Euro-to-Dollar 5-Day Forecast: Reaching Key Range Lows, Support Expected

Image © European Central Bank

- EUR/USD fast approaching major support zone

- Further declines conditional on clear downside break

- Main release for Euro is German GDP; for Dollar CPI

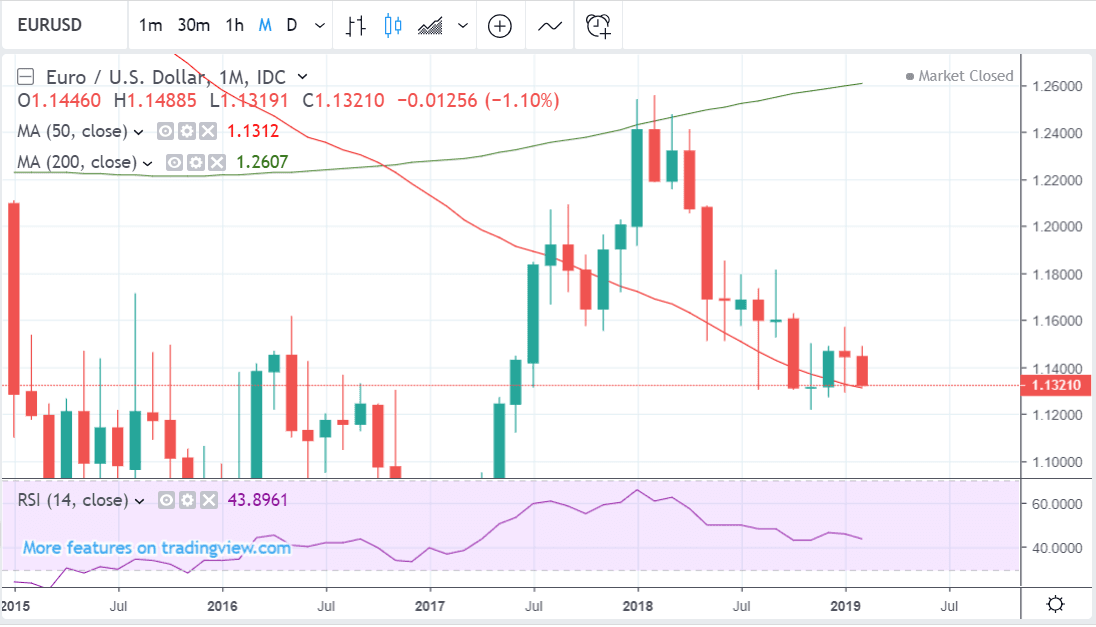

EUR/USD is at 1.1320 at the start of the new week after falling 1.20% in the previous week’s trading.

The outlook for EUR/USD is marginally bearish with our studies seeing a continuation of the recent decline. However, the pair is reaching a key support zone where further downside progress is likely to be much more difficult and there is a substantial risk of a bounce.

The support zone is situated around the 1.1300 level and is composed of a long-term trendline and the S1 monthly pivot.

For a continuation of the downtrend, we should wish to see a break clearly below this zone, confirmed by a close below the 1.1290 January lows. This would probably lead to a continuation down to a probable target at 1.1215.

A bounce from this key support zone, on the other hand, could see the pair lifted to 1.1400 where the 50-day moving average (MA) is situated.

Momentum is neither particularly bearish or bullish as it is falling in line with the recent bearish decline from the 1.1500 highs.

The long-term trend is down, as illustrated by the monthly chart, but it is currently encountering tough support from the 50-month MA, which has slowed the decline. This adds to the profile of support seen on the lower time-frame charts.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Euro: What to Watch this Week

Fourth quarter German growth data out on Thursday at 07.00 GMT is probably the main release for the Euro. It is forecast to show a 0.1% rise compared to the previous quarter, which itself showed a -0.2% decline.

If Q4 also shows a decline it will mean the German economy has contracted for two consecutive quarters which is the definition of a technical recession. If this is the case then it will almost certainly weigh on the Euro.

A key event for the Euro could well be the February 17 deadline for the U.S. government’s investigation into foreign car imports and whether they pose a ‘national security risk’.

If the U.S. Commerce Department decides they do, President Trump will have by May 18 to decide whether or not to impose tariffs on cars of up to 25% which would be a major blow to the European car industry, and weigh heavily on the Euro.

Another key release is Eurozone employment data out at 10.00 on Thursday. This is forecast to show a 0.2% rise in people in employment compared to Q3 which itself showed a 0.2% rise from Q2. A strong result would provide marginal support for the single currency.

News from the European Union’s Eurogroup meeting of member state’s finance ministers could very well impact sentiment at the start of the week.

The second estimate for Q2 GDP growth data could be released at 10.00 on Thursday, and is expected to show growth increasing by 0.2% compared to Q3 and 1.2% compared to the previous year.

The U.S. Dollar: What to Watch this Week

The main release for the Dollar is probably inflation data out on Wednesday. This is especially true given the Federal Reserve’s communication to markets in January that it would shift to a more data-driven stance when considering future interest rate moves.

A higher-than-expected inflation result would probably be positive for the U.S. Dollar and vice versa for a lower result as it suggests the Fed might have reason to deliver further interest rate rises in 2019.

Current expectations are for CPI to show a 0.1% rise in January compared to December. This is higher than the -0.1% result in the previous month.

On a yearly basis, inflation is expected to have risen by 1.5% in January compared to a year ago, compared to 1.9% in December also on a year-on-year (yoy) basis.

Higher inflation puts pressure on the Fed to raise interest rates which in turn attracts higher inflows of foreign capital drawn by the promise of higher returns, and this increases demand for the host currency.

“On Wednesday of next week, financial markets will get a look at CPI numbers for January. For a “patient” and “data-dependent” Fed, these inflation numbers are key,” says a note from the economics team at Wells Fargo. “In December, there was evidence that a number of factors have been driving inflation higher. That was easy to miss because the headline measure was pulled down by falling energy costs and lower commodity prices. Ex-energy, CPI rose 0.2% month-over-month in December and is up 2.1% over the past year.”

Another key release is December retail sales data on Friday, which has been delayed because of the government shutdown. December is also a key month because of the significance of Christmas sales.

“Thursday of next week offers the first look at how the year finished for the nation’s stores and online vendors. This is a particularly important month as it includes most of the key holiday shopping outlays that can make-or-break a store’s year in terms of profitability,” say Wells Fargo.

The market forecasts a rise of 0.1% compared to the previous month, Wells Fargo is more optimistic at 0.3%; the previous month of 0.2%. Measures of consumer confidence, however, have slipped in recent months suggesting the data may not be so strong.

The final key release for the U.S. Dollar is small business optimism or the National Federation of Independent Businesses (NFIB) optimism gauge. This used to be at all-time high in Q3 2018 but has since pulled back. The big question is whether it will decline further or not. The consensus expectations is for more loses to 103 from 104.4 previously.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement