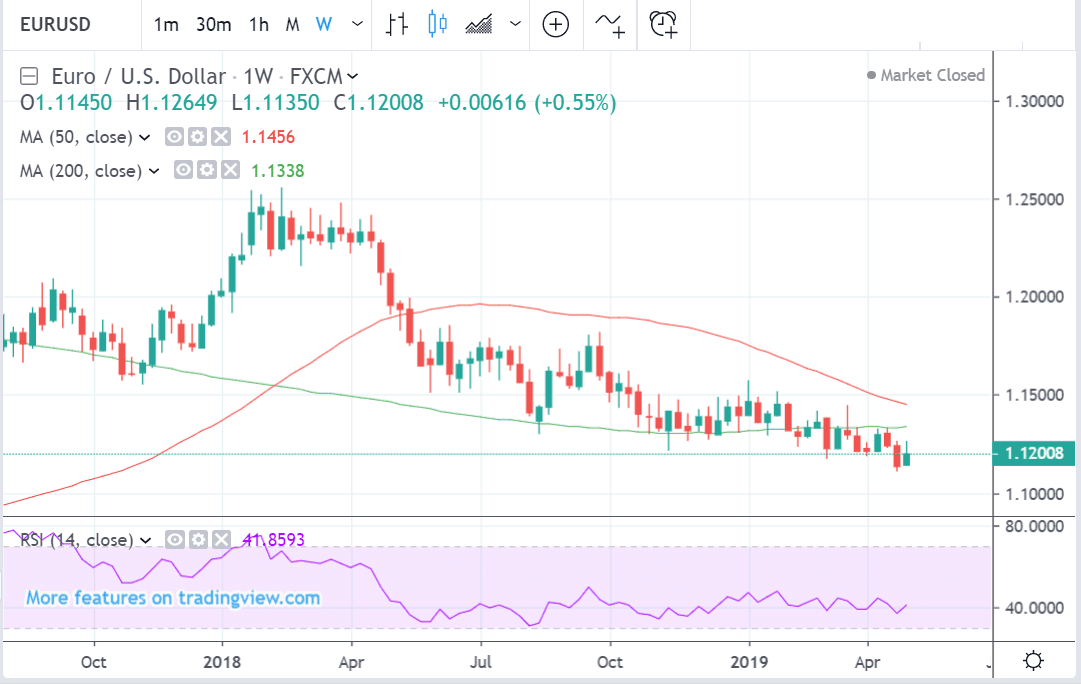

The weekly chart looks bearish. It shows the pair in a gentle downtrend and stuck below the 200-week moving average (MA) - a pivotal support and resistance level. This provides a tough glass ceiling limiting gains.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Euro: What to Watch

The Eurozone ended its run of poor data last week after first quarter GDP data beat expectations, coming out at 0.4%, up from the 0.2% of the previous quarter and the 0.3% forecast.

This week could traders will be looking for confirmation that the Eurozone economy is in fact improving after months of stale underperformance that has seen the European Central Bank (ECB) row back on its commitment to raise interest rates in 2019.

German industrial production for March will be in focus on Tuesday at 07:00 B.S.T. where analysts are forecasting will fall by -0.7% month-on-month from a rise in the prior period of 0.7%.

The release could “reaffirm the need for caution” says Raffi Boyadijian, ana economist at broker XM.com.

A beat of expectations could however prove supportive for the Euro given the market's entrenched negativity on the German and Eurozone economies.

Monday is when most of the key releases for the Euro come out. Retail sales are out at 10.00 BST, and are estimated to have declined -0.1% on a monthly basis in March, from 0.4% previously, and 2.3% on a yearly basis from 2.8% previously.

The final estimates for services and composite PMIs are also out on Monday, at 9.00. They are forecast to decline slightly to 52.5 and 51.3 respectively in April.

The other key release in the week ahead for the Euro is the release of ECB minutes from their most recent policy meeting on Wednesday at 12.30. These are expected to underscore the dovish tone of the meeting statement and press conference by ECB President Draghi out on Wednesday, April 10.

“The European Central Bank’s minutes of the April policy meeting are unlikely to generate much reaction either on Wednesday. Given that policymakers did not discuss introducing a tiered system for the deposit rate and there were no new economic projections available, the minutes are anticipated to produce few surprises,” says Boyadijian.

The Dollar: What to Watch this week

The main release for the U.S. Dollar in the week ahead is inflation data out on Friday, and to a lesser extend producer price - or factory gate inflation (PPI) as it is also known - out on Thursday. Both will be used as gauges against which to measure Federal Reserve chairman Powell’s comments about subdued inflation being only ‘transitory’ at last week’s Fed policy meeting.

