EUR/USD Week Ahead Forecast: Recovery Back Inside Range After False Break Gives Bulls Hope

Image © Grecaud Paul, Adobe Stock

- EUR/USD rotates higher after false break lower

- Signs of new uptrend but major obstacles in way

- Euro impacted by inflation data; U.S. Dollar sees multiple factors at play

The Euro-to-Dollar exchange rate is trading at 1.1345 at the start of the new week after rising over half a percent from the previous week. Although continued concerns over Eurozone growth weighed on the Euro it still outperformed the Dollar which fell even more sharply after the minutes from the last Federal Reserve meeting underlined their more cautious approach.

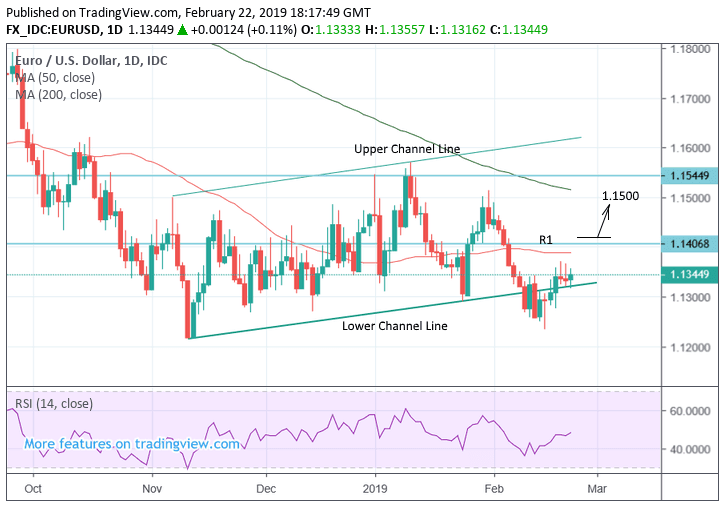

The technical outlook is marginally bullish after the pair pivoted higher following a false break below the lower border of a long-term channel.

EUR/USD is trading on the 200-week moving average (MA) at 1.1335 and continues to underpin the exchange rate supportively. This increases the chances of a recovery starting from the current level.

The daily chart shows more clearly how the exchange rate has broken back inside the gently ascending channel. Yet it also shows how the 50-day MA is capping gains at the 1.1389 level. This is likely to be a major obstacle to further gains.

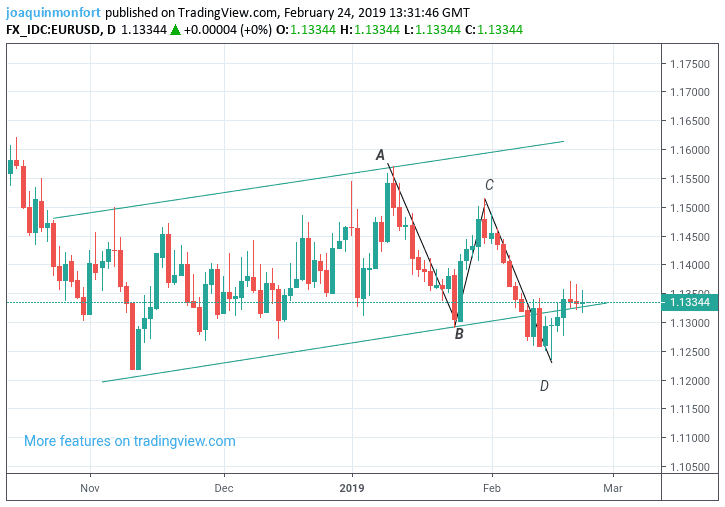

Note how EUR/USD formed an ABCD pattern as it travelled down the inside of the channel during the start of 2019. This pattern completed last week after wave c-d reached a similar length to wave a-b. After it finished, the expectation was for the pair to start rising, which it did.

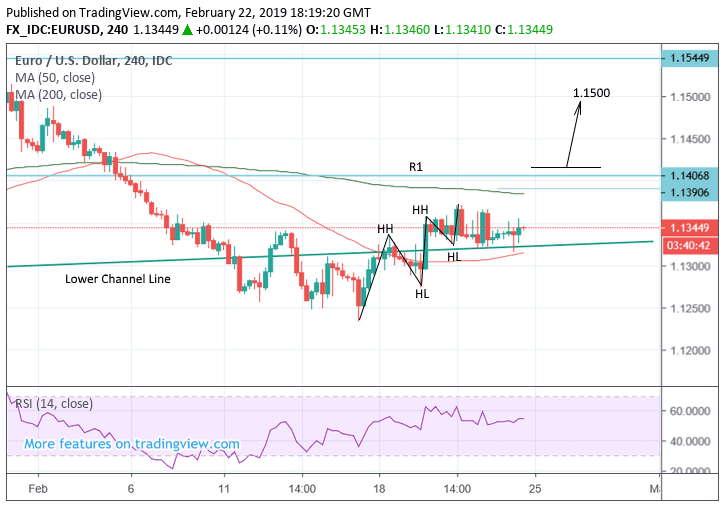

The four hour chart shows how the pair has now completed two higher highs (HH) and higher lows (HL) which is the minimum requirement for the establishment of a new uptrend to be considered.

The 50-day MA is not the only obstacle capping gains - the R1 monthly pivot at 1.1409 is another barrier to progress and we would not expect to see more upside until both these levels had been cleared. A break above the 1.1420 level would provide confirmation of clearance, however, and a probable continuation higher to a target at 1.1500.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Euro: What to Watch this Week

The main release for the Euro in the coming week is flash inflation data for February, out on Friday at 11.00 GMT. Inflation is expected to show a 1.5% rise from 1.4% please. Core inflation is forecast to show a 1.1% rise, the same as the previous month of January.

Inflation is important because it informs central bank policy which is a major driver of currency appreciation. When central banks raise interest rates it drives up the local currency by attracting and keeping greater inflows of foreign capital.

Whilst the European Central Bank (ECB) is not forecast to raise interest rates anytime soon, it has said it is considering raising them after the summer, yet if inflation and growth remain subdued, they may change their mind and delay raising interest rates. Such a delay would lead to a decline in the Euro as expectations are recalibrated.

"We have seen commentary from key ECB policymakers over recent days that suggest that the central bank is increasingly recognising the slowdown in economic growth and is prepared to adjust policy in response," says Nick Kounis, an economist with ABN AMRO. "The implications of weaker growth for the inflation outlook would be a key part of the discussion at the next Governing Council meeting."

A disappointing, below-expectation reading would likely be negative for the Euro exchange rate complex as markets would expect the ECB to engage a cautious stance; a beat could help the currency as it could suggest to markets that perhaps the economy is turning around following a particularly fallow period of performance.

"We think interest rates will ultimately be on hold until December 2020. The dovish shift by the ECB will lead to a further leg down in Bund yields, a flattening of curves and weigh on the Euro," says Kounis.

The latest unemployment rate data is out at the same time as inflation and is forecast to remain unchanged at 7.9%. Unemployment has been a bright spot for the Euro due to a consistent steady decline - a lower reading in January would further support the single currency.

Another key release for the Euro is business confidence data at 11.00 on Wednesday. It is forecast to show a drop from 0.69 to 0.63 in February. Flash PMIs in February provided a “glimmer of hope” for the Eurozone so analysts may watch PMI data more keenly than usual to see if it backs up a brighter outlook.

“The flash reading for Eurozone PMIs provided some glimmer of hope that the severe slowdown might be coming to a halt,” says Raffi Boyadjian, currency analyst at broker XM.com, “There could be more evidence of the downtrend bottoming out in Wednesday's economic sentiment indicator for the Eurozone.”

The Dollar: What to Watch this Week

It is likely to be a busy week for the U.S. Dollar as a large number of important data releases from the U.S, including ISM Manufacturing, the PCE inflation gauge and annualised GDP are scheduled for release, whilst broader geopolitical drivers may also influence the currency as the March 1 deadline for the imposition of higher tariffs on Chinese imports is met on Friday.

The testimony of the head of the chairman of the Federal Reserve (Fed), Jerome Powell, to the Senate economic committee rounds off the many factors which could move the currency during the week.

Annualised GDP, or yearly growth, is expected to have slowed down to only 2.4% from 3.4% previously when 4th quarter figures are released at 14.30 GMT on Friday. On a quarterly basis growth is forecast to have risen by 1.7% in the final quarter, following a 1.5% rise in Q3. Slower-than-expected growth would be negative for the Dollar as it curtain inbound investment flows.

The Dollar is at risk of volatility when Fed chair Powell is questioned on the economy and Fed policy by senators during the week, starting Tuesday. If he continues to endorse a neutral, data-driven stance, the Dollar could dip, if he becomes more bearish and highlights further risks to the economy it could weaken.

PCE, short for ‘personal consumption expenditure’, is a key inflation metric and the Fed's preferred gauge. It is forecast to slow to 0.0% in December from 0.1% in the previous month when it is released at 14.30 on Friday. On a yearly basis is it forecast to show a 1.7% rise compared to a year ago from 1.8% previously. Any unexpected declines are likely to hit the Dollar, especially given the Fed's avowed data driven stance.

Finally, on the data front there is ISM manufacturing, out at 16.00 on Friday, which is forecast to slide to 55.9 from 56.6 in February from the previous month. It is important because it is so timely.

Trade talks between the U.S and China and the approach of the March 1 deadline for increasing tariffs on Chinese imports from 10% to 25% is another geopolitical factor which could impact on the Dollar.

If higher tariffs are enforced the Dollar will probably rise due to an increase in safe-haven flows, but this worst case scenario is on balance is unlikely and an 11th hour agreement or delay is more likely, which would weigh on the greenback.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement