British Pound "to fall Further Towards the end of the Year" - Capital Economics

Above image © John Gomez, Adobe Stock

- Sterling is trapped in a downward sloping trend against the Euro

- Predictable pattern forming that advocates for further losses

- "We expect Sterling to slide" say Capital Economics, but see recovery forecast in 2019

- Increasingly likely UK-EU will reach Canada-style free trade agreement

The Pound-to-Euro exchange rate could be en route to recording a fresh 2018 low in the near-future according to a compelling study of both technical and fundamental drivers.

The current 2018 low rests at 1.0991; and judging by the shape of the GBP/EUR exchange rate's charts the market might in fact currently be locked into the move that will ultimately deliver a break of this level and fresh lows.

Studies show that exchange rate is trapped in a channel; additionally the pair is showing a 'stair-casing' type of pattern that looks suggests any break lower is a matter of days away.

The 'stair-casing' pattern is simply a pattern of lower highs and lower lows, a classic technical give-away of a market that is in a downtrend.

"The structural damage already done by penetrating the March (1.1150) low in recent weeks will not be easily repaired and on this basis re-emergent GBP strength is probably at best wave B corrective," says Trevor Charsley, an analyst with brokers AFEX in London.

Based on the above evidence, to us it appears that a break below the 1.0991 low is inevitable under current technical and fundamental conditions.

"There is scope for it to fall further towards the end of the year," says Liam Peach at Capital Economics following a recent assessment of Sterling. "The growing risk of a 'hard' Brexit has clearly weighed heavily on Sterling."

At the heart of the ongoing Brexit anxieties is that the UK government's preferred Chequers plan is not finding popular support both domestically and in Europe where the EU's chief Brexit negotiator Michel Barnier has effectively rejected the plan's proposal for a common rule book that governs the trade of goods.

The Chequers plan meanwhile doesn't appear to have the parliamentary support required to pass it through parliament, by all accounts there is strong opposition in the Government's parliamentary party to ensure it fails.

As a result, "investors are now increasingly pricing in the possibility of no deal," says Peach, adding "we doubt that a deal will be agreed before the end of the year and as a result, we expect sterling to slide."

Indeed, it appears that the government will have to drastically rethink the Chequers plan and reports suggest there is one clear option left on the table.

"I am hearing from multiple sources that the only trade deal the EU’s lead negotiator Michel Barnier will countenance is Davis’s cherished Free Trade Agreement, what he called Canada Plus, rather than any version of May’s Chequers plan," reports Robert Peston for ITV.

"For more than two years he told me a Canada-style arrangement was the only realistic proposition. And it looks as though he was right," adds Peston.

The question now becomes how long will it take the Prime Minister and her team to realise the above, and change tactic?

Prime Minister Theresa May herself recently said the Chequers plan was "not set in stone", thereby indicating a willingness to change course.

The first opportunity for a fundamental shift for the better in the fortunes of the British Pound will be when convergence between all sides appears to be taking place and markets are finally convinced a deal is on the horizon.

"We expect a Brexit deal to be agreed in early 2019," says Capital Economics' Peach. "We still expect a rebound next year as Brexit risks diminish."

We however doubt such an outcome will however be delivered before the GBP/EUR exchange rate has printed fresh 2018 lows; nevertheless we do find a strong consensus view that 2019 could well be a story of recovery for the UK currency.

"We argue that any positive progress towards an agreement on Brexit could build on recent momentum and result in further GBP shorts rushing for the exit. This could force an abrupt move higher in GBP and the market bias may even be shifted to rebuild GBP long, from sell GBP-on-rallies," says Saktiandi Supaat, an analyst with Maybank.

'No Deal' Sell-Off Could Take GBP/EUR Below 1.0

What is certain is Sterling will be pushed notably lower if 'no deal' is reached?

At present most analysts are calculating this to be relatively low-risk scenario and not their base-case assumption.

However, what all are agreed on is that there will be an element of Sterling weakness if a 'no deal' materialises.

"In a No Deal scenario, which means the UK leaves the EU on 29 March 2019 without a transition agreement or trade deal, we anticipate GBP will decline on a trade-weighted basis. We do not anticipate severe GBP weakness because GBP already trades at very low levels in real effective exchange rate terms," says Peter Kinsella, Senior Currency and Rates Strategist at Commonwealth Bank of Australia.

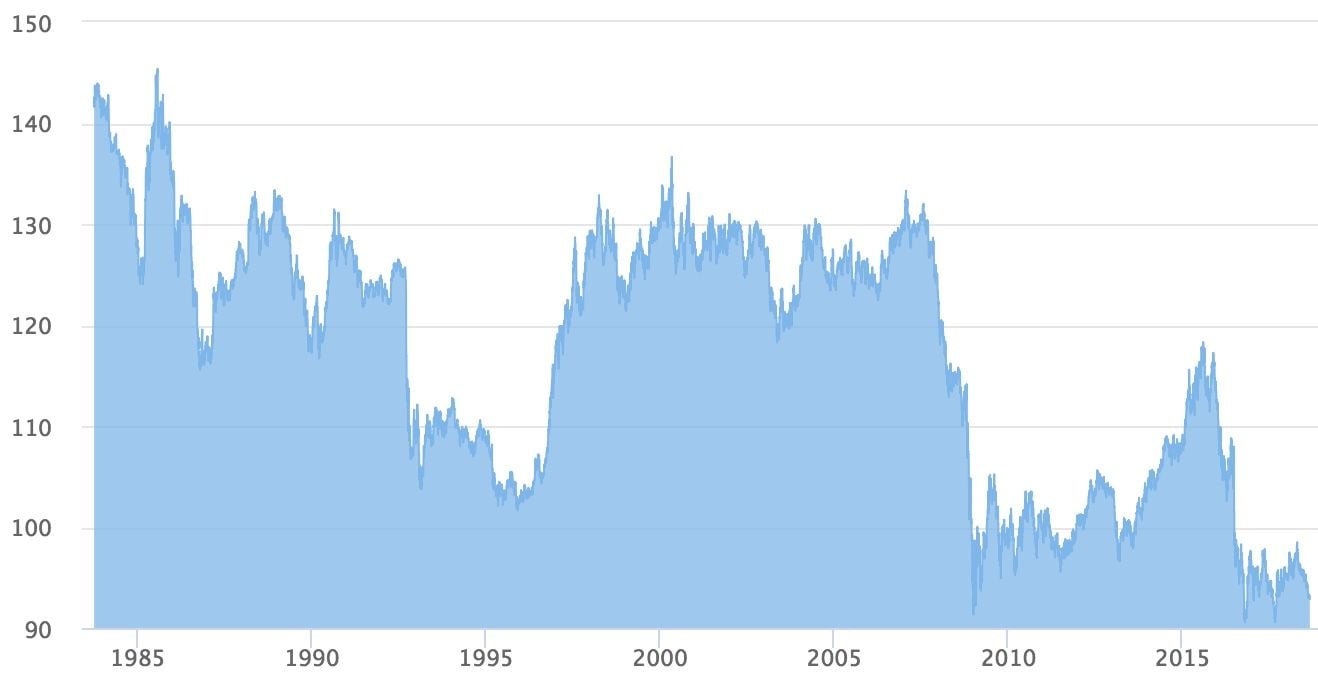

Above: Effective Exchange Rate of the Pound - a broad trade-weighted measure of the currency's value.

Kinsella adds that "most of the worst case scenarios are partially, but not entirely, priced in."

This is interesting as it suggests that even under a 'no deal' scenario the British Pound might be basing.

Others however see notably deeper declines.

Analysts at Bank of America Merrill Lynch meanwhile warn that such a scenario would possibly unleash a barrage of Sterling sales from central banks which could push the currency down to 1.10 against the Dollar.

And looping back to the Pound-to-Euro exchange rate, a break to 1.10 in GBP/USD suggests a break below 1.0 in the GBP/EUR according to Bank of America's forecasts.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here