The Dollar has been rising over recent weeks thanks to an ongoing outperformance of the American economy, which has lead markets to believe the Fed could, in the future, start raising interest rates once more. As a rule of thumb, expectations for rate rises are supportive of a currency.

While expectations for such a rise are still relatively subdued, they nevertheless mark a shift away from expectations for an interest rate cut.

Stronger inflation data out this week would reinforce the trend.

Both the core and broader headline CPI, out at 13.30 BST, are forecast to rise by a faster 2.1% rate in April compared to a year ago; this compares to 2.0% and 1.9% respectively in March.

On a monthly basis core is expected to rise at a faster 0.2% (up from 0.1%) and broad by 0.4% (same as previously).

If the data beats expectations we could well see the Dollar rise.

“Although the Fed pays more attention to the core PCE price index, which has been trending lower, any modest increase in the CPI rate would ease worries of a sustained downtrend in PCE inflation, hence supporting Chairman Powell’s remarks that the current weakness is transitory,” says Raffi Boyadijian an economist at broker XM.com.

PPI is expected to rise by 2.3% in April from 2.2% previously and by a slower 0.2% from 0.6% previously on a monthly basis.

Another key release for the U.S. Dollar is the trade balance which is forecast to show a deepening of the trade deficit to -$51.1bn from -$49.4bn previously.

Trade is a key component of GDP which influences the Dollar. An increasing deficit, however, tends to be a sign of reduced growth and shows increased supply of Dollars by importers, which also weighs on the greenback.

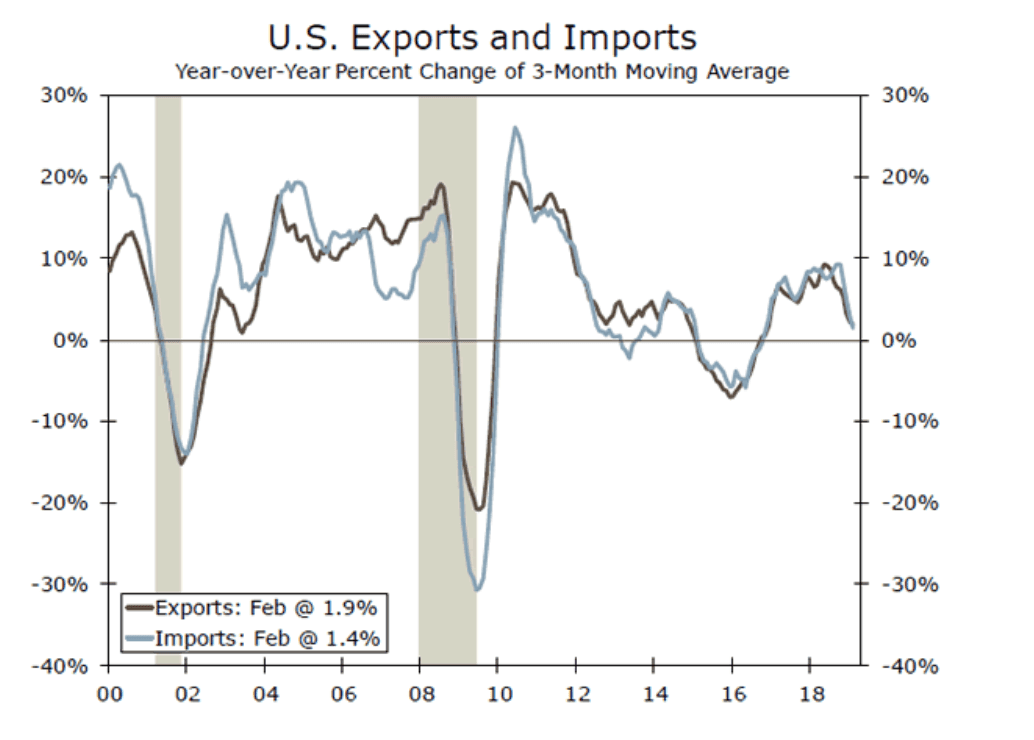

“As the nearby chart shows, both import and export growth have been slowing on trend since the expansion of trade tariffs went into effect late last year. This has occurred alongside a drying up in global trade that has pulled global export volume growth into negative territory, a key factor identified by the IMF in its most dour forecast for global GDP growth since the global recession,” say Wells Fargo in a client note addressing the matter.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement