Euro-to-Dollar Rate in the Week Ahead: Possible Rotation Higher in Progress

Image © Adobe Images

- EUR/USD recovering after 1.1400 bottom

- A break above 50-day MA would provide green-light for longs

- News from Italy will probably be the main driver of the Euro whilst the Dollar could be impacted by retail sales

The Euro has started to recover against the Dollar, the latter was pressured lower last week after rising interest rates led to growth fears which spilled over into a stock market correction.

The Euro, meanwhile, is at the start of the cycle the Dollar at a mature stage of, based on expectations that Europe is on the cusp of a new cycle of higher interest rates which will be supportive of the Euro.

From a technical perspective, the longer-term charts look bullish but the shorter-term charts are less clear. Overall we are marginally bullish in the week ahead conditional upon a break above 1.1610.

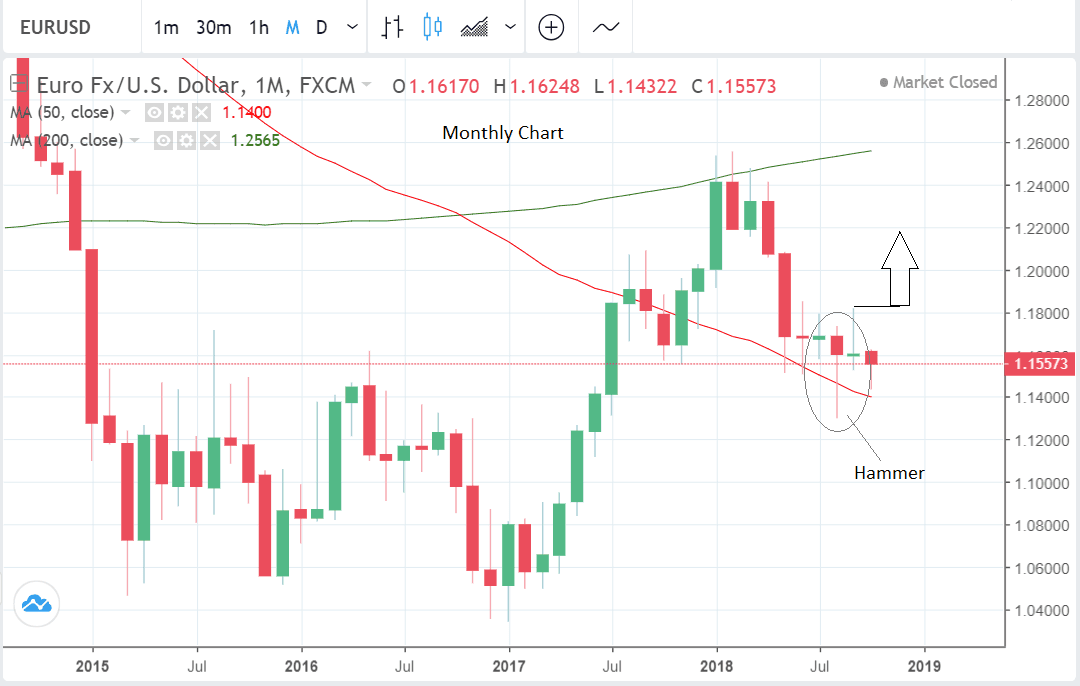

The monthly chart, for example, shows the exchange rate intersecting with the 50-month moving average (MA) in August when it formed a clear hammer candlestick low.

Hammer's are bullish signs and the rise in September to a new 3-month high further confirmed the hammer's bullish tendency. Although there has been no follow-through in October and the pair has so far actually lost ground, it has not negated the hammer's bullish signal.

A break back above September's 1.1815 highs would provide confirmation of a new broader uptrend.

Studies suggest the Euro is undervalued vis a vis the Dollar long-term, and therefore it is more likely to drift higher. Heavy central bank buying at the recent October low is also normally a good sign a pair is putting in a major bottom.

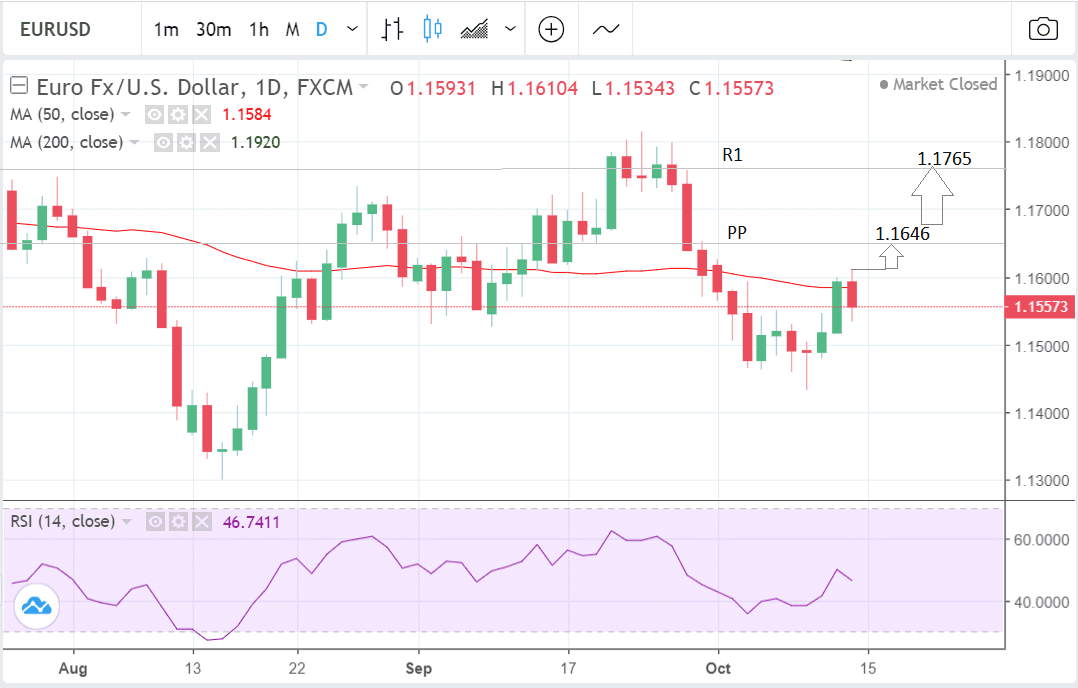

Shorter-term the pair has recovered from off the low if formed in the 1.14s on October 9. The recovery has been quite strong and suggests the possibility of a new short-term trend higher, however, it is too early to say for sure.

The pair pulled back on Friday after meeting the 50-day MA and we would want to first see a clear break above the 50-day, confirmed by a move above the 1.1610 highs for confirmation of a clear breakout higher.

Assuming this happens the way higher looks reasonably clear although the monthly pivot (PP) at 1.1646 is an obstacle.

Nevertheless, on balance, we think that if it reaches the pivot it will probably break through and continue higher in positive sentiment, with the next target at the R1 pivot at 1.1765.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Euro: What to Watch

Italy concerns may be a most significant factor driving the European unit in the week ahead.

The Italian government has said it intends to complete its final budget package proposal for presentation to the EU by Monday, October 15 - a full 5 days before the official deadline on the 20th.

Assuming they make good their promise the proposal will be sent forthwith to Brussels and it is then that markets could witness some volatility. If Brussels reject the amended budget proposal, the Euro could fall again amidst further uncertainty.

Ultimately the Italian executive will probably have to bend to the will of the markets as they will find higher borrowing costs unsustainable, but then again, we are living in extraordinary times.

The main hard data release for the Euro in the week ahead in inflation data which is forecast to rise 0.5% month-on-month (mom) in September, when it is released, and 2.1% compared to a year ago. This would be a rise from the 0.2% increase in August but no change year-on-year.

