EUR/USD Shakes off Merkel's Resignation Bombshell: is the Euro Becoming Bulletproof?

Image © European Central Bank

- Euro unfazed by Merkel resignation

- Italian budget angst no longer an immediate headache

- EUR/USD risks a short-squeeze higher

The Euro has traded relatively steadily in the face of some significant setbacks of late, and this could be a bullish sign for the currency longer-term as it suggests a good dose of bad news is reflected in current valuations.

Angela Merkel's de facto resignation as leader of her CDU party, the continued Italian-EU budget impasse, and a slump in recent activity data hasn't pushed the Euro down as far as expected.

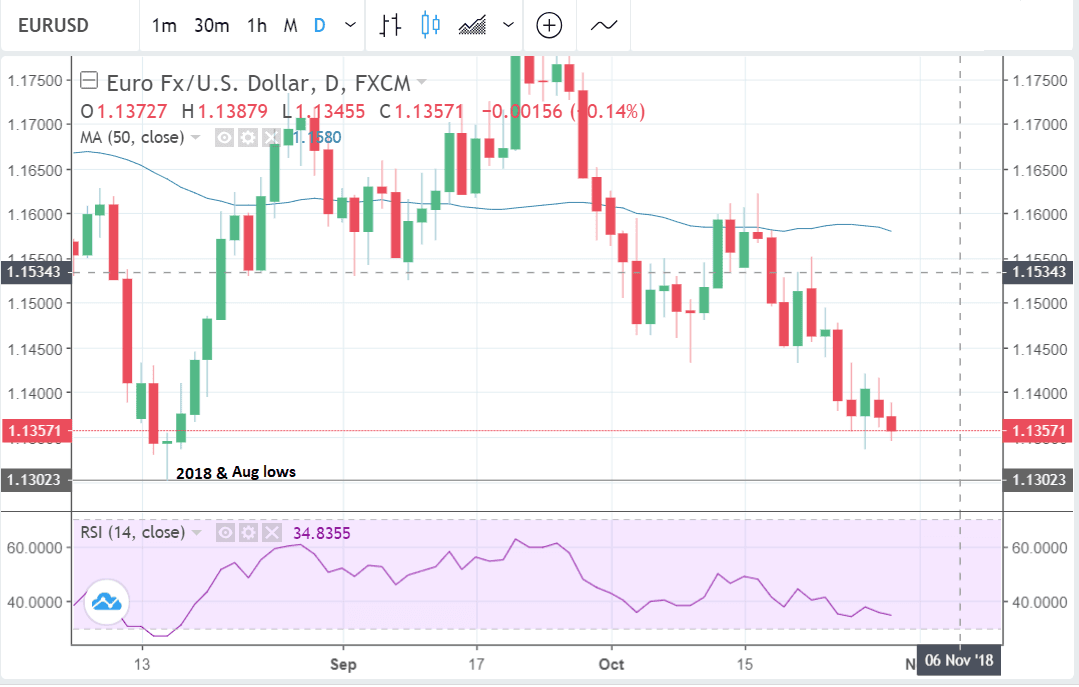

In fact the currency pair has managed to stay above the technical 1.1301 'capitulation' point located at the August and 2018 lows.

"EUR/USD has shown resilience in the face of German Chancellor Angela Merkel's announcement that she will not seek re-election as party chairwoman or another term as chancellor, suggesting the Euro could be in for a rebound," says Christopher Romano, an analyst on the Thomson Reuters currency desk.

Despite suffering a fall in the immediate aftermath of the news, the Euro retraced its losses with markets expecting her to remain at the helm of German politics for the remainder of her term.

"The immediate challenges – the row about the Italian budget and next year’s Brexit – will be tackled by the euro zone with Merkel at the helm, which reassured euro traders," says Esther Maria Reichelt with Commerzbank in Frankfurt.

Reichelt says while Merkel is seen as a guarantor of stability for the Euro, the true guarantor is actually the European Central Bank; "the central bank is currently more decisive for the EUR outlook than the end of a political era in Germany."

Relief at Moody's decision not to downgrade Italy's credit rating has meanwhile offset continued budget concerns ensuring the Italian budget situation is not the pressing headache for EUR/USD that it was earlier in the month.

Last Friday Moody's revised the country's outlook to 'negative' but kept the rating at Baa3. It had been feared the agency would also lower the rating a notch.

While Italy has fallen back as an immediate concern, Commerzbank's Reichelt believes the Italy-induced risk premium will only be priced out of Euro exchange rates once a sustainable solution in the budget debate emerges.

"Until then the Euro’s appreciation potential remains limited," says the analyst.

Advertisement

Bank-beating EUR/USD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Beware a 'Short Squeeze' Higher

Positioning data from the futures market could also be signifying that EUR/USD is about to start rising after it showed US bullish bets falling from an extreme peak.

This may be indicating that the market is rolling-over from an overbought peak - for EUR/USD this would mean more upside.

"Positioning could also be limiting EUR/USD's downside. CFTC stats show the market's net-long dollar position was reduced in the latest week of data," says Romano.

The US Dollar's role as a safe-haven currency has also diminished in importance and recent bouts of risk aversion resulted in a Dollar-negative fall in Treasury yields, not a rise.

Fed funds futures, derivatives used to bet on future interest rates, as also used as a forecasting tool to call changes in US Federal Reserve interest rate policy. These have shown the market expectation for higher rates does not match up to the Fed's more aggressive rhetoric.

Higher interest rates or the expectation of, are normally bullish for the US Dollar because they draw foreign capital inflows with the promise of higher interest, but if there is a revision in expectations lower, this could weaken USD.

"Fed funds futures suggests the Fed will not be as aggressive as their rhetoric implies. Sinking U.S. rates could leave dollar bulls looking to exit, which would buoy EUR/USD," says Romano.

The technicals are also supportive of a rebound: daily RSI is slowing its descent showing bears lack vigour.

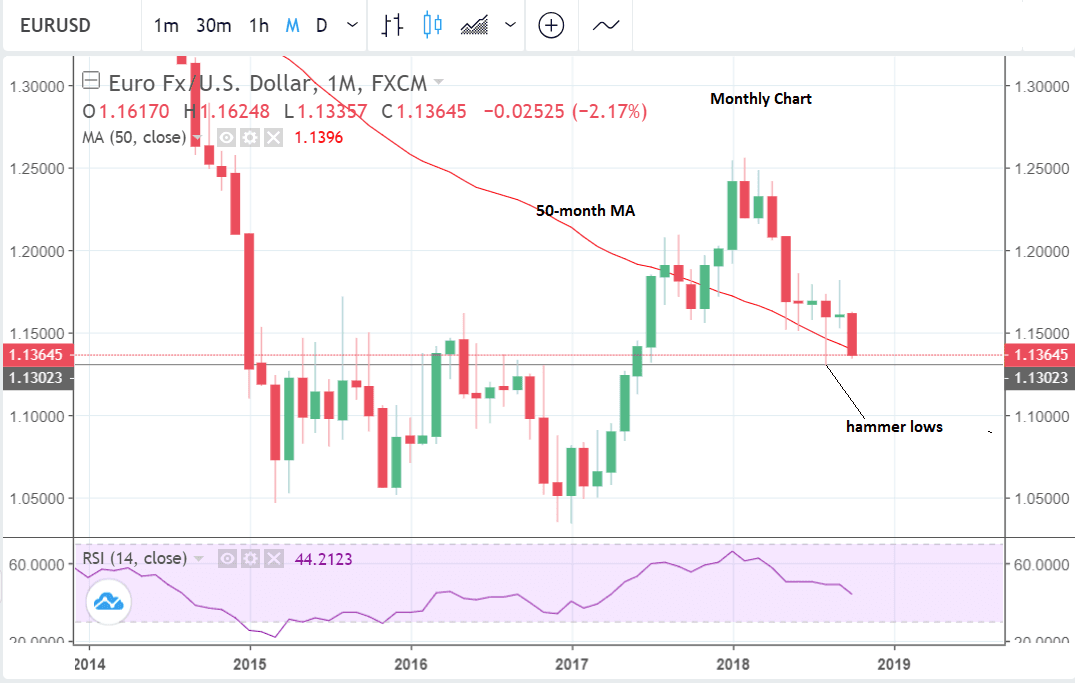

The 50-month MA is acting as underpinning support on the monthly chart and preventing further penetration lower. It is a tough nut to crack and a formidable obstacle to bears.

As long as August's hammer lows at 1.1301 hold the pair still has a good chance of recovering.

The longer it holds above Friday's 1.1335 lows the more chance there is of a short-covering rally developing.

A short-covering rally is what happens when the exchange rate starts rising rapidly after a long-downtrend and bearish traders are caught by surprise. In their panic, they close out their bearish bets adding fuel to the recovery which speeds up. This causes more panic and in a feedback loop leads to further liquidation of shorts and even faster upside. This can lead to sudden sharp rises off key bottoms.

If EUR/USD went higher how high might it go initially?

"If EUR/USD fails to hit new lows soon a short squeeze is likely. The 1.1550/60 and 1.1625/50 resistance zones are eyed," says Romano.

Advertisement

Bank-beating EUR/USD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here