British Pound's 'Carney Correction' Might be Over as GBP/EUR Exchange Rate Finds Support at 1.14

- GBP/EUR finding good buying interest at 1.14, sets potential interim floor

- UK borrowing data "very positive for the Pound" - MUFG

- Sterling could find support as markets start to increase bets for May rate rise once more

- Euro jitters ahead of Thursday's ECB meeting

© Simon Dawson, Bloomberg, Bank of England

Pound Sterling continues to steady against a host of major currencies as it puts a recent poor run behind it and we are told more consolidation is likely near-term.

The Pound is said to be entering into an holding "consolidation pattern" - particularly against the Euro - "as the post-Carney correction slowed" according to analyst Piet Lammens with KBC Markets.

Lammens cites the strong sell-off seen in Sterling following comments from Bank of England Governor Mark Carney which threw into doubt expectations for an interest rate rise at the Bank in May.

Rock-solid expectations for a rise in rates to 0.75% have provided a fundamental underpinning for Sterling over recent months, and the currency is therefore a natural victim as markets now price such a move as being below 50%.

"Carney started to talk down the May hike that markets have been pricing in as a slamdunk since mid-February. His comments come in the wake of a soft CPI print (alongside a soft patch in the data) that has seen markets rethink the prospects of a hike next month. Brexit headlines have not helped. We suspect that the Bank is likely to deliver one more hike this year but should shift to the sidelines afterward," says Mark McCormick, North American Head of

FX Strategy with TD Securities.

However, it might be that markets have found a new equilibrium; "the Sterling decline slowed with EUR/GBP holding below the 0.88 resistance. Some consolidation might be on the cards. Friday’s UK Q1 GDP data are a potential next reference. Brexit noise remains a wildcard," says Lammens.

0.88 resistance in EUR/GBP represents a support level of 1.1363 in the GBP/EUR exchange rate.

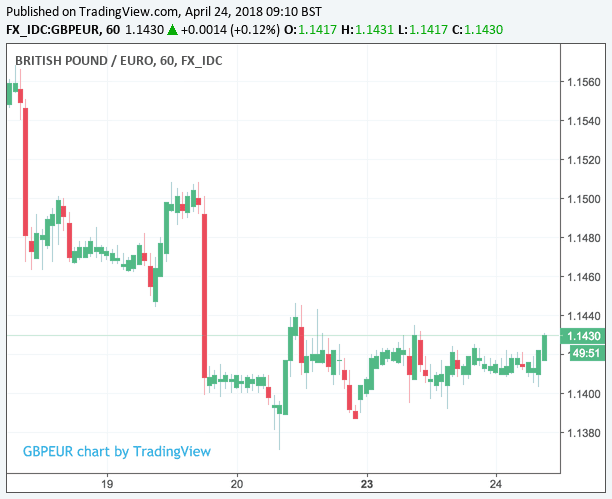

Above: The Pound-to-Euro exchange rate is seen consolidating following sharp declines on soft inflation data on April 18 and Carney's comments on April 19.

However, we note the rounded 1.14 level as being more of a touchstone for markets, simply by noting that since Carney's comments the Pound has rarely stayed below 1.14 for more than a few hours which is suggestive of strong buying interest at this point.

Support for Sterling came on Tuesday, April 24 with the release of stronger-than-forecast UK public finance data that confirmed the UK's attempts to eliminate the budget deficit is paying dividends.

The data showed government borrowing (excluding borrowing by public owned banks) fell by £0.26bn in March compared to February which in turn showed a £0.41bn fall in borrowing, therefore continuing a run of surpluses posted by the exchequer.

The figure beat forecasts that borrowing would increase by £1.1bn in March.

"We weren’t surprised to see the foreign exchange market respond positively to the data on the UK economy yesterday. The budget deficit figures for March confirmed that the UK’s finances are in better shape than originally expected. At a time when market participants are focusing more and more on USD downside risks linked to the potential explosion of the US ‘twin deficit’, the news from the UK is very positive for the Pound," says Derek Halpenny, European Head of Global Markets Research with MUFG.

Looking ahead, KBC Market's Lammens says "EUR/GBP 0.88 is a first relevant resistance area. We look out whether last week’s post-Carney correction has run its course. Some relative Euro softness might also hamper the EUR/GBP topside."

The Euro is unlikely to find a solid bid just days before the key European Central Bank policy meeting, slated for mid-day Thursday, April 26.

Markets are keen for further details on the ECB's thinking as to the timing of the exit from quantitative easing, which is currently expected to take place in September. However, signs that Eurozone growth might have peaked, and anchored inflationary pressures, opens the door to the ECB potentially suggesting the end-date might need to be delayed.

Such an outcome would be negative for the Euro.

Don't expect any explicit communication of such a move on Thursday, rather nuances and subtelties by one of the most masterful communicators in central banking will be heavily scrutinised by markets.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

May Rate Rise at the Bank of England Still Going Ahead: Analyst

The Pound took a hammering after London markets closed on Thursday, April 19 as Bank of England Governor Mark Carney cooled expectations for a May interest rate rise.

Speaking to the BBC in Washington, Carney cited “mixed data” coming out of the UK economy this week saying he didn’t want to be “too focused on the precise timing” of when rates might next rise.

While an interest rate rise is likely in 2018, he clearly failed to offer the kind of hints necessary to keep a May interest rate rise alive, something markets had been certain of with financial markets pricing a 85% chance ahead of Carney's comments.

Carney added the UK should “prepare for a few interest rate rises over the next few years.”

“I don’t want to get too focused on the precise timing, it is more about the general path. The biggest set of economic decisions over the course of the next few years are going to be taken in the Brexit negotiations and whatever deal we end up with. And then we will adjust to the impact of those decisions in order to keep the economy on a stable path,” said Carney.

“We have had some mixed data,” Carney added, the comments following a week of below-par data releases that saw wage growth, inflation and retail sales numbers all come in below expectation.

"Overall, his tone was cautious, not resembling a central banker that is about to raise interest rates, thus disappointing Sterling-bulls looking for signals that a hike is imminent. The implied probability for a May hike fell to 44% from 67% prior to Carney’s speech, according to UK OIS," says Andreas Georgiou, Investment Analyst at trading platform XM.

However, some analysts are not convinced that Carney is shying away from raising interest rates and analyst Chris Turner with ING Bank N.V. believes markets will soon start pricing in a May rate rise once more.

"Our call for a May BoE rate hike remains intact; the growth-inflation trade-off in our view still warrants higher BoE policy rates, while Governor Carney's comment that a rate increase is likely this year was probably about as hawkish a signal he could send three weeks out from a meeting," says Turner.

If correct, we could well find Sterling prove resillient to further downside against the Euro, particularly should markets start to develop jitters ahead of the crucial ECB meeting scheduled for Thursday.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.