Possibly as important is core inflation which is expected to show a 0.9% rise in September - the same as it did in August when it faltered from the previous 1.1% level.

Further inflation declines would be extremely negative for the Euro as they would start to seriously bring into question the European Central Bank's plans to normalise monetary policy in 2019.

The inflation data is out at 10.00 B.S.T on Wednesday, October 17.

Another key release for the Euro in the week ahead is the ZEW economic sentiment survey which is considered a reliable leading indicator for both the German and Eurozone economy.

ZEW interviews 350 German institutional investors and analysts regarding their 6-month outlook for the German economy and the Eurozone. In September they are expected, on balance, to be more pessimistic about the outlook for the Eurozone, with a balance of -9.1 compared to the -7.2 previously. For Germany even more so with a -12.6 result forecast compared to -10.6 previously.

German business sentiment has been the most savagely hit by global trade tensions, according to forex broker XM.

"German business morale has been the worst hit in Europe from the US-China trade war and most German and regional sentiment barometers remain well below the peaks enjoyed in 2017, casting doubt about a rebound in Eurozone growth," say XM in a preview of events lying in the week ahead.

The Eurozone trade balance in August is out at the same time as the ZEW survey and is forecast to show a surplus of 15.1bn Euros compared to 17.6bn previously.

The U.S. Dollar in the Week Ahead

The most important data release for the Dollar in the week ahead is probably retail sales data which is expected to show a 0.6% rise in September - up from the -0.1% in August.

Although some "interest-rate sensitive" portions of the economy appear to have slowed down recently, such as auto-sales which accounts for one-fifth of all retail sales, the majority of sectors have continued to grow.

There may also be increased spending following the aftermath of Hurricane Florence as well.

"The balance of data still suggests that consumer spending will be supportive of above-trend GDP growth in Q3. Consumer confidence and small business optimism remain a shade off of all-time highs. With interest rates rising, consumers still see no time like the present to spend, and we expect retail sales to rise 0.6% in September," says a note from Wells Fargo detailing their expectations for the coming week.

If the data is strong it may help dismiss growth fears linked to the recent sell-off in the US stock market and lead to an appreciation in the Dollar.

Industrial production data for September is out on Tuesday at 14.15 B.S.T. Growth was particularly strong in August the question now is can the trend continue in September?

"On Tuesday attention will shift to the industrial sector, where production was up a solid 0.4% in August. More impressive was the 4.9% year-over-year gain, which marked the strongest pace since 2010," say Wells Fargo. The consensus estimate is for a 0.2% rise month-on-month.

The main releases on Wednesday is housing data. Also out is the minutes from the Federal Reserve (Fed) meeting.

Building Permits are expected to show a 1.28m rise in September from 1.25m previously when released at 13.30; and housing starts are forecast to fall -4.5% after rising 9.2% in the previous month.

Wells Fargo sees signs the housing market may be slowing down but are overall optimistic about the sector's longer-term trajectory.

"We still expect homebuilding to improve over coming quarters but have taken down the degree of improvement in our forecast. Still, the remainder of the fall could see a rebound in starts. Lumber prices have fallen significantly from recent highs, and inventories of units authorised but not yet started continue to climb," says Wells Fargo.

The other major release is the minutes from the Fed's September meeting which are expected to reiterate the same hawkish message (hawkish meaning in favour of raising rates) as the statement from the actual meeting.

Yet, interestingly, this time around it may not have the same effect on the US Dollar which may be changing its relationship to rising interest rates.

"The U.S. dollar may not necessarily strengthen this time around as the hawkish outlook could lead to further losses on Wall Street and that would drag on the currency," say brokers XM.

Other key releases which could affect the Dollar in the week ahead include the New York Empire State manufacturing index in October (Exp 19, Prev 19); the Philadelphia Fed manufacturing index (Exp 20.5, Prev 22.9); and commentary from Fed's Bostic, Kaplan (Friday) and Bullard (Thursday).

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here