Pound on Cusp of new Uptrend vs. Euro, Could hit 1.20s say BofAML Techs

GBP/EUR has jumped above a key resistance point and this advocates for further gains argues one technical analyst.

Pound Sterling has endured a lacklustre start to the week that takes us through month-end; the uninspiring moves are particularly disappointing to those hoping for a stronger Pound considering the impressive gains seen in the preceeding week.

One Pound now buys 1.1376 Euros on the inter-bank market but it had bought as much as 1.1510 at one brief stage on January 25.

Yet, despite the pullback, we are told the Pound remains in a strong position against the Euro and could ultimately make an attempt on the highs achieved back in mid-2017.

A technical analyst with Bank of America Merrill Lynch Global Research - the global investment banking giant - believes a recent breakthrough in the Pound-to-Euro exchange rate could ultimately match that of the September 2017 advance in scope, hence why he sees a potential target in the early 1.20s.

The Pound Sterling uptrend "is starting to gain steam," says Paul Ciana, a technical strategist with Bank of America Merrill Lynch in a strategy briefing to clients.

The call comes as Sterling hovers towards the top end of its recent range held against the Euro that loosely falls between €1.11 at the bottom and €1.15 at the top. What those watching this market are ultimately looking for is a break out of this range and into an upward-sloping trend.

Our own studies note that the breakout has not yet materialised, and we look for a break above 1.1510 for confirmation that the exchange rate is about to make a decent run higher.

Nevertheless, Ciana has a different set of criteria to consider when approaching GBP/EUR and is confident Sterling is gearing up for further advances, and believes the gains could resemble those made in the rally of September 2017 when the Pound-to-Euro exchange rate went from an opening level of 1.0838 to record a high of 1.1431, before closing the month at 1.1334.

Ciana's view rests largely with the observation that the advance in GBP/EUR over the past two weeks has led to a "decisive" bullish break above the 50wk SMA.

The 50wk SMA - the 50 week Simple Moving Average - is the average level of the GBP/EUR exchange rate over the last 50 weeks. When the exchange rate moves from below to above the moving average; i.e. it is higher than the average price of the past 50 weeks, it is taken by technical analysts to be a very bullish signal indeed.

Above: The weekly chart for the GBP/EUR shows a breach of the 50 week moving average - denoted by the grey line.

At the time of writing, our charts are telling us the 50 day moving average is located at 1.1375; the spot market price is at 1.1411.

Ciana thinks the decline in the Euro over the last two weeks "is the end of the 2H17 consolidation and thus the beginning of a new downtrend."

If the ensuing rise in the GBP/EUR is about equal to the rise seen in the beginning of September 2017 then Bank of America Merrill Lynch think the exchange rate can trend up to the 1.20s.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Further Signs that the Euro is Turning Bearish vs. the Pound

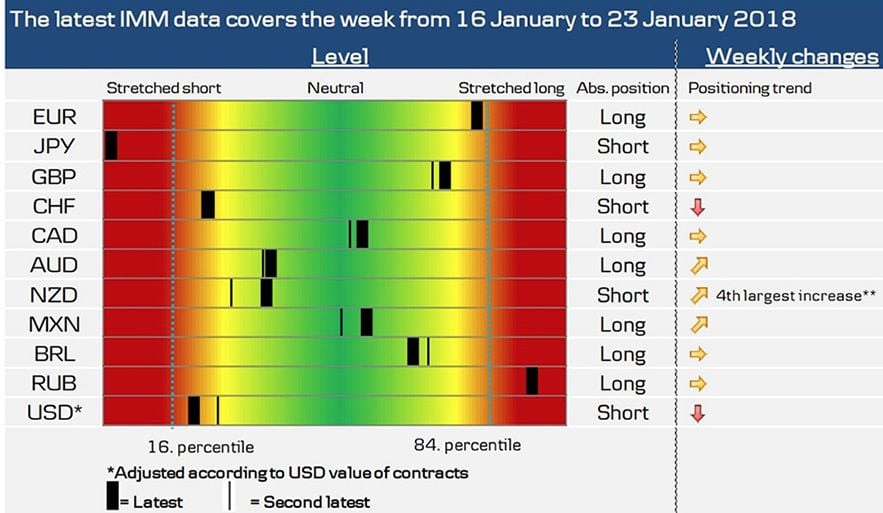

Further backing Ciana's theory that Sterling is about to embark on a more sustained rise against the Euro are the extended long EUR positions in the market - i.e. the build up of pro-Euro bets is elevated, but traders are now starting to pare back from this position.

They are seen to be "falling by wayside to bullish GBP sentiments". Over recent weeks market data has confirmed a steady improvement in sentiment towards the Pound with the market no longer engaged in a net bet against the currency. In fact, for the first time since the EU referendum of June 2017 the market is holding a net long position.

This has been confirmed by the most recent data on the positions held by non-commercial traders by the CFTC which shows Sterling is now well into 'long' territory - i.e. the Pound is a expected to rise:

Images (C) Danske Bank

"While improving Brexit outlook appears to have been priced-in to GBP/USD to some extent, there is more downside in store for EUR/GBP," says Ciana.

"According to our Moving Average Aggregator, EUR/GBP downtrend has formed late last week and is set to break lower on the back of growing downside momentum as shown by Up-Down volatility indicator. The risk to this view is a worsening Brexit outlook," says the technical analyst.

So while Sterling has come off the boil somewhat, the picture remains constructive in the views of Bank of America.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Euro Loses its Shine

Month-end data has proven to be a mixed bag for the Euro.

The Eurozone economy slowed a touch in the final quarter of the year, according to Eurostat data released Tuesday, but 2017 overall saw the currency bloc experience its strongest rate of growth since 2011.

Eurozone GDP grew by 0.6% during the fourth quarter, which is in line with the economist estimate for growth but down from the 0.7% pace of expansion seen in the three months to the end of September.

This made for an overall growth rate of 2.5% during the 2017 year as a whole, which is up from the 1.8% pace of growth seen back in 2016 and makes for the strongest expansion since the debt crisis that began in earnest during 2011.

“Euro-zone GDP growth continued at a healthy pace in Q4 and, while the EC’s Economic Sentiment Indicator (ESI) declined in January, it continues to point to a pick-up in growth to come,” says Stephen Brown, a European economist at Capital Economics. “While there is no detail in this release, the breakdown for France suggests that growth was broad-based.”

Separate, other data released Tuesday showed France contributing notably to the Eurozone upturn during the fourth quarter, with the economy growing by 0.6% during the period.

This strong recovery of the Eurozone economy has already prompted the European Central Bank to begin the process of winding down its crisis-era quantitative easing programme; something that has contributed to the multi-month surge in the value of the Euro.

However, expectations for a rapid exit from quantitative easing were pared back somewhat following the release of inflation data from Germany.

German month-on-month CPI for January read at -0.7%, worse than the -0.6% forecast by economists. The annualised figure read at 1.6%, less than the 1.7%.

The below-consensus numbers serve as a reminder just why the ECB warned at their January meeting that they will maintain a slow-and-steady approach to ending their quantitative easing programme amidst concerns that inflation in the Eurozone is not yet where they would like it to be, partly thanks to the rising value of the Euro having a dampening effect on price pressures.

"German CPI miss taking some shine off the Euro - if this translates to EZ core CPI missing, where does it leave the data-dependent ECB?" asks Neil Wilson at ETX Capital.

The Bank reduced the amount of Eurozone bonds it buys each month from €60 billion to €30 billion this January and markets have been hoping that it will cease buying bonds completely some time in 2018 - if the date is pushed back further expect the Euro to struggle.

The ECB said in October that the program will continue until September “or beyond”, from which point markets will turn their attention back to Eurozone interest rates and the question of how soon an initial increase can be expected.

“Rising inflation expectations further increase the chance that the ECB will bring its asset purchases to an end this year, but the fact that expectations point to core inflation rising to just 1.5% suggests that interest rate hikes are a long way off,” says Capital Economics’ Brown.